What Health Coverage Is Reported on W-2s? Your ACA Box 12 Guide

December 9th, 2025

10 min read

Every January, employers face a mountain of year-end payroll tasks—and ACA W-2 reporting is often one of the most confusing. Many wonder: Do I need to report health coverage costs on W-2s this year? What counts as applicable coverage? For organizations on the verge of the 250-employee threshold, these questions become even more pressing.

At Lift HCM, we work with hundreds of employers each year to ensure accurate and compliant payroll reporting. We know that even small errors in ACA compliance can trigger unnecessary IRS scrutiny. That’s why we make it a priority to help employers understand not only what they need to do—but why these reporting rules exist and how to meet them confidently.

This article walks you through every detail of ACA W-2 reporting, including which employers are required to report, which types of coverage are included or excluded, how to calculate the cost, and what special exceptions or scenarios apply. By the end, you’ll have a clear, step-by-step understanding of how to stay compliant.

Table of Contents

- What Is Box 12 Health Coverage Reporting?

- Do You Need to Report? The 250-W-2 Threshold

- The Core Rule: If It's Subject to COBRA, It's Probably Reportable

- Which Benefits Must Be Reported in Box 12?

- Which Benefits Are Excluded from Box 12?

- Complete Coverage Matrix: What's In, What's Out

- The Top 3 Scenarios That Confuse Employers

- How to Calculate the Reportable Cost

- The 5 Most Common Mistakes (Ranked by Frequency)

- Common Employer Questions About ACA W-2 Reporting

- How Lift HCM Helps You Stay ACA-Compliant

What Is Box 12 Health Coverage Reporting?

Under the Affordable Care Act (ACA), certain employers must report the total cost of employer-sponsored health coverage on each employee's W-2 form. This cost appears in Box 12 using Code DD.

This requirement helps employees understand the full value of their health benefits—but it does NOT increase their taxes. The amount in Box 12 Code DD is informational only and does not affect taxable income.

Do You Need to Report? The 250-W-2 Threshold

Under the Affordable Care Act (ACA), employers that issue 250 or more Forms W-2 in the prior calendar year must report health coverage costs in Box 12 using Code DD.

Key Facts:

Key Facts About ACA W-2 Reporting:| Rule | Details |

| Threshold | 250+ W-2s in prior calendar year |

| Per EIN | Each company with separate EIN counts independently |

| What counts | All W-2s issued: full-time, part-time, seasonal, terminated |

| Exemptions | Multiemployer plans (union trusts), employers under 250 |

| QSEHRA | Different rules (Code FF, no threshold exemption) |

Example: Preparing 2025 W-2s in early 2026? Count how many W-2s you filed in 2024.

💡 Pro Tip: Track your W-2 count monthly. If you're approaching 250, start preparing your reporting process in Q4 rather than scrambling in January.

The Core Rule: If It's Subject to COBRA, It's Probably Reportable

The IRS uses one key test to determine what's reportable:

If coverage is subject to COBRA continuation requirements, it's generally reportable in Box 12 Code DD.

This explains why major medical insurance is always reportable (always subject to COBRA) and why standalone dental/vision plans are excluded when offered separately (employees can elect or decline them independently).

But watch for exceptions: Several benefits that ARE subject to COBRA are specifically excluded by IRS rules—like HRAs, HSAs, FSAs, and certain wellness programs.

Use this as your framework when evaluating benefits.

Which Benefits Must Be Reported in Box 12?

The following health benefits must be reported in Box 12 Code DD on employee W-2s. For each type, report the full cost of coverage—not just the employee's payroll deduction.

1. Major Medical Insurance (The Big One)

This is the primary coverage that must always be reported:

✅ Fully insured group health plans (traditional insurance through a carrier)

✅ Self-funded (self-insured) health plans (employer assumes the risk)

✅ Level-funded health plans (hybrid between insured and self-funded)

What to report:

- The total cost of coverage (employer portion + employee portion)

- All premium types: pre-tax payroll deductions and after-tax contributions

- All coverage tiers: single, employee + spouse, employee + children, family

Example:

- Total monthly premium for family coverage: $1,200

- Employer pays: $900 (75%)

- Employee pays: $300 (25%) via pre-tax payroll deduction

- Report in Box 12 Code DD: $1,200/month

2. Prescription Drug Coverage

Reportable when:

- Included in a major medical plan (almost always)

- Offered as a standalone prescription plan subject to COBRA

Not reportable when:

- Part of a Medicare Part D plan (different rules)

3. Integrated Hospital Indemnity or Specified Illness Coverage

This is where it gets tricky. Hospital indemnity and specified illness coverage (like critical illness or cancer policies) are only reportable if they're integrated with your group health plan.

Reportable when:

- Offered only to employees who enroll in the major medical plan

- Priced as part of the group health plan

- Subject to COBRA as part of the group plan

Not reportable when:

- Offered on a standalone basis (employees can buy it without the medical plan)

- Funded entirely by employee after-tax dollars

- Not subject to COBRA

4. On-Site Medical Clinics

Reportable when:

- The clinic provides significant medical care beyond first aid

- Employees are charged a COBRA premium for clinic access

- The clinic is treated as part of the group health plan

Not reportable when:

- The clinic only provides first aid and basic care

- No COBRA premium is charged

- Treated as a de minimis benefit

Which Benefits Are Excluded from Box 12?

Some benefit types, while health-related, are not required to be included in ACA W-2 reporting. These exclusions help prevent double-counting or unnecessary complexity in employee reporting.

1. Standalone Dental and Vision Plans

This is the most common question we get.

The rule: Dental and vision are excluded if they're offered separately from medical coverage.

What "separately" means:

- Employees can elect or decline dental/vision without affecting medical coverage eligibility

- Dental/vision has separate premium pricing (not bundled into medical premium)

- Employees can have medical without dental, or dental without medical

Example of excluded coverage:

- Medical plan: $800/month

- Dental plan: $50/month (optional, separate election)

- Vision plan: $15/month (optional, separate election)

- Report only: $800 (medical only)

Example of reportable coverage:

- Combined medical + dental plan: $850/month (must take both together)

- Report: $850 (full package)

💡 Pro Tip: Check your plan documents and enrollment materials. If dental/vision is optional and separately priced, it's almost certainly excluded.

2. Health Reimbursement Arrangements (HRAs)

All HRAs are excluded from Box 12 Code DD reporting—even when subject to COBRA.

This applies to:

- Integrated HRAs (paired with group health plans)

- Retiree-only HRAs

- Individual coverage HRAs (ICHRAs)

Exception: Qualified Small Employer HRAs (QSEHRAs) use a different code (Box 12 Code FF) and follow different rules—they must always be reported regardless of employer size.

3. Health Savings Accounts (HSAs)

HSA contributions are never reported in Box 12 Code DD.

This includes:

- Employer HSA contributions

- Employee salary reduction contributions

- Employer matching contributions

Note: Employer HSA contributions appear elsewhere on the W-2 (Box 12 Code W), but that's separate from health coverage cost reporting.

4. Flexible Spending Accounts (FSAs)

Health care FSAs funded through salary reduction are excluded.

The employee's FSA elections don't count toward Box 12 Code DD reporting.

Exception: Employer non-elective contributions to FSAs may have different reporting requirements—consult your tax advisor for complex FSA structures.

5. Wellness Programs and Employee Assistance Programs (EAPs)

Excluded when:

- No COBRA premium is charged

- Participation is voluntary

- The program provides wellness services, not medical treatment

Common examples:

- Gym membership reimbursements

- Biometric screenings

- Health coaching

- Mental health EAP services

- Smoking cessation programs (when not part of the medical plan)

6. Long-Term Care Insurance

Always excluded, regardless of:

- Who pays the premium

- Whether it's group or individual coverage

- Tax treatment

7. Supplemental Insurance Paid Entirely by Employees

Excluded when ALL of these apply:

- Funded 100% by employee after-tax dollars

- Employer is not contributing

- Coverage is truly supplemental (not primary medical)

Examples:

- Critical illness insurance

- Accident insurance

- Hospital indemnity (when standalone and not integrated)

Why this matters: If you offer voluntary supplemental insurance through payroll deduction but don't contribute as the employer, these amounts shouldn't be reported.

Complete Coverage Matrix: What's In, What's Out

Use this quick-reference table to determine whether a specific benefit belongs in Box 12 Code DD. When in doubt, find the benefit type and check the "Key Factor" column to understand why it's included or excluded.

|

Benefit Type |

Reportable in Box 12 DD? |

Key Factor |

|

Group medical insurance |

Yes |

Always reportable |

|

Self-funded health plan |

Yes |

Always reportable |

|

Prescription coverage (in medical plan) |

Yes |

Part of medical plan |

|

Standalone dental plan |

No |

Separate from medical |

|

Standalone vision plan |

No |

Separate from medical |

|

Bundled medical + dental |

Yes (full amount) |

Not separately available |

|

HRA (any type except QSEHRA) |

No |

Specific exclusion |

|

QSEHRA |

⚠️ Different (Code FF) |

Special reporting rules |

|

HSA contributions |

No |

Reported elsewhere (Code W) |

|

FSA salary reductions |

No |

Excluded |

|

EAP (no COBRA premium) |

No |

Not subject to COBRA |

|

Wellness program |

No |

Not medical treatment |

|

Long-term care |

No |

Always excluded |

|

Employee-paid supplemental |

No |

After-tax, voluntary |

|

On-site clinic (with COBRA premium) |

Yes |

Subject to COBRA |

|

On-site clinic (basic care, no premium) |

No |

De minimis benefit |

The Top 3 Scenarios That Confuse Employers

Even after understanding the COBRA test and reviewing the coverage matrix, these three situations trip up employers year after year. Here's how to handle each one correctly.

Scenario 1: The HRA vs. HSA Question

Both are health accounts with three-letter acronyms. Neither gets reported in Box 12 Code DD—but they appear in different places.

|

Account |

Box 12 DD? |

Where It Goes |

Example |

|

HSA |

No |

Box 12 Code W |

Employer contributes $1,000 → Code W |

|

HRA |

No |

Not on W-2 |

Employer funds $2,000 → Nothing in Box 12 |

|

QSEHRA |

⚠️ Different |

Box 12 Code FF |

Small employer QSEHRA → Code FF |

|

Medical insurance |

Yes |

Box 12 Code DD |

Group health plan → Code DD |

Scenario 2: Is Our Dental Plan Reportable?

Quick decision matrix:

|

Question |

Answer |

Result |

|

Can employees elect dental separately? |

Yes |

Exclude from Box 12 |

|

Is dental priced separately? |

Yes |

Exclude from Box 12 |

|

Can employees have medical without dental? |

Yes |

Exclude from Box 12 |

|

Must employees take both together? |

No |

Exclude from Box 12 |

If you answered YES to any of the first three → Dental is separate → Exclude it

If you answered YES to the last question → Dental is bundled → Report full cost

Scenario 3: Voluntary Supplemental Benefits Through Payroll

You offer critical illness, accident insurance, hospital indemnity via payroll deduction. Employees pay 100% with after-tax dollars.

|

Factor |

Status |

Impact |

|

Employee pays 100%? |

Yes |

Points to "exclude" |

|

After-tax deduction? |

Yes |

Points to "exclude" |

|

Available without medical? |

Yes |

Points to "exclude" |

|

Employer contributes $0? |

Yes |

Points to "exclude" |

All four YES? → Definitely exclude

Any NO? → Review more carefully; might be reportable

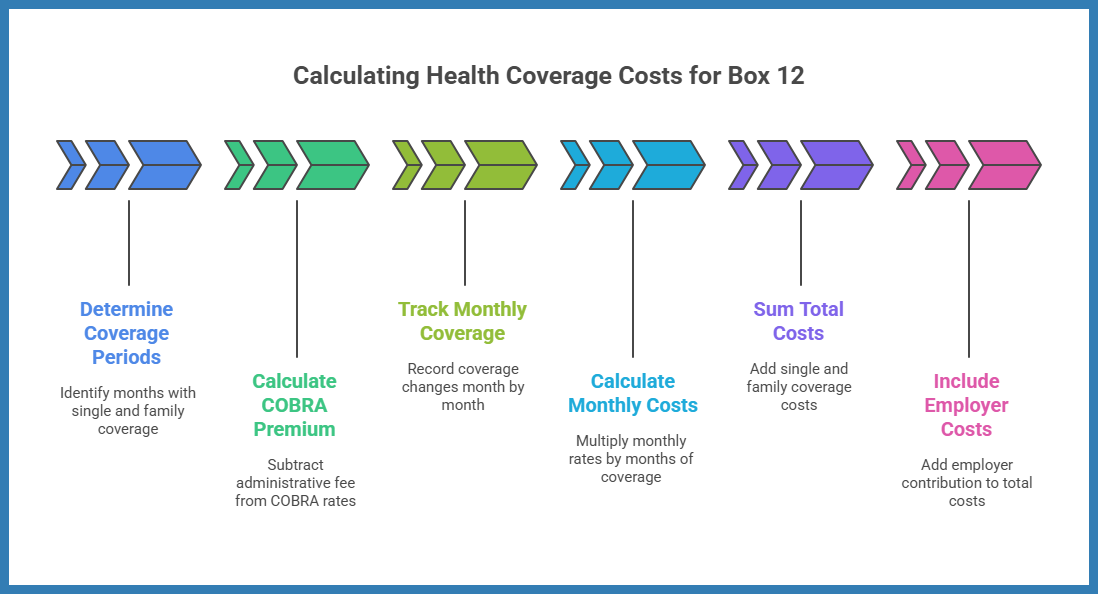

How to Calculate the Reportable Cost

Calculating the cost correctly is crucial for ACA compliance. The standard IRS-approved method uses COBRA premium rates (minus administrative fees) as the basis for the calculation.

The total cost reported should include both the employer’s and the employee’s share of health coverage.

Calculation Example:

If an employee had:

- Single coverage from January through June, and

- Family coverage from July through December,

Then, the reported cost equals:

(6 × single premium) + (6 × family premium).

Once you've determined what coverage counts, here's how to calculate the cost for Box 12.

Step 1: Use COBRA Rates (Minus Administrative Fee)

The IRS standard method uses COBRA premium rates as the basis.

Calculation:

- Start with your COBRA premium for each coverage tier

- Subtract the 2% administrative fee

- Multiply by the number of months at each coverage level

Example:

- COBRA family premium: $1,020/month

- Administrative fee (2%): -$20/month

- Reportable rate: $1,000/month

Step 2: Track Coverage Changes Month by Month

Employees often change coverage levels during the year. Track each month separately.

Example:

- January–April: Single coverage ($600/month × 4 = $2,400)

- May–December: Family coverage ($1,000/month × 8 = $8,000)

- Total reportable: $10,400

Step 3: Include Both Employer and Employee Costs

Report the full cost of coverage, not just the employee's payroll deduction.

Common mistake: Only reporting the employee-paid portion.

Correct approach: Employer contribution + employee contribution = Box 12 amount

The 5 Most Common Mistakes (Ranked by Frequency)

These mistakes trigger the most IRS penalties and corrections. Check your current W-2 process against this list to ensure you're calculating and reporting correctly.

|

Rank |

Mistake |

Wrong |

Right |

Penalty Risk |

|

#1 |

Including standalone dental/vision |

Report $865 (medical + dental + vision) |

Report $800 (medical only) |

Over-reports by $780/year per employee |

|

#2 |

Reporting employee portion only |

Report $300 (payroll deduction) |

Report $1,000 (total cost) |

Under-reports by $8,400/year per employee |

|

#3 |

Including HRA values |

Report medical + HRA ($800 + $2,000) |

Report medical only ($800) |

Over-reports by $24,000/year per employee |

|

#4 |

Forgetting 2% COBRA admin fee |

Report $1,020 (full COBRA rate) |

Report $1,000 (minus 2% fee) |

Over-reports by $240/year per employee |

|

#5 |

Miscounting threshold |

Count Dec 31 headcount (245 employees) |

Count total W-2s filed (265 W-2s issued) |

Miss entire reporting requirement |

Penalty range: $290–$1,750 per incorrect form

300-employee example: $87,000–$525,000 in potential penalties

Common Employer Questions About ACA W-2 Reporting

Q: Does ACA reporting apply to self-insured plans? Yes. Self-insured plans are considered employer-sponsored coverage and must be reported if the employer meets the 250-Form threshold.

Q: Are employers penalized for incorrect reporting? While minor mistakes can often be corrected, consistently failing to report or misreporting coverage may result in IRS penalties.

Q: Does ACA W-2 reporting replace 1095-C reporting? No. These are separate requirements. W-2 reporting reflects the cost of coverage, while Form 1095-C reports offer enrollment details under the Employer Shared Responsibility provisions.

Q: Is there a simplified reporting method for small employers nearing 250 W-2s? Unfortunately, no simplified version exists. Once the employer crosses the 250-Form threshold, full ACA W-2 reporting rules apply.

Q: Do I report the health coverage cost if an employee waived coverage? No. Only report coverage that was actually provided. If an employee declined coverage, there's no cost to report in Box 12.

Q: What if an employee only had coverage for part of the year? Report only the months when coverage was active. If coverage ended in June, calculate January through June only.

Q: How do I handle employees who changed from single to family coverage mid-year? Track each coverage level separately by month. Calculate the cost for months at single coverage, then add the cost for months at family coverage.

Q: Our dental plan is optional but priced into our medical premium. Do we report it? Yes. If dental is bundled into the medical premium and not available as a separate, standalone election, report the full bundled cost.

Q: What if we offer an HSA and also an HRA—do either get reported? No. Both HSAs and HRAs are excluded from Box 12 Code DD reporting (though HSA employer contributions appear in Box 12 Code W).

Q: Can we be penalized for reporting optional benefits we shouldn't have included? Yes. Over-reporting (including excluded benefits) makes your forms incorrect and can trigger penalties just like under-reporting. Report only applicable coverage.

Q: What's the penalty for getting this wrong? $290–$1,750 per incorrect form, depending on when you correct the error. For a 300-employee company, that could mean $87,000–$525,000 in penalties.

Q: Do we need to report health coverage costs for COBRA participants who are former employees? No, if they're no longer receiving wages. You only issue W-2s to individuals who received taxable wages. If a former employee only has COBRA (no wages), no W-2 is required.

How Lift HCM Helps You Stay ACA-Compliant

Understanding what health coverage must be reported in Box 12 is the key to accurate ACA W-2 compliance. Focus on the COBRA test: if coverage is subject to COBRA, it's likely reportable—but watch for the major exceptions like standalone dental/vision, HRAs, HSAs, and wellness programs.

The most common errors happen when employers:

- Include standalone dental/vision that should be excluded

- Report only employee-paid portions instead of total cost

- Forget to verify their calculation method uses COBRA rates

- Over-report by including HRAs, FSAs, or wellness programs

Audit your current benefits against the reportable/excluded list in this guide

Download our free ACA Employer Compliance Checklist to validate your reporting before submitting

Review your payroll system to ensure Box 12 calculations are automated and accurate

At Lift HCM, our integrated payroll and benefits technology automatically identifies reportable coverage, calculates Box 12 Code DD amounts using IRS-compliant methods, and flags potential errors before W-2s are filed. We've helped hundreds of restaurants, hospitality businesses, auto repair shops, and service companies navigate ACA W-2 reporting without penalties or stress.

Whether you're filing W-2s for 250 employees or 2,500, we're here to ensure accuracy and compliance.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.png?width=1536&height=1024&name=Create%20a%20background%20that%20reads%2c%20How%20Long%20to%20Keep%20P%20(1).png)