What Is Form 1099-K? IRS Thresholds, Rules, and Reporting Changes Explained

November 18th, 2025

7 min read

Did you receive a Form 1099-K this year and feel uncertain about your tax obligations for the reported amount? Recent changes in IRS reporting requirements for payments received through third-party platforms such as PayPal, Venmo, and popular online marketplaces have created significant confusion.

At Lift HCM, we help employers, finance professionals, and HR leaders navigate evolving federal reporting standards, freeing up your time and reducing compliance risks.

To support greater clarity, the IRS has published updated FAQs for Form 1099-K, providing important guidance for both taxpayers and businesses. These updates outline the reinstated $20,000/200-transaction reporting threshold, address frequent questions, and reinforce key compliance requirements. We’ve summarized the most relevant changes to help you prepare and file your taxes accurately and confidently.

Table of Contents

- What is Form 1099-K and Why Is It Important?

- Who Is Eligible to Receive a Form 1099-K?

- How to Determine Which 1099-K Income to Report

- Major Changes Impacting Form 1099-K

- Form 1099-K Frequently Asked Questions

- Key Takeaways for Navigating Form 1099-K Compliance

What is Form 1099-K and Why Is It Important?

Form 1099-K, formally known as “Payment Card and Third-Party Network Transactions,” is an IRS information return designed to capture the total gross payments you have received in a calendar year through specific channels. It applies to payments processed by payment card providers—including credit cards, debit cards, or gift cards—as well as transactions facilitated by third-party payment networks.

These networks include well-known platforms such as PayPal, Venmo, and most online marketplaces (like eBay or Etsy). The form details the gross amount of reportable transactions processed on your behalf, regardless of whether those payments are for business, personal, or other purposes. It helps the IRS ensure that income received electronically is properly reported, supporting accurate tax compliance for individuals and businesses alike.

Who Is Eligible to Receive a Form 1099-K?

You will receive a Form 1099-K if you are paid for goods or services through credit/debit card transactions or processed by Third-Party Settlement Organizations (TPSOs). The threshold for reporting depends on the type of payment and the tax year.

-

Payment Card Transactions: Anyone with direct card payments (e.g., using a merchant terminal or processor like Square or Stripe), regardless of the number of transactions or the total amount, will receive a 1099-K from their payment processor. There is no minimum threshold for these payments.

-

Third-Party Network Transactions (TPSOs): The reporting threshold for payments made through apps or online marketplaces (TPSOs) is subject to ongoing IRS phase-in guidance.

| Tax Year | Reporting Threshold (TPSOs Only) | Transactions Required |

| 2023 | $20,000 | More than 200 |

| 2024 | More than $5,000 | None |

| 2025 | $20,000 | More than 200 |

The $20,000 and 200 transaction threshold for 2025 was reinstated retroactively by recent legislation (the Omnibus Spending Bill), reversing the previous plan to lower the threshold to $600.

How to Determine Which 1099-K Income to Report

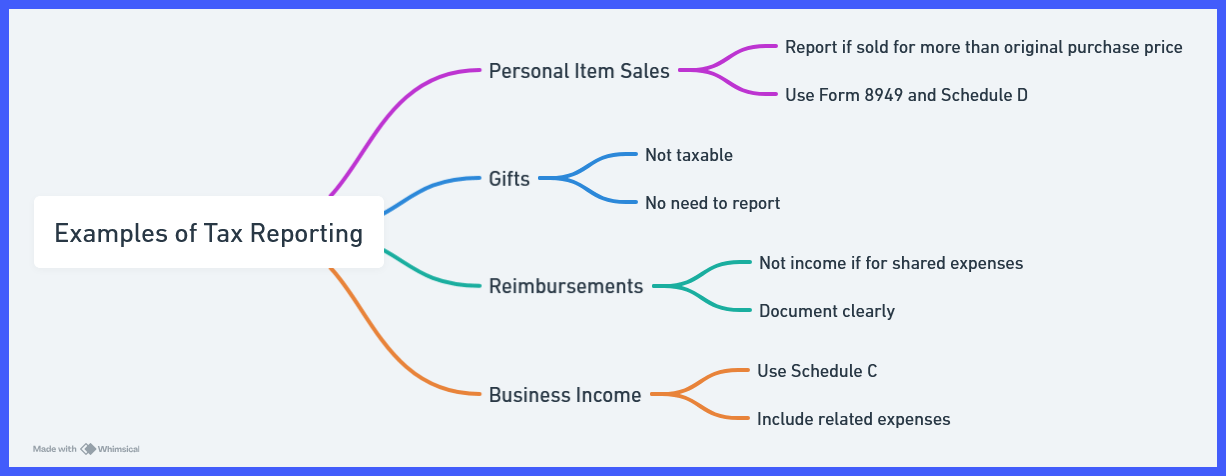

Reporting 1099-K income correctly is essential for tax compliance. How you report it depends on whether it’s from business activities, a hobby, or personal sales. Here’s what you need to know to accurately report each type on your federal return.

Business or Self-Employment Income: If your 1099-K income is from a business, gig work, freelancing, or other self-employment activity, report the gross income shown on your 1099-K (plus any other business income you received) on Schedule C (Form 1040), "Profit or Loss From Business". Deduct any related business expenses there to determine your taxable profit or loss.

Hobby Income: If your income comes from a hobby (not a business), report the gross proceeds on Schedule 1 (Form 1040) under "Other income." You cannot deduct expenses in excess of hobby income.

Personal Items Sold: If you sold a personal item (not for business) for more than you paid, report the gain on Form 8949 and Schedule D. For a loss (selling for less than you paid), you may need to report the transaction to show the loss isn’t taxable, but the loss itself isn’t deductible. Use Form 8949 with the correct code or offset the income on Schedule 1 so it doesn’t affect your taxable income.

|

Income Type |

Where to Report |

Key Notes |

|

Self-Employment/Business |

Deduct expenses, report profits |

|

|

Hobby |

No loss deduction allowed |

|

|

Sale Personal Property |

Form 8949/Schedule D or Schedule 1 |

Use 8949 for gain/loss; offset non-taxable losses |

💡 Important: Even if you do not receive a 1099-K (below IRS thresholds), you are still required to report all taxable income from goods and services sold.

Major Changes Impacting Form 1099-K

We have summarized the most impactful changes that directly affect how you file your taxes.

1. Reporting Thresholds Clarified (TPSOs vs. Payment Cards)

There are two distinct sets of rules based on how you receive the payment:

- Third-Party Settlement Organizations (TPSOs): The reporting threshold for TPSOs (e.g., PayPal, Venmo, Etsy) has been reinstated to $20,000 in gross payments and more than 200 transactions. This change, introduced by the Omnibus Spending Bill, replaces the confusing $600 threshold that was previously put in place.

- Payment Cards: There is no minimum threshold for payment card transactions (e.g., payments processed via Square or Stripe). Even payments as low as $0.01 must be reported.

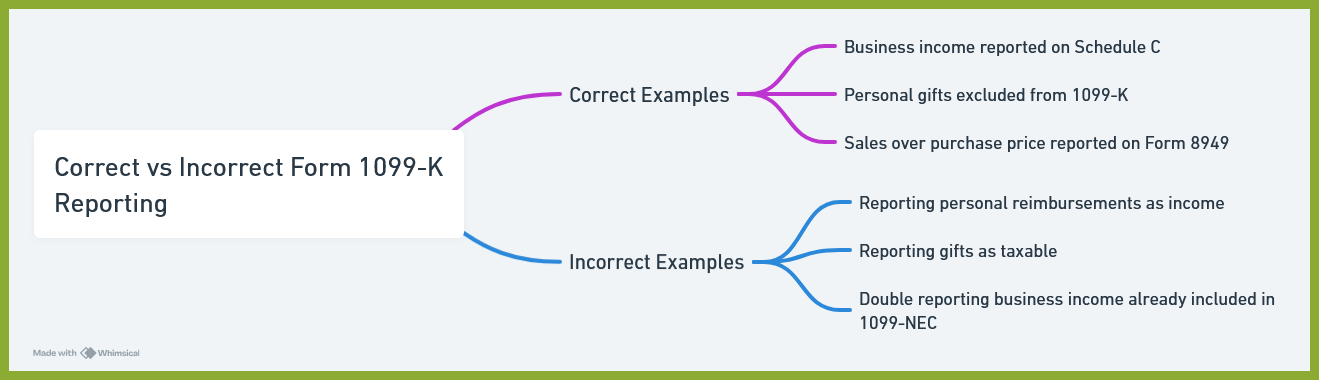

2. Understanding Taxable vs. Non-Taxable Income

Receiving a Form 1099-K does not automatically mean the payments are taxable. Taxpayers must use the form alongside other financial records to determine their actual tax liability.

-

Scenario A Selling Personal Items at a Loss: This is generally not taxable. For example, if you sold your old personal laptop for $400 on eBay, but you originally paid $1,500 for it, the payment is reported, but you do not owe tax on it because it represents a personal loss, not income.

-

Scenario B Payments for Goods or Services (Taxable): These amounts are taxable and must be reported on your tax return, typically on Schedule C or Schedule E. This includes any income generated from services (like freelance design work) or from selling items purchased specifically for resale (like an inventory of vintage clothing).

3. Handling Erroneous Forms

If you receive an incorrect Form 1099-K, the first step is to contact the filer listed on the form to request a correction. If you cannot get a corrected form in time, you can report the error on your tax return using Schedule 1 (Form 1040). The IRS provides detailed instructions for handling such situations.

4. Crowdfunding and Gifts

The tax implications of funds you receive depend on the purpose of the payment:

-

Crowdfunding (May Be Taxable): Money raised through crowdfunding may be taxable, depending on whether it is considered income (e.g., funding a business venture or book launch) or a tax-free gift.

-

Gifts and Reimbursements (Generally Not Reportable): Payments for personal gifts or reimbursements from friends and family (like splitting a dinner bill) are generally not reportable on Form 1099-K.

-

Receiving a Gift vs. Selling a Service: If a friend sends you $100 via Venmo for a birthday gift, it is not taxable. However, if a client sends you $100 via Venmo for a service you performed, it is taxable income, regardless of the TPSO reporting threshold.

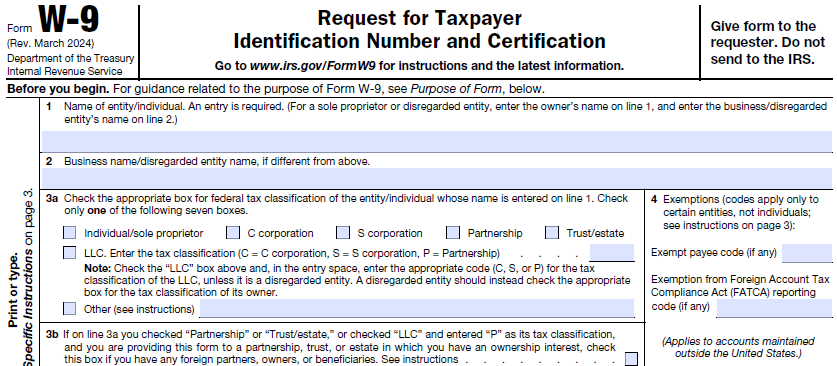

5. Backup Withholding Explained

If you fail to provide the payer with a correct Taxpayer Identification Number (TIN), you may be subject to backup withholding. This is a federal tax deducted by the payor and can be refunded or credited when filing your tax return. Ensure your TIN is accurate to avoid unnecessary deductions.

6. What to Do with Multiple Forms 1099-K

If you receive multiple Forms 1099-K, you should combine the amounts from all forms and use your comprehensive financial records (like business expense logs) to determine your actual tax liability. The IRS provides guidance on how to report these combined amounts on your tax return.

Form 1099-K Frequently Asked Questions

What is Form 1099-K and why would I receive one?

Form 1099-K reports payments received during the year from payment cards, payment apps, or online marketplaces for goods or services. You may receive one if your gross payments exceed the reporting threshold or if you accepted any payment via a payment card.

Is there a threshold amount that must be met before I would receive a Form 1099-K?

For payment card transactions, there is no threshold; even $0.01 must be reported. For TPSOs, the federal threshold is $20,000 in gross payments and more than 200 transactions, but states may have lower thresholds.

Do I have to report payments on my tax return if they are not reported on a Form 1099-K?

Yes, all income is taxable unless explicitly exempted by tax law, even if it is not reported on a Form 1099-K.

What is reported on the Form 1099-K?

The gross payment amount (Box 1a) reports the total dollar amount of payment transactions, excluding fees, credits, refunds, shipping, and discounts. Taxpayers must use their own records to determine taxable income.

What do I do if I get a Form 1099-K?

Use the form with your other tax records to file your return. Review the form for accuracy, determine deductible expenses, and report payments based on their type (e.g., personal items, goods, services).

Are all the payments reported on my Form 1099-K taxable?

Not all payments are taxable. For example, selling a personal item at a loss or receiving gifts/reimbursements are not taxable. Taxpayers should use their records to determine taxable income.

What should I do if my Form 1099-K is incorrect?

Contact the filer listed on the form to request a correction. If you cannot get a corrected form, report the error on Schedule 1 (Form 1040) when filing your return.

Will I get a Form 1099-K if friends or family send me money for gifts and reimbursements?

No, payments for gifts or reimbursements should not be reported on Form 1099-K. If you receive one in error, follow IRS instructions to correct it.

I sold a personal item and the gross payment amount is reported on Form 1099-K. How do I determine my taxable income?

Calculate the gain or loss by subtracting the purchase price from the sales price. Gains are taxable and reported on Form 8949 and Schedule D, while losses are not deductible.

If I receive multiple Forms 1099-K, each reflecting different transactions, what should I do?

Use all forms and your records to determine your actual tax liability. Report the combined amounts on your tax return.

Who is responsible for reporting payment card transactions?

The entity that submits the instructions to transfer funds to the payee’s account is responsible for reporting payment card transactions.

Is there a de minimis exception for TPSOs reporting third party network transactions on Form 1099-K?

Yes, TPSOs are not required to file Form 1099-K unless gross payments exceed $20,000 and there are more than 200 transactions.

Is there a de minimis exception for reporting payment card transactions on Form 1099-K?

No, all payment card transactions must be reported, regardless of the amount.

Why did the ticket sale app or online marketplace ask for my social security number?

If payments exceed $20,000 and more than 200 transactions, TPSOs must report the gross sales to the IRS and require your SSN for Form 1099-K reporting. Failure to provide it may result in backup withholding.

If I received a Form 1099-K for donations through crowdfunding, am I required to report the proceeds?

Some crowdfunding money may be taxable and must be reported, while other funds may be considered gifts and not taxable. Use IRS guidance to determine your tax obligations.

Key Takeaways for Navigating Form 1099-K Compliance

Navigating the latest Form 1099-K requirements can be complex, but by staying informed and organized, you’re already taking important steps to protect your business and ensure compliance. The clarifications provided by the IRS on thresholds, taxable versus non-taxable income, and how to manage various payment scenarios are designed to help you report accurately and avoid common pitfalls. Remember, diligent recordkeeping and understanding how each type of payment is treated will make tax season far less stressful.

At Lift HCM, we recognize that your time is valuable—and that accurate reporting isn’t just a regulatory necessity, but a cornerstone of business integrity. Our experienced team is here to support employers, finance leaders, and HR professionals as federal standards continue to evolve. If you have questions or need guidance on payroll compliance, workforce management, or navigating new reporting requirements, we’re ready to help.

Disclaimer: This blog post is for informational purposes only and does not constitute tax or legal advice. Please consult with a qualified tax professional for advice specific to your financial situation.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.jpg?width=4000&height=3723&name=stack-papers-tax-concept-illustration(1).jpg)

.jpeg?width=1344&height=768&name=two%20binders%20stacked%20on%20top%20of%20eachother%20on%20top%20of%20paperwork%20and%20a%20calculator(1).jpeg)

.jpeg?width=1792&height=1024&name=glass%20jar%20on%20a%20restaurant%20table%20top%20bar%20with%20someone%20putting%20cash%20tips%20in%20it(1).jpeg)

.jpeg?width=1792&height=1024&name=a%20restaurant%20employee%20counting%20cash%20tips%20at%20a%20table(1).jpeg)

.jpg?width=5000&height=3337&name=account-assets-audit-bank-bookkeeping-finance-concept(1).jpg)