Illinois SUI Quarterly Reporting: 3 Steps to Avoid Tax Filing Fines

November 26th, 2025

5 min read

If you’re an HR or finance professional responsible for quarterly reporting, you know how quickly one missed deadline can snowball into costly fines. In Illinois, errors in State Unemployment Insurance (SUI) filings are among the most common and preventable compliance issues. The penalties are compounding, the deadlines are strict, and the rules change annually.

At Lift HCM, we see this every quarter: even experienced teams struggle to keep track of SUI rate updates, taxable wage base adjustments, and MyTax Illinois submission requirements. With the January 31, 2026 deadline fast approaching, now is the time to review your Q4 reporting process, fix potential issues, and avoid unnecessary fines. By the end of this article, you’ll have a clear roadmap and renewed confidence heading into year-end.

Table of Contents

- Understanding Illinois SUI and Why It Matters

- The Essential Quarterly Reporting Calendar

- How to Audit Your Current SUI Process Before Q4 Ends

- Three Common Mistakes That Trigger Illinois Fines

- What Happens If You Miss a Filing?

- The HCM Solution: Automating Quarterly Peace of Mind

- Frequently Asked Questions About Illinois SUI Compliance

- Get Ahead Before January 31

Understanding Illinois SUI and Why It Matters

State Unemployment Insurance (SUI) is an employer-paid tax that funds unemployment benefits for workers who lose their jobs through no fault of their own. In Illinois, SUI plays a critical role in supporting the state’s workforce safety net. Employers are required to file reports and pay contributions quarterly through the Illinois Department of Employment Security (IDES).

Illinois operates one of the largest unemployment trust funds in the Midwest, and its financial stability depends on accurate and timely employer contributions. Because of prior trust fund shortfalls during the pandemic, the IDES has tightened enforcement around late filings and underpayments. That means even a small error—like misreporting a taxable wage or missing a due date—can have significant financial consequences.

Accurate SUI management also protects your business reputation. Consistent compliance signals strong internal controls and helps you maintain a favorable experience rating, which directly impacts your future SUI tax rate.

The Essential Quarterly Reporting Calendar

Core Forms and Deadlines

Illinois employers must file Form UI‑3/40 (Employer’s Contribution and Wage Report) and remit their contributions each quarter via MyTax Illinois. The required due dates are:

|

Quarter |

Period Covered |

Filing Deadline |

|

Q1 |

Jan 1 – Mar 31 |

April 30 |

|

Q2 |

Apr 1 – Jun 30 |

July 31 |

|

Q3 |

Jul 1 – Sept 30 |

October 31 |

|

Q4 |

Oct 1 – Dec 31 |

January 31 (following year) |

With Q4 already underway, this means your 2025 reports and payments are due January 31, 2026.

The Taxable Wage Base Trap

Illinois adjusts its taxable wage base nearly every year. For 2025, the taxable wage base is $13,916 per employee (IDES, 2025 UI Tax Rates Report). Employers pay SUI contributions only on the first $13,916 of each employee’s annual wages.

If your payroll system hasn’t been updated to reflect the new base, you risk one of two outcomes:

- Overpayment: Paying more than required and straining cash flow.

- Underpayment: Triggering fines, back payments, and interest.

In 2025, SUI rates in Illinois range approximately from 0.75% to 7.85%, depending on employer experience rating and industry classification.

How to Audit Your Current SUI Process Before Q4 Ends

Performing a final audit before the January 31 deadline is the smartest way to catch errors before IDES does. Use this checklist to ensure every compliance box is checked:

- Verify your SUI rate notice.

Check that you received your new 2025 rate notice from IDES (typically sent mid-December). Confirm your payroll or HCM system has updated it. - Confirm taxable wage base accuracy.

Ensure the 2025 wage base ($13,916) is reflected in your payroll software. - Reconcile total wages.

Compare year-to-date totals across your internal payroll reports and previous UI‑3/40 submissions to detect discrepancies. - Review employee identification data.

Check names and Social Security Numbers for accuracy. Even minor mismatches can trigger filing rejections. - Test your MyTax Illinois login.

Ensure your e-filing credentials are valid and linked to the correct employer account before the January rush.

Year-End Compliance Tip: IDES typically sends 2026 rate notices in mid-to-late December. Be ready to update your payroll system with your 2026 SUI rate before your first payroll of the new year.

With November already underway, take time now to reconcile your wage data before the holidays. Many employers rush UI‑3/40 filings in January only to discover mismatches too late. Setting aside even one hour this month can prevent thousands in penalties.

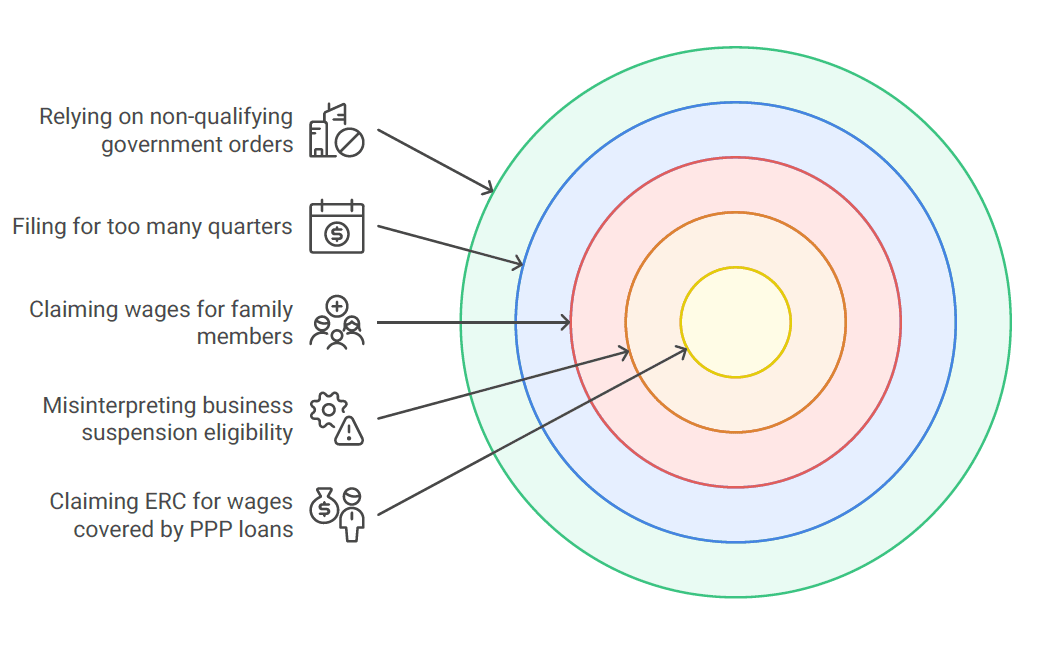

Three Common Mistakes That Trigger Illinois Fines

Mistake 1: Late or Incorrect UI-3/40 Filing

Illinois enforces strict penalties for late filings. Employers face a fine of $5 for each $10,000 (or fraction thereof) in total wages, capped at $2,500 per month, and never less than $50. Penalties accrue monthly until filing is complete, and interest accumulates on unpaid contributions.

A single missed deadline can also raise your future SUI rate by negatively impacting your experience rating—a hidden cost few realize until renewal season.

Mistake 2: Wage and Identity Mismatches

The IDES system automatically cross-references employee wage data with Social Security Administration (SSA) records. Errors in reporting a Social Security Number (SSN) or an employee's name cause an instant rejection of your report and can delay the accurate crediting of tax payments. This often occurs when HR staff rush through onboarding or fail to update employee records promptly. Mismatches force manual intervention, delaying the process and subjecting you to penalties for inaccurate filing.

Mistake 3: Mismanagement of SUI Rate Notices

Each December, IDES sends your business a notice outlining your specific SUI tax rate for the upcoming year.

If this notice is sent to an outdated address or generic inbox—and isn’t received by the correct person—or if the updated rate isn’t accurately entered into your payroll system before January 1, your Q1 liability will be calculated incorrectly. This almost always results in underpayment, exposing your business to retroactive fines and interest charges once the discrepancy is identified by the state.

What Happens If You Miss a Filing?

When an Illinois employer misses a filing, IDES automatically assesses penalties and interest. For example, if your company reports $1.2 million in taxable wages and misses a monthly filing window, you could face up to $600 in fines plus interest and potential audit scrutiny.

Interest compounds daily until the liability is resolved, and chronic lateness can cause your unemployment experience rating to worsen—raising future tax costs. IDES may also refer repeated non-filers for audit or further enforcement.

In addition, failing to file or underreporting wages can delay employees' unemployment claims. This exposes your organization to employee relations risks, especially during layoffs or restructuring.

The HCM Solution: Automating Quarterly Peace of Mind

Manual spreadsheets and calendar reminders are no match for today’s compliance demands. Automated human capital management systems dramatically reduce risk by ensuring accuracy and timeliness.

Automated SUI Tax Calculation

Lift HCM’s technology automatically:

- Applies the correct Illinois wage base and tax rate each year.

- Flags employees who reach the taxable limit.

- Detects missing or invalid employee data before submission.

- Updates in real time as IDES releases new wage base or rate information.

This precision eliminates the human error that causes most fines.

Guaranteed On-Time E-Filing

The system also automates every filing step:

- Prepares the UI‑3/40 form for each quarter.

- E-files directly through MyTax Illinois.

- Generates a pre-submission validation report.

- Stores audit-ready proof of filing and payment confirmations.

When combined with Lift HCM’s managed payroll services, your team gains full visibility and assurance that filings are always accurate and on time.

Frequently Asked Questions About Illinois SUI Compliance

Q: How do I file Illinois SUI online?

Employers file via MyTax Illinois, IDES’ online tax portal. You’ll need your employer account number and PIN.

Q: What is the Illinois UI-3/40 due date for Q4 2025?

January 31, 2026.

Q: What if I overpay my Illinois unemployment tax?

IDES applies overpayments to future quarters or issues refunds upon request.

Q: Can I amend a previous UI-3/40 report?

Yes. You can submit an amended report through MyTax Illinois to correct wage or contribution errors.

Get Ahead Before January 31st

Late filings, data mismatches, and outdated rate settings create unnecessary stress for HR and finance teams. Now, with the Q4 deadline only weeks away, you understand the causes, the penalties, and the practical steps to prevent them. With a clear reporting calendar, internal audit checklist, and modern HCM automation, your organization can close Q4 2025 confidently and start the new year strong.

At Lift HCM, we help employers simplify payroll, ensure compliance, and eliminate reporting risks. Take your next step toward peace of mind and learn more about how our solutions can help your business today!

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.jpg?width=4000&height=3723&name=stack-papers-tax-concept-illustration(1).jpg)

.jpeg?width=1344&height=768&name=two%20binders%20stacked%20on%20top%20of%20eachother%20on%20top%20of%20paperwork%20and%20a%20calculator(1).jpeg)

.jpeg?width=1792&height=1024&name=glass%20jar%20on%20a%20restaurant%20table%20top%20bar%20with%20someone%20putting%20cash%20tips%20in%20it(1).jpeg)

.jpeg?width=1792&height=1024&name=a%20restaurant%20employee%20counting%20cash%20tips%20at%20a%20table(1).jpeg)

.jpg?width=5000&height=3337&name=account-assets-audit-bank-bookkeeping-finance-concept(1).jpg)