Payroll Fraud Signs: Red Flags Every Business Owner Should Watch For

October 24th, 2025

6 min read

Have you ever worried that your payroll system could be manipulated without you noticing? Do you wonder if small changes in time entries or pay adjustments might be slipping past your review process?

Payroll fraud doesn’t only happen at large corporations. According to the Association of Certified Fraud Examiners (ACFE), it’s one of the most common schemes in small businesses—and it often goes undetected for years. The average case lasts 30 months before discovery, resulting in significant financial losses and compliance risks.

At Lift HCM, we understand how complex payroll systems can feel when you’re unsure where risks might hide. This article will walk you through the most common payroll fraud patterns, red flags every employer should watch for, and the internal controls you can implement this month to strengthen your defenses. You’ll also learn how integrating time and attendance with payroll creates a natural barrier against fraud—helping you move forward with confidence.

Table of Contents

- The Most Common Payroll Fraud Patterns

- Payroll Fraud Red Flags in Timekeeping and Pay Changes

- Internal Controls to Strengthen Payroll Fraud Prevention

- How Integrated Time & Attendance and Payroll Reduce Fraud Risk

- Beyond the Loss: The True Cost of Payroll Fraud

- What To Do If You Suspect Payroll Fraud

- FAQs About Payroll Fraud

- From Vulnerability to Vigilance: Safeguarding Your Payroll

The Most Common Payroll Fraud Patterns

Payroll fraud occurs in many forms, but most schemes fall into a handful of recurring patterns. Recognizing these patterns is the first step toward building effective defenses.

- Ghost Employees: These are individuals added to the payroll system by someone with payroll access, often collecting paychecks for months before being noticed. This is especially prevalent in businesses with high employee turnover.

- Buddy Punching: Employees clock in or out for absent coworkers, leading to inflated hours and payroll waste. Modern electronic timekeeping systems are designed to combat this physical form of time theft.

- Pay Rate Manipulation: Payroll staff or supervisors may change pay rates without proper authorization, usually to benefit themselves or an accomplice.

- Other Schemes: Additional common patterns include overstated overtime, misclassified employees (who are paid differently than their duties require), commission padding, and unauthorized pay advances.

Each of these tactics exploits gaps in internal controls, leaving businesses vulnerable to losses that extend beyond financial impact to reputational damage and compliance risks. According to PwC's Global Economic Crime and Fraud Survey, nearly half of businesses worldwide report experiencing some form of fraud every two years, with payroll consistently among the top internal schemes.

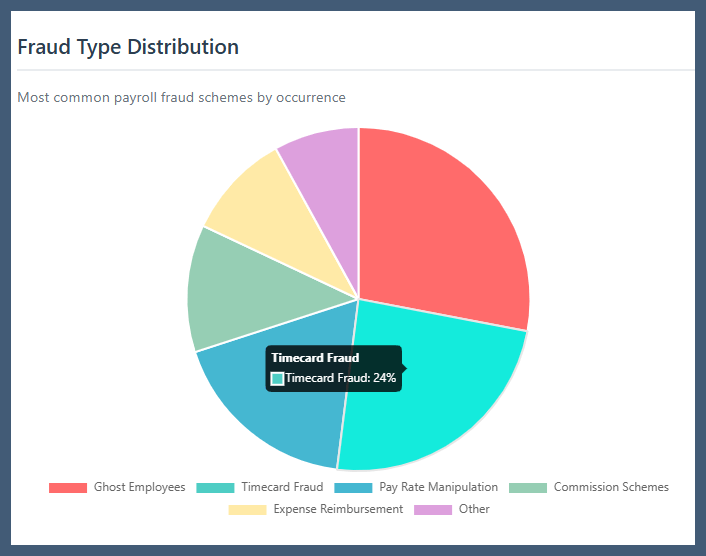

To better understand the scope of the problem, let's look at how these fraud schemes break down across organizations:

As the data reveals, ghost employees and timecard fraud alone account for over half (52%) of all payroll fraud cases, making them critical areas for focused prevention efforts. Understanding this distribution helps you prioritize where to strengthen your controls first.

Each of these tactics exploits gaps in internal controls, leaving businesses vulnerable to losses that extend beyond financial impact.

Payroll Fraud Red Flags in Timekeeping and Pay Changes

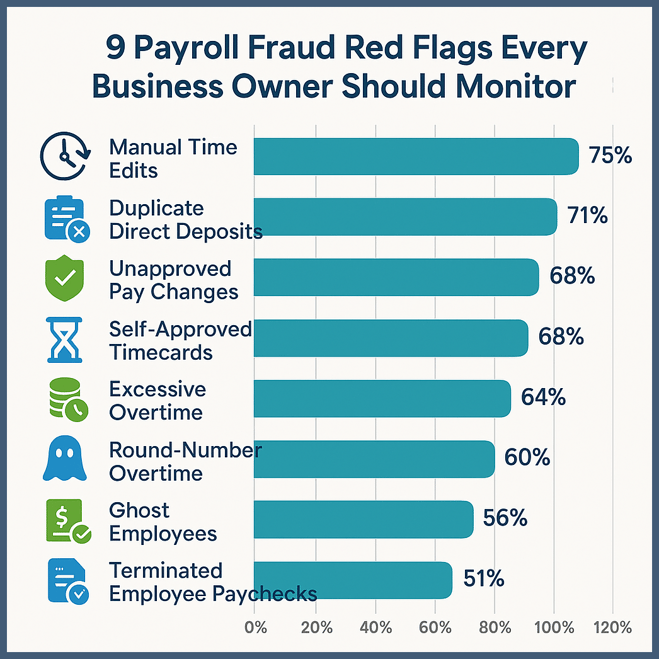

The signs of payroll fraud are often subtle, but they leave traces that attentive leaders can detect. In timekeeping systems, repeated manual edits to employee hours—especially without a clear reason—should raise concern. Similarly, excessive overtime in departments with steady workloads or consistent round-number overtime entries (like exactly 10.00 hours each week) may signal falsified reporting.

One of the best ways to prevent these issues is to ensure your time-tracking process is standardized and accurate. As we shared in our article on best practices for accurate time and attendance tracking in payroll management, electronic systems that require supervisor approval and maintain edit histories help detect manipulation early.

Fraud indicators also show up within payroll itself. Duplicate direct deposit accounts can funnel multiple paychecks into one bank, while unusual payments to terminated employees or multiple checks for one worker in the same period warrant immediate review. One of the most overlooked signs is when supervisors approve their own timecards—a direct conflict of interest that removes a vital control layer.

While any single sign may have an innocent explanation, recurring irregularities point to deeper problems. Building a culture of accountability, where discrepancies are questioned respectfully and quickly, is one of the strongest ways to prevent long-term fraud.

Internal Controls to Strengthen Payroll Fraud Prevention

The best way to reduce payroll fraud risks is by tightening internal controls, turning reactive monitoring into proactive defense.

Implement these critical controls regardless of your business size:

- Segregate Duties: Ensure the same employee is not responsible for both entering/validating data and approving the final changes or processing payments.

- Require Dual Approvals: Implement a policy for two signatures on pay rate adjustments, off-cycle payments, and new employee onboarding.

- Standardize Electronic Timekeeping: Move away from paper timesheets to limit the risk of falsified data and create an immutable digital audit trail.

- Conduct Regular Audits: Reconcile payroll registers against records and bank accounts monthly or quarterly to uncover inconsistencies early.

- Enable Audit Logs: Configure your system to track every change made to employee records, pay rates, or timecards, recording the "who, what, when."

- Rotate Duties: Periodically rotate payroll responsibilities among staff to reduce the chance of long-term schemes.

- Configure Threshold Alerts: Automatically flag transactions like excessive overtime or large, off-cycle payments for immediate review.

According to data, businesses with proactive controls experience lower median fraud losses than those without.

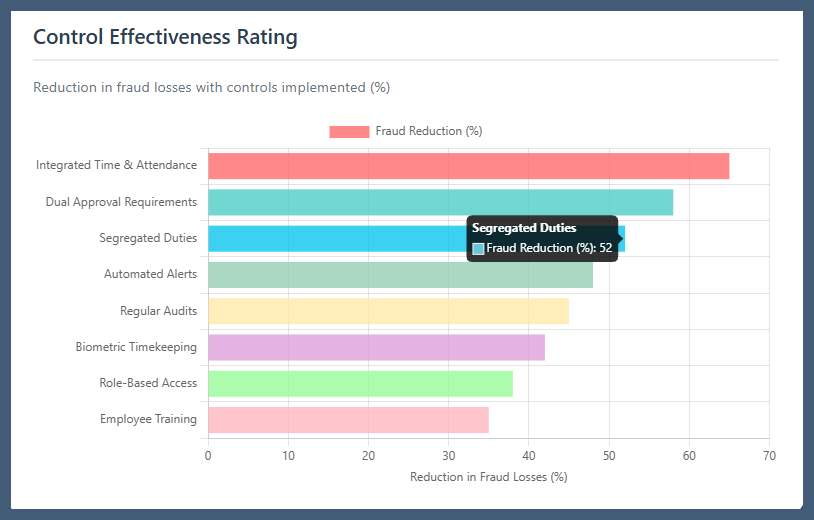

While all these controls are important, research shows significant variation in their effectiveness. Here's how each control measures up in reducing fraud losses:

The data makes it clear: integrated time and attendance systems deliver the highest return on investment, reducing fraud by 65%. This explains why modern businesses are rapidly moving toward unified platforms rather than managing separate systems.

According to data, businesses with proactive controls experience lower median fraud losses than those without.

How Integrated Time & Attendance and Payroll Reduce Fraud Risk

Many businesses unintentionally create risk by running separate systems for timekeeping and payroll. When these systems don’t communicate, manual entry increases errors, and disconnected approvals allow fraudulent changes to pass unnoticed.

Integrating time and attendance with payroll eliminates those gaps. It creates a single source of truth where hours, rates, and approvals are automatically synchronized. This type of integration not only improves accuracy but also reinforces data security. As discussed in our comparison of SaaS vs. local payroll systems for data security, modern cloud-based solutions reduce the risk of internal manipulation by tracking changes and enforcing access controls.

Integration also enhances transparency. Supervisors approve hours directly within the same workflow that feeds payroll processing, making unauthorized adjustments immediately visible. The result is faster payroll accuracy, stronger compliance, and a smaller attack surface for fraud to occur.

Beyond the Loss: The True Cost of Payroll Fraud

When payroll fraud happens, the immediate financial impact is only part of the damage. Regulatory fines, legal costs, and employee morale all take a hit—often costing far more than the fraud itself.

Organizations risk penalties from agencies like the IRS and Department of Labor if internal control failures lead to noncompliance. Investigations can consume weeks of leadership time and require costly forensic accountants. Internally, trust suffers. Honest employees may feel betrayed, especially if leadership delays addressing known issues.

For small and midsized companies, even one publicized incident can harm reputation and client confidence. The long-term cost isn’t just financial—it’s cultural. Addressing payroll fraud quickly and transparently helps maintain trust both within and outside the organization.

What To Do If You Suspect Payroll Fraud

Discovering payroll fraud signs can feel overwhelming, but acting quickly and deliberately makes a major difference in limiting the damage.

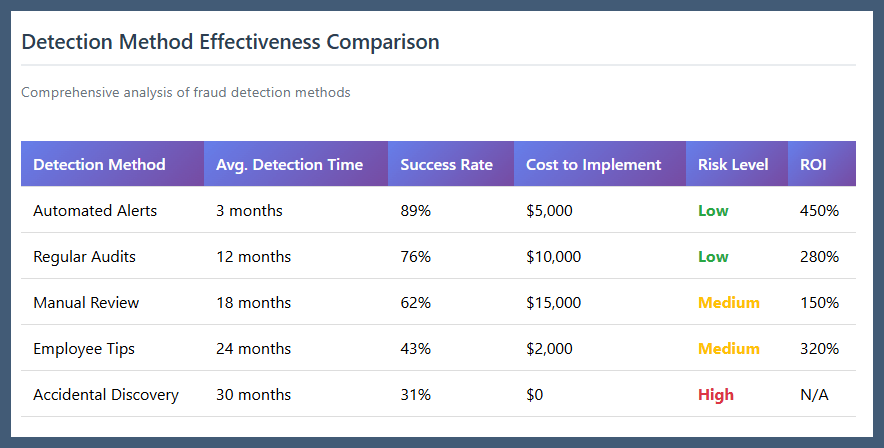

Before diving into immediate action steps, it's crucial to understand how different detection methods perform. This knowledge can help you implement the right monitoring systems to catch fraud early:

As you can see, automated alerts provide the fastest detection time at just 3 months with an 89% success rate, while waiting for accidental discovery means fraud can continue for an average of 30 months. This underscores why proactive monitoring is essential.

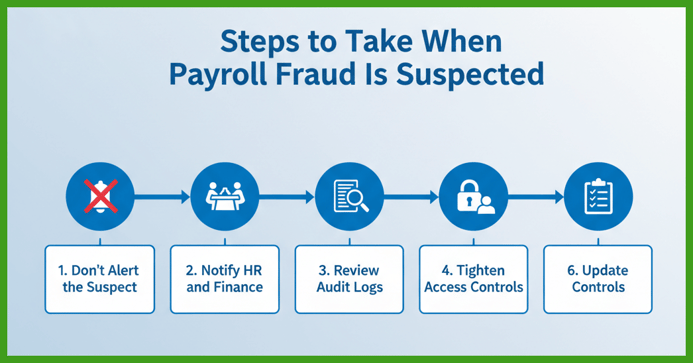

If you do suspect fraud despite these preventive measures, follow these steps immediately:

- Do Not Alert the Suspect: Avoid compromising evidence or allowing additional manipulation.

- Notify Leaders Quietly: Inform and finance leaders and begin cross-checking payroll data with active employee records.

- Review Audit Logs: Identify when and by whom changes were made to create a timeline of activity.

- Tighten System Access: Limit permissions until the issue is fully resolved.

- Engage Experts: For complex cases, engage legal counsel or forensic accountants to help investigate and mitigate losses.

- Update Controls: After the situation is addressed, close identified system gaps and update internal controls to prevent recurrence.

Acting quickly not only limits losses—it preserves integrity and demonstrates your company’s commitment to transparency.

To ensure data remains protected during this process, follow the security protocols outlined in our guide on SMB payroll cybersecurity best practices. These steps help prevent further exposure while the issue is resolved.

FAQs About Payroll Fraud

Which payroll fraud signs are most common?

The most frequent red flags include repeated manual time edits, duplicate direct deposits, unapproved pay changes, and self-approved timecards.

Can small teams segregate duties?

Yes. Even small businesses can split responsibilities—for example, having one person enter time data while another reviews and approves pay adjustments.

Which audit logs help detect payroll fraud quickly?

Enable logs for employee additions or deletions, pay rate changes, direct deposit updates, and timecard edits. Reviewing them monthly accelerates detection.

How common is payroll fraud in small businesses?

The ACFE reports that small businesses experience nearly double the rate of payroll fraud compared to larger organizations, mainly due to fewer internal controls.

How long does payroll fraud usually last?

Payroll fraud schemes typically last around 30 months before detection, which highlights the importance of continuous monitoring.

From Vulnerability to Vigilance: Safeguarding Your Payroll

Payroll fraud isn’t just a threat—it’s a reality that many businesses won’t spot until real damage is done. But as you’ve learned, it’s possible to shift from reactive to proactive, defending your organization with the right mix of vigilance, technology, and strong internal controls.

By understanding common fraud schemes and their warning signs, fostering a culture of accountability, and leveraging integrated solutions, you dramatically reduce your risk. Investing in controls today gives you more than compliance—it builds trust, safeguards your resources, and positions your business for stable, confident growth.

At Lift HCM, we know that peace of mind in payroll is invaluable. Our experience, paired with a personal approach and industry-leading technology, empowers you to focus on what matters most: your people and your mission.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.png?width=1536&height=1024&name=Create%20a%20background%20that%20reads%2c%20How%20Long%20to%20Keep%20P%20(1).png)