What is the Work Opportunity Tax Credit (WOTC)? A Guide for Employers 2024

September 11th, 2024

5 min read

By Jason Noble

Did you know that businesses can save up to $9,600 per eligible employee through the Work Opportunity Tax Credit (WOTC)? What if you could reduce your business's tax liability while promoting diversity and inclusion in your workplace?

At Lift HCM, we specialize in helping businesses like yours navigate the complexities of tax credits to maximize savings and foster a diverse, inclusive workforce. Our team has extensive experience with various federal and state tax credit programs, such as the Work Opportunity Tax Credit (WOTC) and the Employee Retention Credit (ERC), ensuring you take full advantage of available incentives. We've successfully guided numerous clients through the application process, leading to substantial tax savings and enhanced employee retention across various industries.

In this guide, we'll explain everything you need to know about the WOTC, including how it works, who qualifies, and how your business can benefit.

Table of Contents

- What is the Work Opportunity Tax Credit (WOTC) and Why Is It Important for Businesses?

- Understanding WOTC Eligibility and Screening

- Who Qualifies for WOTC?

- How Does the WOTC Benefit Employers?

- How Does the WOTC Benefit Employees?

- How Much is a WOTC Credit Worth?

- Is WOTC Mandatory?

What is the Work Opportunity Tax Credit (WOTC) and Why Is It Important for Businesses?

Work Opportunity Tax Credit (WOTC) is a federal tax incentive program established in 1996. It encourages employers to hire individuals from specific target groups who face significant barriers to employment. This initiative promotes workplace diversity and inclusion and helps businesses reduce their tax liabilities.

Key facts about WOTC:

- It's a federal program administered by the Internal Revenue Service (IRS) and Department of Labor

- The program has been renewed multiple times, most recently through 2025

- WOTC can provide tax credits ranging from $1,200 to $9,600 per eligible employee

As of 2024, the WOTC program has been extended through December 31, 2025. However, given its long history and bipartisan support, many expect it to be renewed beyond this date. Potential future developments could include:

- Expansion of target groups to include other disadvantaged populations

- Increases in credit amounts to further incentivize hiring

- Integration with other workforce development initiatives

The Work Opportunity Tax Credit program uniquely combines business interests and social responsibility. By incentivizing hiring individuals who have faced significant barriers to employment, the program creates a win-win situation: businesses reduce their tax liability and gain valuable employees, while individuals from target groups gain opportunities for economic advancement.

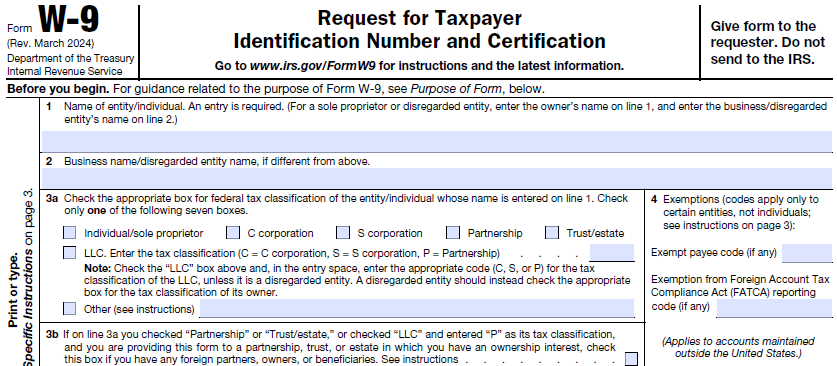

Understanding WOTC Eligibility and Screening

Tax credit screening is the process by which employers identify and verify the eligibility of new hires for the WOTC. This involves using Form 8850, gathering the necessary documentation, and submitting it to the appropriate state workforce agency within a specified timeframe. Accuracy and timeliness are crucial, as missing deadlines or providing incomplete information can result in the loss of valuable credits.

Who Qualifies for WOTC?

The WOTC program targets several specific groups, each facing unique challenges in the job market. Let's explore these groups in more detail:

- Veterans: This category includes disabled veterans, veterans who have been unemployed for extended periods, and veterans receiving Supplemental Nutrition Assistance Program (SNAP) benefits.

- Ex-felons: Individuals who have been convicted of a felony and hired within one year of their conviction or release from prison.

- Long-term unemployment recipients: Those who have been unemployed for 27 consecutive weeks or more and have received unemployment compensation.

- Supplemental Nutrition Assistance Program (SNAP) recipients: Individuals between 18 and 39 years old who are members of a family that has received SNAP benefits.

- Supplemental Security Income (SSI) recipients: Any individual who has received SSI benefits within 60 days of being hired.

- Designated community residents: Individuals between 18 and 39 years old living in Empowerment Zones or Rural Renewal Counties.

- Vocational rehabilitation referrals: Individuals with physical or mental disabilities who have been referred to the employer upon completion of or while receiving rehabilitative services.

- Summer youth employees: Young people aged 16 or 17 living in Empowerment Zones and employed between May 1 and September 15.

- Temporary Assistance for Needy Families (TANF) recipients: Individuals from families receiving TANF benefits.

- Qualified long-term unemployment recipients: Individuals unemployed for not less than 27 consecutive weeks at the time of hiring and received unemployment compensation during some or all of the unemployment period.

Understanding these target groups is crucial for employers looking to participate effectively in the WOTC program.

How Does the WOTC Benefit Employers?

The WOTC program offers several significant advantages for employers:

- Substantial Tax Savings: Employers can claim a tax credit ranging from $1,200 to $9,600 per eligible employee, depending on the target group and the qualified wages paid to the employee. Here's a breakdown of potential credit amounts:

- For most target groups, the credit is 40% of qualified first-year wages up to $6,000 for a maximum credit of $2,400.

- For long-term TANF recipients, the credit can be up to $9,000 over two years.

- For certain veterans, the credit can be as high as $9,600.

- Reduced Hiring Costs: By incentivizing hiring individuals from target groups, companies can potentially reduce their overall recruitment and training costs. This is particularly beneficial for small and medium-sized businesses with limited hiring budgets.

- Enhanced Corporate Social Responsibility: Participating in the WOTC program demonstrates a commitment to providing opportunities for disadvantaged groups. This can enhance the company's reputation among customers, investors, and the broader community.

- Diverse Workforce: The program encourages the creation of a more diverse and inclusive workplace. Research has shown that diverse teams tend to be more innovative and better at problem-solving, leading to improved company performance.

- Improved Employee Retention: Studies have shown that WOTC hires often have higher retention rates than traditional hires. This can lead to reduced turnover costs and a more stable workforce.

- No Limit on Number of New Hires: An employer can hire any number of eligible individuals. This allows businesses to maximize their tax savings as they grow.

How Does the WOTC Benefit Employees?

The WOTC program isn't just beneficial for employers; it also offers significant advantages for job seekers:

- Increased Job Opportunities: The tax credit incentivizes employers to consider candidates they might otherwise overlook, opening doors for individuals who have faced barriers to employment.

- Skill Development: Gaining employment gives individuals the opportunity to develop new skills and gain valuable work experience, which can significantly improve their long-term career prospects.

- Economic Empowerment: Stable employment allows individuals to achieve greater financial independence, contribute to their local economies, and potentially break cycles of poverty.

- Reduced Stigma: The program helps reduce stigma associated with certain groups, such as ex-felons or long-term unemployment recipients, by demonstrating their value in the workplace.

- Pathway to Career Advancement: For many, a job obtained through the WOTC program can serve as a stepping stone to better opportunities and career advancement.

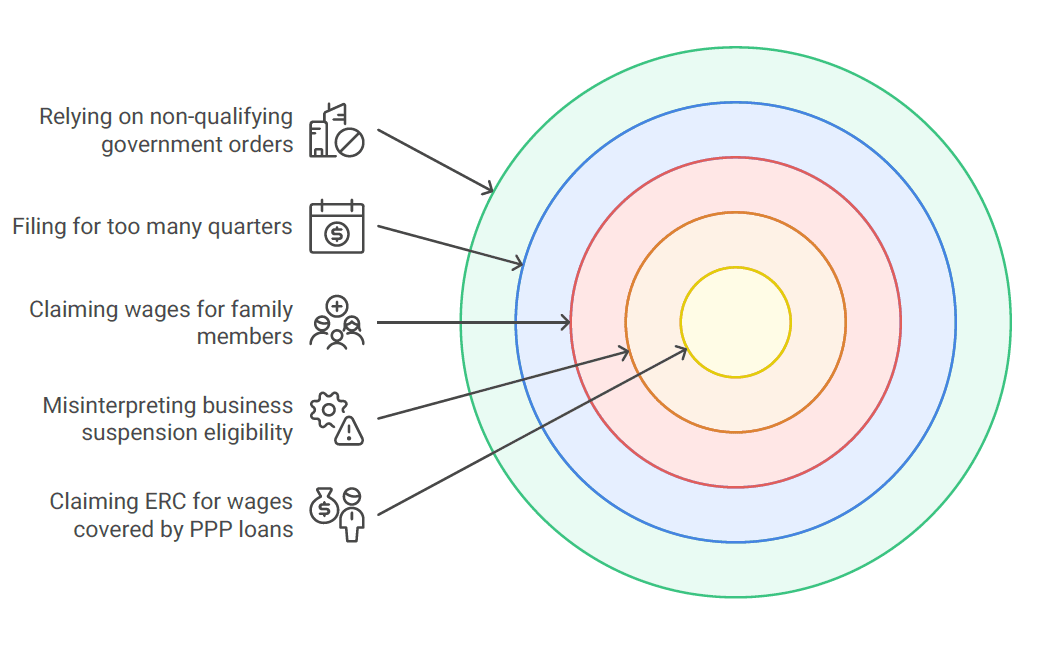

How Much is the WOTC Worth?

The value of the WOTC varies depending on the target group of the new hire and the number of hours worked. Here's a breakdown:

(1).png?width=1347&height=581&name=Work%20Opportunity%20Tax%20Credit%20(WOTC)(1).png)

The Work Opportunity Tax Credit (WOTC) offers a one-time credit for each eligible employee hired. Employers can claim multiple credits for different qualified new hires without any limit on the total number of hires. These credits directly reduce your tax bill, potentially providing substantial savings for your business.

📌 Pro Tip: Implement a system like WOTC or HRlogics to track application deadlines and maintain required documentation to ensure you don't miss out on potential credits.

Is WOTC Mandatory?

The Work Opportunity Tax Credit (WOTC) program is designed to be voluntary. Legally, employers are not permitted to require employees or job applicants to complete WOTC forms, including IRS Form 8850 and ETA Form 9061. Individuals can decline to fill out these forms without fear of negative repercussions.

Despite this, some companies may integrate WOTC paperwork into their application process to make it seem compulsory. Such practices, however, contradict the program's intended voluntary nature. Employees and applicants should be aware that they have the option to opt out of providing WOTC information without jeopardizing their employment or application status.

How Can a Payroll Service Provider Like Lift HCM Help Companies with WOTC?

For businesses that haven't yet explored the WOTC program, now is an excellent time to start. The potential for substantial tax savings, combined with the opportunity to contribute positively to society, makes the WOTC program a valuable tool in any company's hiring strategy.

Remember, while this guide provides a comprehensive overview of the WOTC program, tax laws and regulations can be complex and subject to change. It's always advisable to consult with a qualified tax professional or the IRS for the most up-to-date information and guidance on how the WOTC program applies to your specific business situation.

At Lift HCM, we have the expertise and experience to guide you through the WOTC process, from screening to certification and beyond. Our team is dedicated to helping you optimize your tax savings while building a stronger, more diverse workforce.

Ready to transform your hiring process and reduce your tax liability? Contact Lift HCM today to learn more about how we can help you make the most of the Work Opportunity Tax Credit.

Please note that this article does not cover all possible scenarios, and any discussions or viewpoints should not be considered legal advice. Readers are advised to consult with legal professionals for specific legal guidance.

.jpg?width=196&height=130&name=composition-with-book-light-bulb(1).jpg) If you are not yet ready to speak with a team member, you may find these resources helpful:

If you are not yet ready to speak with a team member, you may find these resources helpful:

Jason Noble is a seasoned expert in payroll and human capital management. With a wealth of experience in streamlining payroll processes and optimizing workforce management, Jason has successfully held key roles at leading organizations. His deep understanding of industry best practices ensures that his insights are both practical and authoritative.

Topics:

.jpg?width=4000&height=3723&name=stack-papers-tax-concept-illustration(1).jpg)

.jpeg?width=1344&height=768&name=two%20binders%20stacked%20on%20top%20of%20eachother%20on%20top%20of%20paperwork%20and%20a%20calculator(1).jpeg)

.jpeg?width=1792&height=1024&name=glass%20jar%20on%20a%20restaurant%20table%20top%20bar%20with%20someone%20putting%20cash%20tips%20in%20it(1).jpeg)

.jpeg?width=1792&height=1024&name=a%20restaurant%20employee%20counting%20cash%20tips%20at%20a%20table(1).jpeg)

.jpg?width=5000&height=3337&name=account-assets-audit-bank-bookkeeping-finance-concept(1).jpg)