2026 Illinois Payroll Tax Changes: OBBBA Compliance Guide

February 5th, 2026

10 min read

For many Illinois business owners, seeing the state minimum wage remain at $15.00 for 2026 feels like a rare moment of stability. But don't let that number fool you into complacency. Between Chicago's aggressive local ordinances and a massive federal tax shift that Illinois has already rejected, your payroll "status quo" is about to become a compliance liability.

At Lift HCM, we specialize in navigating the friction between local, state, and federal mandates. We've spent the last year deconstructing the One Big Beautiful Bill Act (OBBBA) and the Chicago One Fair Wage Ordinance to ensure our clients don't just stay compliant, but stay ahead of the curve.

In this article, we'll break down why 2026 is a pivotal moment for your bottom line. We'll expose the "federal trap" of tax-free overtime, explain the shrinking tip credit in Chicago, and give you a concrete action plan for dual-track reporting.

Table of Contents

What is the Illinois Minimum Wage for 2026?

The Illinois state minimum wage will remain at $15.00 per hour throughout 2026. This marks the continuation of a plateau that began in 2025, following the state's multi-year wage increase schedule that started at $8.25 in 2019.

Why "Stable" Doesn't Mean "Simple"

While the state rate holds steady, the real complexity lies in the decoupling of state and federal law. Illinois is increasingly charting its own fiscal course, meaning what you see on a federal tax form may no longer match your state obligations. This divergence creates new compliance challenges that go far beyond simply paying the correct hourly rate.

For employers with locations in Chicago, there's an additional layer: the city operates on its own minimum wage schedule that exceeds the state requirement.

Chicago's One Fair Wage Ordinance: What Employers Must Know

If you have even one employee working within Chicago city limits, your "standard" state payroll won't work. Under the city's One Fair Wage Ordinance, the tip credit—the amount an employer can count toward the minimum wage from an employee's tips—is being phased out entirely by July 1, 2028.

What is a Tip Credit?

A tip credit allows employers to pay tipped employees (servers, bartenders, valets, etc.) a lower base wage, with the assumption that tips will bring their total compensation up to or above the minimum wage. Under traditional rules, if an employee doesn't earn enough in tips to reach minimum wage, the employer must make up the difference.

2026 Chicago Tip Credit Phase-Out Schedule

Effective July 1, 2026, Chicago employers will see the next scheduled reduction in the allowable tip credit:

|

Effective Date |

Standard Chicago Minimum Wage |

Maximum Tip Credit |

Minimum Base Wage for Tipped Workers |

% of Full Wage Required |

|

July 1, 2025 |

$16.60* |

24% ($3.98) |

$12.62 |

76% |

|

July 1, 2026 |

$17.01* |

16% ($2.72) |

$14.29 |

84% |

|

July 1, 2027 |

$17.44* |

8% ($1.40) |

$16.04 |

92% |

|

July 1, 2028 |

$17.87* |

0% ($0.00) |

$17.87 |

100% |

*Chicago's standard minimum wage is adjusted annually based on the Consumer Price Index (CPI) or 2.5%, whichever is lower. Figures shown are estimates based on 2.5% annual increases.

Who is Affected?

This ordinance applies to:

- Restaurants and bars within Chicago city limits

- Hotels and hospitality venues in Chicago

- Catering companies operating in Chicago

- Any business with tipped employees working in Chicago, even if your business headquarters is located elsewhere

Critical Note: The ordinance applies based on where the work is performed, not where your business is registered. If your suburban restaurant has employees who work catering events in Chicago, those hours fall under Chicago's wage rules.

Real Cost Impact: Restaurant Example

Let's look at what this means for a typical Chicago restaurant:

Scenario: You operate a restaurant in Chicago with 5 tipped servers working 30 hours per week each.

2025 Costs (July-December):

- Base wage: $12.62/hour

- Weekly payroll: $12.62 × 30 hours × 5 employees = $1,893/week

- Annual base wage cost: $98,436

2026 Costs (July-December):

- Base wage: $14.29/hour

- Weekly payroll: $14.29 × 30 hours × 5 employees = $2,143.50/week

- Annual base wage cost: $111,462

The Increase: $13,026 in additional labor costs for just 5 employees—a 13.2% increase in your base wage expenses.

And this doesn't account for the ripple effect on payroll taxes (FICA, unemployment insurance, workers' compensation premiums) that are calculated on base wages. Your true cost increase will be higher.

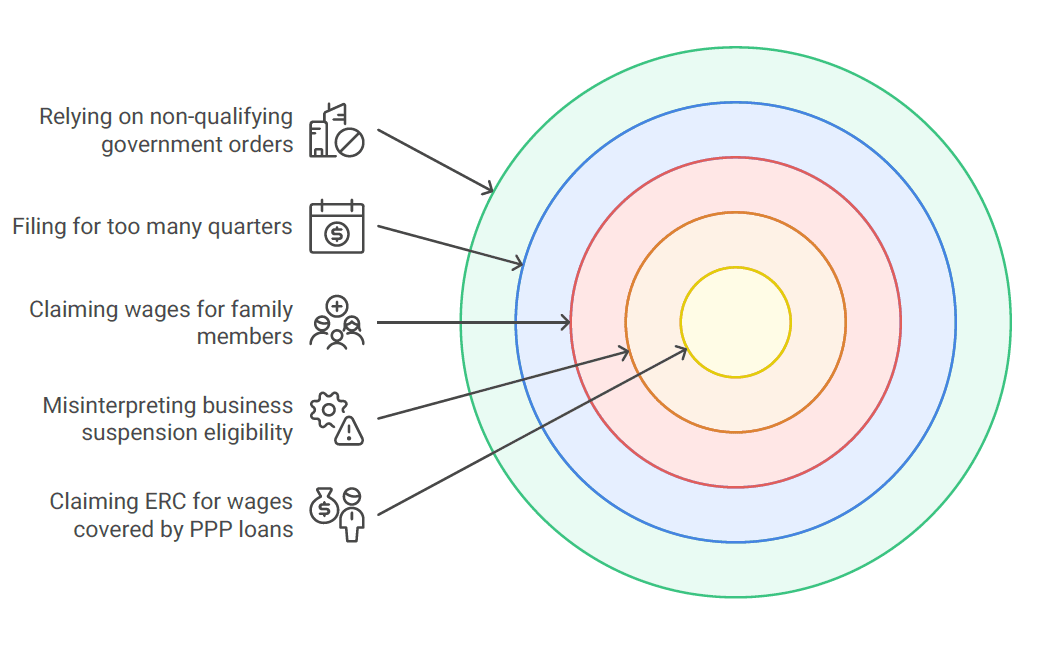

Understanding the One Big Beautiful Bill Act (OBBBA)

The federal One Big Beautiful Bill Act (OBBBA) has introduced a massive change for tax years 2025–2028: a federal income tax deduction for "qualified tips" and "qualified overtime."

What is OBBBA?

Passed in early 2025, OBBBA allows certain employees to deduct specific types of income from their federal taxable income:

- Qualified Tips: Up to $25,000 in tip income per year can be deducted from federal taxable income

- Qualified Overtime: Up to $12,500 in overtime premiums (the "half" in time-and-a-half) can be deducted from federal taxable income

Who Qualifies for the Federal Overtime Deduction?

The overtime deduction applies only to:

- Non-exempt (hourly) employees covered by the Fair Labor Standards Act (FLSA)

- Employees who receive overtime pay at 1.5× their regular rate

- The deduction covers only the "premium" portion (the extra 0.5×), not the full overtime pay

Who Does NOT Qualify:

- Salaried exempt employees (managers, professionals, etc.)

- Employees paid "straight time" for extra hours

- Independent contractors

The Federal Promise

For eligible employees, this sounds like a windfall. A server earning $20,000 in tips could deduct the entire amount from federal taxes. An hourly manager earning $5,000 in overtime premiums could deduct that from their federal return.

But here's where Illinois employers face a critical trap.

Illinois Decoupling: The Hidden Tax Liability

While the IRS now allows these federal deductions, Illinois has officially decoupled from OBBBA provisions. This means:

|

Income Type |

Federal Treatment (2025-2028) |

Illinois Treatment |

|

Qualified Tips |

Deductible up to $25,000 from federal taxable income |

Fully taxable as regular income |

|

Qualified Overtime Premium |

Deductible up to $12,500 from federal taxable income |

Fully taxable as regular income |

|

Regular Wages |

Taxable |

Taxable |

Why This Creates a Compliance Crisis

If your payroll system only tracks "Gross Pay" without distinguishing between regular wages, tips, and overtime premiums, your employees will likely underpay their Illinois state taxes.

Here's what happens:

Without Proper Tracking:

- Employee receives W-2 showing reduced federal taxable income (tips/overtime deducted)

- Employee files federal return claiming OBBBA deductions

- Employee uses same figures for Illinois state return

- Illinois Department of Revenue flags the return for underreporting

- Employee receives penalty notices, interest charges, and a demand for back taxes

The Employer's Liability: While the tax liability falls on the employee, employers who fail to properly withhold Illinois state taxes can face:

- Penalties for incorrect withholding

- Liability for unpaid withholding amounts

- Administrative headaches and employee relations problems

Federal vs. State Treatment: Complete Comparison Table

|

Category |

Federal (IRS/OBBBA) |

Illinois |

Employer Action Required |

|

Minimum Wage |

$7.25/hour |

$15.00/hour |

Pay Illinois rate; track location |

|

Tip Credit |

Up to $5.12/hour (70% of minimum) |

Up to $5.55/hour (37% of state minimum) |

Track by location; Chicago has separate rules |

|

Tip Income Taxation |

Deductible up to $25,000 (2025-2028) |

Fully taxable |

Separate tracking required; dual withholding |

|

Overtime Premium Taxation |

Deductible up to $12,500 (2025-2028) |

Fully taxable |

Calculate and track premium separately |

|

W-2 Reporting |

New Box 12 Code "TT" for qualified overtime |

Standard reporting; add-back required |

Configure payroll system for dual reporting |

|

Withholding Calculation |

Based on reduced taxable income |

Based on full gross income |

Maintain separate state withholding tables |

|

Form 941 (Quarterly) |

Standard FICA on all wages |

N/A - state uses own forms |

No change to federal reporting |

|

IL-941 (Quarterly) |

N/A |

Must reflect full taxable income |

Ensure state withholding matches actual liability |

|

Penalties for Underpayment |

IRS penalties (employee liability) |

IDOR penalties (employee liability; employer withholding liability) |

Audit systems before 2026 year-end |

Implementing Dual-Track Reporting: Your 2026 Action Plan

Because of this decoupling, 2026 is the year of dual-track reporting. You can no longer rely on a single set of numbers for both the IRS and the Illinois Department of Revenue.

What is Dual-Track Payroll Reporting?

Dual-track reporting means maintaining separate calculations for:

- Federal taxable income (with OBBBA deductions applied)

- State taxable income (with OBBBA amounts added back)

This requires your payroll system to:

- Separately track qualified tips and overtime premiums

- Calculate federal withholding based on reduced taxable income

- Calculate Illinois withholding based on full gross income

- Generate compliant W-2s with proper federal and state wage reporting

The Penalties You Can't Afford to Ignore

Non-compliance with Illinois wage and tax laws carries serious financial consequences. Here's what's at stake:

Wage Violation Penalties

Illinois Minimum Wage Violations:

- Back wages: Full amount owed to employee, plus damages

- Liquidated damages: Equal to the full amount of unpaid wages (essentially doubling the penalty)

- Attorney's fees: You may be required to pay the employee's legal costs

- Civil penalties: Up to $5,000 per violation for willful or repeated violations

Chicago One Fair Wage Violations:

- Fines: $500 to $1,000 per violation

- Back pay: Full wage differential owed to the employee

- Investigation costs: You may be liable for the city's cost of investigating the complaint

- Business license consequences: Repeated violations can affect license renewal

Tax Withholding Penalties

Illinois Department of Revenue Penalties:

For Employers:

- Failure to withhold: Employer is liable for the amount not withheld, plus penalties and interest

- Late payment penalty: 2% of the tax due for the first 30 days, then an additional 2% for each additional 30 days (maximum 25%)

- Negligence penalty: 5% of the deficiency if you failed to exercise ordinary care

- Fraud penalty: 50% of the deficiency if underpayment was intentional

For Employees (which creates employer relations problems):

- Underpayment penalty: Interest on the unpaid tax (currently 5% annually, adjusted quarterly)

- Late filing penalty: $250 per month for individuals (up to a maximum)

- Estimated tax penalty: If withholding was insufficient and no estimated payments were made

Real-World Cost Example

Scenario: A restaurant with 15 employees fails to properly track the state/federal tax split. Each employee underpays Illinois taxes by an average of $800.

Employee Impact:

- Total underpayment: $12,000

- Interest (5% for one year): $600

- Penalties (varies): ~$600-$1,200

- Total employee liability: $13,200-$13,800

Employer Impact:

- Potential withholding liability: $12,000

- Late payment penalties: $2,400 (2% × 10 months average)

- Administrative costs and employee relations damage: Immeasurable

- Potential total cost: $14,400+

Now multiply this by the number of employees affected and the years this goes undetected. A "simple" oversight can quickly become a five-figure problem.

Audit Risk Factors

The Illinois Department of Revenue is more likely to audit employers who:

- Have a history of late or incorrect filings

- Show unusual patterns in withholding (sudden drops in state withholding vs. wages)

- Operate in high-risk industries (hospitality, restaurants, service industries with tipped employees)

- Have employee complaints about wage issues

- Show discrepancies between federal and state reporting

The 2026 OBBBA decoupling creates a massive red flag for these audit triggers. If your state withholding drops in 2026 while your federal wages stay the same, expect scrutiny.

Don't Forget: The Returning Citizens Tax Credit

While navigating all these compliance challenges, don't overlook a valuable opportunity: the Returning Citizens Tax Credit.

What is it? Illinois offers a 15% tax credit for businesses that hire formerly incarcerated individuals ("returning citizens"). The credit was expanded in 2025 and is now available through the MyTax Illinois portal.

Credit Details:

- Amount: 15% of qualified wages paid to returning citizens

- Maximum: Credit amount varies based on wages and employment duration

- Application: Submit through MyTax Illinois

- Eligibility: Employee must have been released from incarceration within the past 5 years

When to Apply: The credit is available starting January 1, 2026, for wages paid in the 2025 tax year and forward.

Why It Matters in 2026: With rising wage costs due to Chicago's tip credit phase-out and increased compliance expenses, this credit can help offset your labor cost increases while supporting workforce development.

FAQ: Your 2026 Illinois Payroll Questions Answered

Q: Does the "no tax on overtime" rule apply to all employees? A: No. The federal OBBBA overtime deduction is only for non-exempt (hourly) employees receiving time-and-a-half (1.5×) overtime, and only applies to the extra 0.5× premium (up to $12,500/year). Salaried exempt employees don't qualify. Important: Illinois taxes the full overtime amount regardless of the federal deduction.

Q: Is the Chicago tip credit phase-out happening statewide? A: No. The One Fair Wage phase-out is specific to the City of Chicago only. Suburban and downstate Illinois employers still use the state tip credit (currently up to $5.55/hour). Other municipalities may adopt similar policies later.

Q: What happens if my employee works in both Chicago and the suburbs? A: Track hours by location and pay accordingly: Chicago hours require Chicago minimum wage/tip credit rules; non-Chicago hours follow state minimum wage/tip credit rules. This mandates careful time tracking and potentially split payroll.

Q: Can I reduce my employees' wages to account for the tax savings they get from OBBBA? A: Absolutely not. This is illegal wage theft, violating federal and Illinois wage laws. OBBBA is an employee tax benefit and does not change your required wage payment.

Q: How do I know if my payroll software can handle dual-track reporting? A: Ask your payroll provider specifically if their system can:

- Track tips/overtime premiums separately.

- Calculate federal withholding with OBBBA deductions while taxing the full gross in Illinois.

- Automatically populate Box 12 Code TT on W-2s.

- Handle state-specific add-backs (decoupling).

- Inability to answer clearly is a red flag.

Q: What if I realize mid-year that I've been withholding Illinois taxes incorrectly? A: Act immediately: Stop incorrect withholding, calculate the under-withheld amount, contact the Illinois Department of Revenue for voluntary disclosure, correct future withholding, and consider making up the shortfall (with employee consent). Proactive correction minimizes penalties.

Q: Do I need to tell my employees about the OBBBA deduction and Illinois tax implications? A: While not legally required, it's strongly recommended. Employees should know income deductible federally is still Illinois-taxable to prevent surprise state tax bills. Communicate this via pay stubs, year-end summaries, and by suggesting tax professional consultation.

Q: What's the risk if I just ignore this and keep doing payroll the same way I always have? A: Risks are significant:

- Short-term: Employee under-withholding, resulting in penalties and poor morale.

- Medium-term: IDOR audit, potential liability for under-withheld taxes, penalties, and interest.

- Long-term: Wage claims, difficulty recruiting/retaining staff. Compliance costs less than non-compliance.

Q: Will the OBBBA deduction continue after 2028? A: Unknown. It is set to expire after the 2028 tax year unless Congress extends it. The Illinois decoupling issue will persist as long as the federal deduction is active.

Q: Where can I get help if this feels overwhelming? A: Contact specialized Payroll Service Providers like Lift HCM. We handle complex multi-jurisdictional compliance, including dual-track reporting, Chicago wages, and system configuration.

Professional Advisors:

- CPAs and tax professionals can advise on withholding strategies

- Employment attorneys can review your wage and hour practices

- HR consultants can help with employee communication

Government Resources:

- Illinois Department of Revenue: www.revenue.state.il.us

- Chicago Department of Business Affairs and Consumer Protection: www.chicago.gov/bacp

- U.S. Department of Labor Wage and Hour Division: www.dol.gov/whd

The key: Don't wait until you have a problem to ask for help. Proactive compliance is always cheaper than reactive damage control.

Don't Let "Stability" Be Your Downfall

The $15.00 state minimum wage may look like a plateau, but underneath the surface, the fiscal ground is shifting dramatically. Between Chicago's aggressive tip credit phase-out and the complexities of OBBBA decoupling, your payroll needs to be more precise than ever.

Trying to manually track deductible versus non-deductible overtime is a recipe for an audit. Hoping your current system "probably handles it" is wishful thinking. The consequences—employee tax bills, state penalties, audit exposure, and compliance headaches—are too significant to leave to chance.

The good news? You don't have to navigate this alone. At Lift HCM, we've already updated our systems to handle dual-track reporting and Chicago-specific wage schedules. We specialize in Illinois compliance precisely because we understand how complicated it's become. We don't just process checks; we protect your business from the hidden risks of a changing legislative landscape.

Don't wait for a "Notice of Deficiency" from the state or a complaint from an employee who owes unexpected taxes. Contact Lift HCM today for a payroll audit to ensure your 2026 configurations are ready for the OBBBA/Illinois decoupling.

Lift HCM is your partner in Illinois compliance. We don't just process checks; we protect your business from the hidden risks of a changing legislative landscape. Let us do the heavy lifting so you can focus on growing your business.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.jpg?width=4000&height=3723&name=stack-papers-tax-concept-illustration(1).jpg)

.jpeg?width=1344&height=768&name=two%20binders%20stacked%20on%20top%20of%20eachother%20on%20top%20of%20paperwork%20and%20a%20calculator(1).jpeg)

.jpeg?width=1792&height=1024&name=glass%20jar%20on%20a%20restaurant%20table%20top%20bar%20with%20someone%20putting%20cash%20tips%20in%20it(1).jpeg)

.jpeg?width=1792&height=1024&name=a%20restaurant%20employee%20counting%20cash%20tips%20at%20a%20table(1).jpeg)

.jpg?width=5000&height=3337&name=account-assets-audit-bank-bookkeeping-finance-concept(1).jpg)