Form W-9 Updates: 9 Key Changes 2024

August 15th, 2024

9 min read

Are you struggling to keep up with the latest tax form changes? You're not alone. Many businesses and individuals find it challenging to stay on top of updates, especially when trying to comply with IRS requirements. The IRS Form W-9 underwent significant revisions in March 2024, and understanding these changes is crucial for accurate tax reporting.

At Lift HCM, we get it. Managing your business while navigating complex tax obligations can be overwhelming. That's why our team of experts is here to guide you through the key updates to Form W-9.

In this blog, we’ll cover the nine essential updates to Form W-9 from the March 2024 revision. Whether it’s clarifications on how disregarded entities should report their tax status or new requirements for flow-through entities with foreign partners, we’ll help you understand these changes so you can confidently complete your Form W-9. Let’s dive in!

Table of Contents

- Clarification on Disregarded Entities (Line 3a)

- Introduction of Line 3b for Flow-Through Entities

- Updated Instructions for Foreign Persons

- Expanded Explanation of FATCA Reporting

- Updated Penalties Section for Non-Compliance

- Revised Instructions for Establishing U.S. Status

- Updated Information on Identity Theft Protection

- Clarification on Backup Withholding

- Updated Privacy Act Notice

- Actionable Steps to Ensure Compliance

- Common Concerns and Misconceptions with the W-9

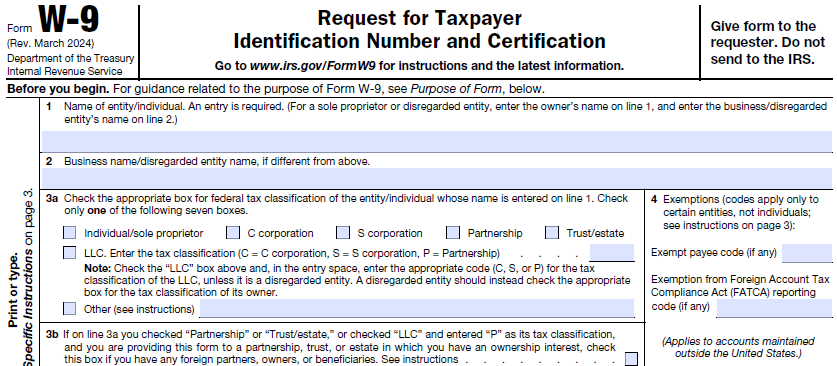

1. Clarification and Disregarded Entities (Line 3A)

One of the most significant changes in the new Form W-9 is the clarification on how disregarded entities should complete Line 3a. The form now explicitly states that an LLC that is a disregarded entity should check the appropriate box for the tax classification of its owner. This change aims to reduce confusion and ensure that disregarded entities are properly reporting their tax status.

Check the appropriate box for the federal tax classification of the entity whose name is entered on line 1. For disregarded entities, the tax classification of the owner must be entered.

For instance, if a single-member LLC is owned by an individual, the "Individual/sole proprietor" box should be checked. Conversely, if the disregarded entity is owned by a corporation, the "Corporation" box should be marked. This update ensures that the IRS receives accurate information about the entity's tax classification.

Why this matters: This change helps reduce errors by ensuring disregarded entities correctly report their tax status, leading to more accurate tax filings.

2. Introduction of Line 3b for Flow-Through Entities

A new addition to the form is Line 3b, specifically for partnerships, trusts, and estates with foreign partners, owners, or beneficiaries. If an entity selects the "Partnership" or "Trust/estate" box on Line 3a or checks the "LLC" box and enters "P" as its tax classification, it must now indicate on Line 3b whether it has any foreign partners, owners, or beneficiaries.

Why this matters: This change is designed to ensure that flow-through entities properly report the status of their indirect foreign partners, owners, or beneficiaries. This is especially important for fulfilling reporting requirements like Schedules K-2 and K-3.

3. Updated Instructions for Foreign Persons

The revised Form W-9 includes more detailed instructions for foreign persons, explicitly stating that foreign individuals or entities should use the appropriate Form W-8 or Form 8233 instead of Form W-9.

Why this matters: This clarification helps prevent incorrect form submissions and ensures that foreign entities use the correct documentation, which can have significant tax implications.

4. Expanded Explanation of FATCA Reporting

The new revision expands on the Foreign Account Tax Compliance Act (FATCA) reporting requirements. It clarifies that the FATCA exemption codes apply to persons submitting the form for accounts maintained outside of the United States by certain foreign financial institutions.

Why this matters: The instructions now state that if you're only submitting the form for an account you hold in the United States, you may leave the FATCA exemption code field blank. This clarification helps reduce confusion for U.S. taxpayers who may have been unsure whether they needed to provide a FATCA exemption code.

5. Updated Penalties Section for Non-Compliance

The penalties section of the form has been revised to include more detailed information about the consequences of providing false or incorrect information. The form now explicitly states that willfully falsifying certifications or affirmations may subject you to criminal penalties, including fines and/or imprisonment.

Additionally, the revised form outlines penalties for failing to provide a correct TIN, submitting false information, and misusing TINs.

Why this matters: Understanding these penalties can help taxpayers avoid severe consequences and ensure compliance with IRS regulations.

6. Revised Instructions for Establishing U.S. Status

The form now provides more explicit instructions for establishing U.S. status under Chapters 3 and 4 of the Internal Revenue Code. It clarifies who must submit Form W-9, including disregarded entities with U.S. owners and grantor trusts with U.S. grantors.

Why this matters: This clarification helps ensure that only eligible entities claim U.S. status, reducing errors in tax reporting.

7. Updated Information on Identity Theft Protection

The identity theft protection section has been expanded to provide more comprehensive guidance on protecting your tax records. The form now includes information about the IRS Identity Theft Hotline and instructions on how to submit Form 14039 if you believe you're at risk of identity theft.

Additionally, the form provides more detailed information about phishing schemes and how to report suspicious emails claiming to be from the IRS.

Why this matters: As tax-related identity theft remains a significant concern, these updates provide crucial steps to safeguard your information.

8. Clarification on Backup Withholding

The form provides a more detailed explanation about backup withholding, including a clear list of payments subject to this requirement. Notably, it clarifies that real estate transactions are exempt from backup withholding.

Why this matters: This clarification helps taxpayers avoid unnecessary withholding and ensures compliance with IRS regulations.

9. Updated Privacy Act Notice

The Privacy Act Notice section has been revised to provide more detailed information about how the IRS uses the information collected on Form W-9. It now includes potential data-sharing scenarios, such as disclosure to other countries under treaties and to federal and state agencies.

Why this matters: Understanding how your information might be used helps you stay informed about your rights and the potential implications of sharing your data.

Impact of the Changes

Understanding the updates to Form W-9 is one thing, but knowing how they affect your day-to-day operations is where the real value lies. Here’s how the March 2024 revisions might impact you, depending on your situation:

Freelancers and Contractors

If you’re a freelancer or contractor, the new field for digital payment accounts is particularly relevant. Many freelancers receive payments through platforms like PayPal or Venmo, and the IRS now requires this information to ensure all income is accurately reported. This change means you’ll need to double-check that all your payment accounts are included when filling out the form.

The revised instructions on backup withholding also mean you need to be more vigilant. If you’re flagged for backup withholding, your clients may be required to withhold 24% of your payments and send it to the IRS. This can happen if you fail to provide your correct TIN, so it’s crucial to ensure your information is accurate and up-to-date.

Small Business Owners

As a small business owner, you may need to request Form W-9 from your contractors or vendors. The updated certification language means that you should pay close attention when reviewing these forms, ensuring that all the required information is provided and accurate. Missteps here could lead to penalties for both you and your contractors.

Additionally, if your business makes payments to individuals with foreign financial accounts, the new reporting requirements may affect your record-keeping processes. You’ll need to be aware of the latest criteria to ensure you comply with international tax reporting standards, which could involve additional documentation or information gathering.

Accountants and Financial Professionals

For accountants and financial professionals, these updates mean you must guide your clients through the revised Form W-9. Whether you’re advising small businesses or individual clients, it’s essential to explain the significance of these changes, especially in areas like the new digital payment account field and the updated TIN instructions.

Moreover, clarifying backup withholding could lead to more questions from clients who are uncertain about their obligations. Being well-versed in these updates will allow you to provide clear, accurate advice and help your clients avoid unnecessary withholding or penalties.

Actionable Steps to Ensure Compliance

Staying compliant with the IRS’s latest updates to Form W-9 doesn’t have to be overwhelming. By following these actionable steps, you can ensure that you’re meeting all the requirements and avoiding potential issues down the line.

Review and Update Your Form W-9

- For Individuals and Contractors: If you haven’t yet submitted the updated form, make sure to download the latest version of Form W-9 from the IRS website. Carefully fill out all required fields, paying attention to the new digital payment account section if it applies to you. Double-check your TIN to ensure accuracy.

- For Business Owners: Request the revised Form W-9 from all contractors and vendors you work with. It’s important to confirm they’re using the March 2024 version and have provided accurate information, including any new fields like the digital payment accounts.

Understand the Backup Withholding Rules

- For All Taxpayers: Familiarize yourself with the updated instructions on backup withholding. If you’re subject to backup withholding, ensure that the correct amount is being withheld from your payments. If you’re a business owner, make sure you’re applying the backup withholding correctly when required.

Pay Attention to Certification and Signature

- For All Taxpayers: The certification section of Form W-9 is not just a formality. The revised language underscores the legal implications of providing false information. Read the certification carefully before signing, and make sure all the details you’ve provided are correct to avoid any potential legal issues.

Monitor Foreign Account Reporting

- For Individuals with Foreign Accounts: If you hold financial accounts outside the U.S., review the updated reporting requirements on Form W-9. Ensure that you meet the new criteria and provide any necessary information on the form. Consult with a tax or payroll professional like Lift HCM if you’re unsure about your obligations.

Keep Records and Stay Informed

- For All Taxpayers: Retain copies of all your submitted W-9 forms and any related correspondence. Keeping thorough records will help you quickly address any issues that arise. Additionally, stay informed about any further IRS updates or clarifications regarding Form W-9, as tax regulations can evolve.

Common Concerns and Misconceptions with the W-9

Whenever there’s a revision to a key tax form like the W-9, confusion and misconceptions are bound to arise. Let’s clear up some of the most common concerns people have about the March 2024 updates.

Do I Need to Resubmit My W-9 If I Already Sent One Before March 2024? Generally, if you’ve already submitted a W-9 before the March 2024 revision, you don’t need to resubmit unless specifically requested by the person or entity you provided it. However, if the new fields apply to you (such as the digital payment account information) or if there were errors in your previous submission, it’s wise to fill out and submit the updated form.

Will the New Digital Payment Account Field Lead to More Scrutiny from the IRS? The addition of the digital payment account field is part of the IRS’s broader effort to capture income that might otherwise go unreported, particularly as more transactions occur online. However, if you’re accurately reporting your income and providing the correct information, this change should not lead to any additional scrutiny. It’s simply another step in ensuring all income is properly documented.

I’m Confused About Backup Withholding—How Do I Know If It Applies to Me? Backup withholding applies if you fail to provide a correct TIN, or if the IRS notifies you that you’re subject to backup withholding due to underreporting your interest or dividends on previous returns. The March 2024 revision of Form W-9 provides clearer instructions on this. If you’re unsure, it’s best to consult with a tax professional or carefully review the updated guidelines.

Does the Update Affect My Reporting of Foreign Financial Accounts? Yes, if you have foreign financial accounts, the March 2024 revision includes changes to how these are reported. The IRS has aligned the W-9’s requirements more closely with other international tax reporting standards. If you hold such accounts, it’s crucial to review the new requirements and ensure you’re in compliance to avoid penalties.

Can I Still Use the Old Version of Form W-9? Technically, some institutions might accept the older version, but it’s highly recommended that you use the latest version of Form W-9 to avoid any potential issues. The updated form includes important changes that may not be reflected in older versions, and using the most current form ensures that all required information is accurately provided.

Will the New Digital Payment Account Field Lead to More Scrutiny from the IRS?The addition of the digital payment account field is part of the IRS’s broader effort to capture income that might otherwise go unreported, particularly as more transactions occur online. However, if you’re accurately reporting your income and providing the correct information, this change should not lead to any additional scrutiny. It’s simply another step in ensuring all income is properly documented.

Answer: Backup withholding applies if you fail to provide a correct TIN, or if the IRS notifies you that you’re subject to backup withholding due to underreporting your interest or dividends on previous returns. The March 2024 revision of Form W-9 provides clearer instructions on this. If you’re unsure, it’s best to consult with a tax professional or carefully review the updated guidelines

Answer: Yes, if you have foreign financial accounts, the March 2024 revision includes changes to how these are reported. The IRS has aligned the W-9’s requirements more closely with other international tax reporting standards. If you hold such accounts, it’s crucial to review the new requirements and ensure you’re in compliance to avoid penaltie

Let Lift HCM Do the Heavy Lifting

The March 2024 revision of Form W-9 introduces several important updates that affect a wide range of taxpayers and businesses. From clarifications on reporting requirements for disregarded entities to new mandates for flow-through entities with foreign partners, these changes aim to improve the accuracy of information reported to the IRS and enhance compliance.

Managing tax regulations doesn’t have to be a burden. With these insights, you’re now equipped with the knowledge to handle the updates in the March 2024 Form W-9 revision confidently. Stay informed, and remember, Lift HCM is here to help you navigate these changes. Contact our expert team for personalized support in maintaining compliance and focusing on what you do best—growing your business.

Please note that this article does not cover all possible scenarios, and any discussions or viewpoints should not be considered as legal advice. For specific legal guidance, readers are advised to consult with legal professionals.

If you are not yet ready to speak with a team member, you may find these resources helpful:

If you are not yet ready to speak with a team member, you may find these resources helpful:

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.jpg?width=4000&height=3723&name=stack-papers-tax-concept-illustration(1).jpg)

.jpeg?width=1344&height=768&name=two%20binders%20stacked%20on%20top%20of%20eachother%20on%20top%20of%20paperwork%20and%20a%20calculator(1).jpeg)

.jpeg?width=1792&height=1024&name=glass%20jar%20on%20a%20restaurant%20table%20top%20bar%20with%20someone%20putting%20cash%20tips%20in%20it(1).jpeg)

.jpeg?width=1792&height=1024&name=a%20restaurant%20employee%20counting%20cash%20tips%20at%20a%20table(1).jpeg)

.jpg?width=5000&height=3337&name=account-assets-audit-bank-bookkeeping-finance-concept(1).jpg)