5 New Warning Signs of Incorrect Employee Retention Credit (ERC) Claims

November 6th, 2024

4 min read

If you’ve recently applied for the Employee Retention Credit (ERC), you're likely counting on this relief to support your business. However, with IRS audits on the rise, inaccurate ERC claims are under heightened scrutiny. Mistakes could mean audits, penalties, or even repayment demands that put your business at risk.

At Lift HCM, we’ve guided countless businesses through the complex ERC filing process, helping secure relief funds while avoiding common pitfalls. In fact, we’ve helped our clients (and nonclients) claim over $98 million in employee retention credits to date.

In this article, you’ll learn about five major warning signs of inaccurate ERC claims, how to correct potential errors, and practical steps to stay compliant with IRS guidelines (plus, a free IRS ERC Eligibility Checklist).

Table of Contents

- What is the Employee Retention Credit (ERC)?

- 5 Warning Signs of Incorrect ERC Claims

- The Risks of Filing Incorrect ERC Claims

- Steps If an Ineligible Claim Was Submitted

- Protect Your Business from ERC Filing Errors with Lift HCM

- Frequently Asked Questions about the Employee Retention Credit

What is the Employee Retention Credit (ERC)?

The Employee Retention Credit (ERC) is a refundable tax credit introduced in March 2020 under the CARES Act to incentivize businesses that kept employees on payroll during the COVID-19 pandemic. Since then, the credit has expanded through the Consolidated Appropriations Act (CAA) of December 2020 and the American Rescue Plan Act (ARPA) of 2021.

Eligible businesses can claim a credit on qualifying wages paid during eligible quarters, with any amount exceeding tax liability refunded directly to the business. However, as IRS requirements have evolved, navigating ERC eligibility has become increasingly complex, leading to widespread filing errors. To help businesses stay compliant, the IRS has identified several red flags for inaccurate claims—many of which we’ll cover here.

5 Warning Signs of Incorrect ERC Claims

1. Claiming ERC Without a Significant Decline in Gross Receipts

Many essential businesses assume that pandemic-related challenges qualify them for the ERC, but eligibility is more specific. For an essential business to qualify, one of the following must apply:

- A full or partial suspension of operations due to a government mandate.

- A significant decline in gross receipts (defined as a 20% or greater drop in 2021 compared to the same quarter in 2019).

Simply implementing safety protocols like mask-wearing or social distancing doesn’t meet these criteria. Without a mandated suspension or revenue decline, your ERC claim may be invalid.

What You Should Do: Check your financial records to confirm a sufficient decline in gross receipts or mandated suspension. If you’re unsure, consult a tax professional to review your ERC eligibility.

2. Inadequate Documentation for Business Suspension

Some businesses claim ERC based on a government-ordered suspension but fail to provide adequate documentation. The IRS requires specific evidence showing how these mandates directly impacted your operations.

What You Should Do: Keep thorough records of government orders, closure notices, and internal communications detailing operational changes. Failing to do so could invalidate your claim.

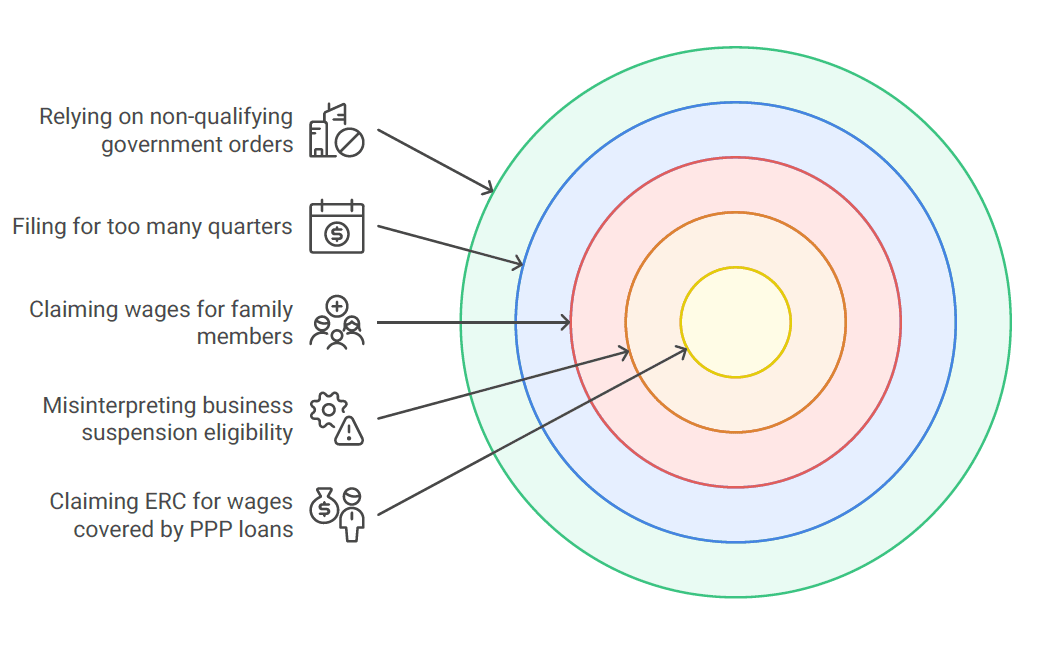

Below is a pie chart illustrating the top 5 common ERC filing mistakes. It visually breaks down the mistakes as follows:

- Claiming ERC for wages covered by PPP loans: 30%

- Claiming wages for family members: 20%

- Misinterpreting business suspension eligibility: 25%

- Filing for too many quarters: 15%

- Relying on non-qualifying government orders: 10%

3. Claiming Wages Paid to Family Members

One of the most common errors is including wages paid to family members in ERC claims. The IRS excludes wages paid to direct relatives of business owners, including spouses, children, and other family members, from ERC eligibility.

What You Should Do: If you’ve claimed wages for family members, amend your filing to exclude these ineligible wages to avoid penalties.

Did You Know? The IRS increased its enforcement budget by 25% in 2024, signaling a rise in scrutiny for ERC claims. Review your records carefully to stay compliant!

4. Claiming Wages Covered by Paycheck Protection Program (PPP) Loans

Businesses cannot claim ERC for wages also covered by forgiven PPP loans, as it would amount to “double-dipping.” The IRS requires clear separation between wages claimed for PPP forgiveness and those used for ERC.

What You Should Do: Verify that wages for PPP forgiveness and ERC claims do not overlap. If they do, amend your claim immediately to avoid penalties.

ERC Vs PPP Loan Comparison chart:

| ERC | PPP Loan | |

| Eligibility | Revenue decline or suspended ops | Businesses that maintained payroll |

| Claim Type | Tax credit | Forgivable loan |

| Covered Expenses | Employee Wages | Payroll, utilities, rent, mortgage |

| Repayment Required | No, unless incorrectly filed | No if forgiven, yes if not forgiven |

5. Claiming ERC for Employees Who Continued Working During Disruption

For businesses with over 100 full-time employees in 2020 (or over 500 employees in 2021), ERC eligibility is limited to wages paid to employees who weren’t actively working. Including wages for employees who continued working during the disruption is a common mistake.

What You Should Do: Double-check that your claim includes only wages paid to employees who were not working. Amend incorrect filings promptly to avoid potential penalties.

The Risks of Filing Incorrect ERC Claims

Filing inaccurate ERC claims can have serious repercussions, including:

- IRS Audits: The IRS has stepped up audits on ERC claims to ensure compliance.

- Repayment of Credits: If claims are found inaccurate, businesses may need to repay credits with interest.

- Penalties and Interest: Penalties and interest apply to improperly claimed credits, adding to financial strain.

- Criminal Charges: Deliberate or fraudulent claims can lead to criminal charges in severe cases.

Steps If an Ineligible Claim Was Submitted

Employers that submitted an ineligible claim have options to avoid future issues such as audits, repayment, penalties and interest.

- Withdraw an ERC claim if your ERC hasn’t been paid yet, or if you already received a check for ERC but haven’t cashed or deposited it.

- Apply for the second Employee Retention Credit Voluntary Disclosure Program if you received an incorrect ERC and want to pay it back.

Protect Your Business from ERC Filing Errors with Lift HCM

The ERC has been a critical support for businesses during the pandemic, but with IRS scrutiny increasing, it’s crucial to ensure your filings are accurate. At Lift HCM, our team of tax and compliance professionals has guided businesses across industries to correctly claim their ERC and avoid financial and legal pitfalls.

Take Action Now! Ready to review your ERC claim? Connect with Lift HCM’s tax experts today to ensure compliance and avoid costly mistakes!

📋 Get the IRS's ERC Eligibility Checklist to assist your business in determining your eligibility!

Frequently Asked Questions about the Employee Retention Credit

Q: What happens if I filed an incorrect ERC claim?

A: Filing errors can lead to IRS audits, penalties, and interest charges, and may require repaying credits, impacting your business’s finances.

Q: How do I know if my business qualifies for the ERC?

A: Eligibility is based on revenue decline or government-mandated suspension. Consult a tax professional to confirm specific requirements.

Q: Can I claim ERC if I received a PPP loan?

A: Yes, but you cannot claim ERC for wages that were also covered by PPP forgiveness.

Q: Is there a penalty for claiming wages paid to family members?

A: Yes. Including wages for family members in your ERC claim may result in penalties and repayment of those credits.

Q: What should I do if my claim is incorrect?

A: Consult a tax expert to amend your filing and prevent further penalties. Lift HCM’s advisors can help you navigate this process.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.png?width=1536&height=1024&name=Create%20a%20background%20that%20reads%2c%20How%20Long%20to%20Keep%20P%20(1).png)