How To Protect Your Business From Tax Scams

July 9th, 2024

6 min read

Worried about tax scams targeting your business? You're not alone. Many business owners share this concern, especially during tax season when fraudulent activities peak. Scammers are becoming increasingly sophisticated, making it crucial for you to stay informed and vigilant.

To address this issue, the IRS has developed a one-page flyer to raise awareness of tax scams and provide guidance on prevention. Publication 5961, titled "Protect Your Business From Tax Scams," was released as part of the IRS’s National Small Business Week initiative.

The IRS reports that small businesses continue encountering various financial and identity theft-related schemes designed to steal information for filing fraudulent tax returns, draining business bank accounts, and creating stolen identities.

Small business owners and employees should be aware of these scams and take steps to protect themselves. The IRS flyer outlines red flags to watch for, such as unsolicited calls, emails, or visits from someone claiming to be from the IRS. It also provides tips on verifying the legitimacy of IRS contacts and reporting suspected scams.

At Lift HCM, we treat our clients like family. As a family-owned payroll and HCM service provider for three generations, we understand the importance of having a trusted partnership.

Lift HCM Pro Tip 💡Anyone can sign up to receive the IRS newswire at the following: irs.gov/newsroom.

In this article, you will learn practical steps to protect your business from tax scams, identify common types of scams, and discover what to do if you suspect fraud. By the end, you'll have the knowledge and confidence to safeguard your business's well-being.

Table of Contents

- Tax-Related Scam Examples

- Common Tax Scams Targeting Businesses

- Steps to Protect Your Business from Tax Scams

- What To Do If You Suspect a Tax Scam

Tax-Related Scam Examples

Fake Requests for W-2's

One of the most prevalent tax scams involves fraudulent requests for W-2 forms. Scammers often pose as company executives or other trusted individuals to trick employees into providing sensitive information. These fake requests can come through emails that look legitimate but have subtle differences in email addresses or domain names.

Tips to Protect Your Business

- Verify the identity of the person requesting W-2 forms through a known, secure communication channel, such as a phone call to their known number

- Educate employees about the importance of verifying such requests and provide them with a process for doing

- Implement a two-step verification process for handling sensitive information requests.

Misleading Tax Advice on Social Media

Social media can be a breeding ground for misleading tax advice. Scammers may use platforms like Facebook, Twitter, or Instagram to spread false information. They might encourage you to:

- File fraudulent tax documents, which can lead to severe penalties and legal issues.

- Manually prepare a Form W-2 with false income information to receive a larger refund

- Pay fees to a preparer based on your refund amount, which is often a scam to get your money upfront

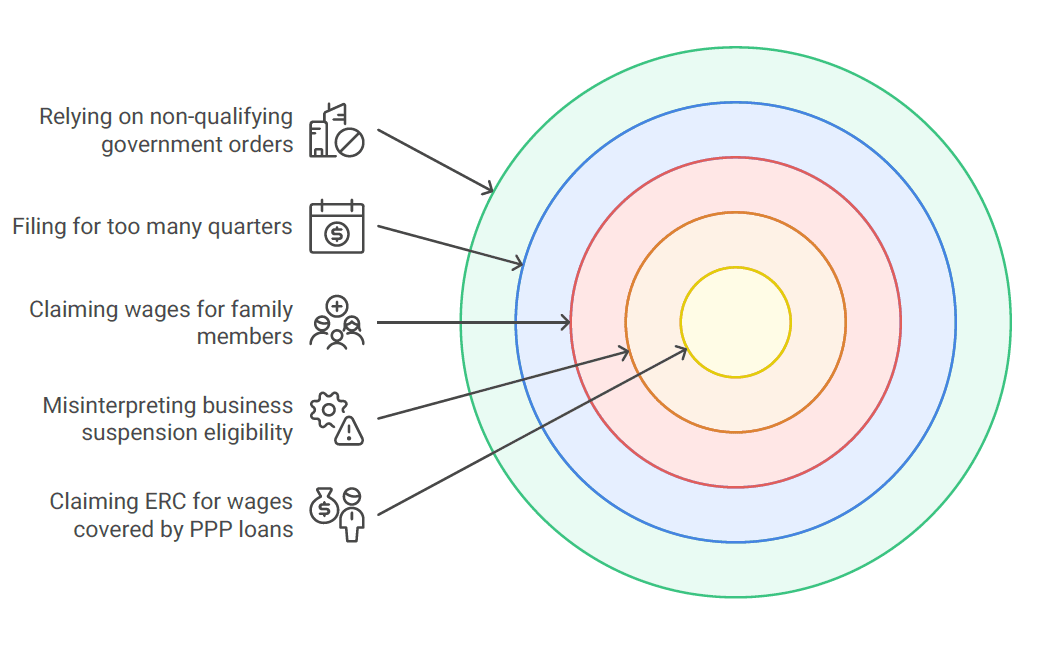

- Misrepresenting eligibility for tax credits, such as the Employee Retention Credit, could result in fines and repayment of the credits claimed.

Tips To Protect Your Business

- You should only seek tax advice from verified and trusted sources, such as certified public accountants (CPAs) or directly from the IRS.

- Be skeptical of tax advice shared on social media and always cross-check with official sources.

- Report misleading posts to the platform to prevent others from falling victim.

Quick Tip Signs of Identity Theft!

Rejected extension request due to duplicate EIN/SSN

Unexpected tax documents

IRS notices about discrepancies (Letters 6042C or 5263C)

Missing IRS communication (possibly due to address change)

Common Tax Scams Targeting Businesses

Phishing Emails

Phishing emails are fraudulent messages that appear to come from legitimate sources, such as the IRS or other trusted entities. These emails often contain links or attachments designed to steal personal information or infect your computer with malware.

Red Flags to Watch Out For

- Unexpected emails claiming to be from the IRS

- Requests for sensitive information, such as your EIN or bank account details

- Poor grammar and spelling mistakes

Real IRS Correspondence

- The IRS generally does not initiate contact with taxpayers via email.

- Emails from the IRS should come from an official domain, such as @irs.gov. Always verify the sender's email address carefully.

Phone Scams

Phone scams involve fraudsters impersonating IRS agents and demanding immediate payment of taxes. They often use threats of legal action, arrest, or business closure to create a sense of urgency.

Red Flags to Watch Out For

- Calls from aggressive or threatening individuals claiming to be IRS representatives

- Demands for immediate payment via prepaid debit cards, gift cards, or wire transfers

- Caller ID spoofing to make the call appear legitimate

Real IRS Correspondence

- The IRS will typically contact you by mail before making any phone calls. If you receive a phone call out of the blue, it’s likely a scam.

- Real IRS agents will not threaten you with immediate legal action or demand instant payment over the phone.

Fake IRS Letters

Scammers may send fraudulent letters that look like official IRS correspondence. These letters often include a bogus phone number or website, directing you to provide personal information or make a payment.

Red Flags to Watch Out For

- Letters that don't match the format or language used in genuine IRS communications

- Contact details that don't match the official IRS contact information

- Requests for payment or personal information that seem unusual or suspicious

Real IRS Correspondence

- Genuine IRS letters will have an official IRS letterhead and a notice number in the upper right corner.

Letters that don't match the format or language used in genuine IRS communications.

Contact details that don't match the official IRS contact information.

Requests for payment or personal information that seem unusual or suspicious.

Real IRS Correspondence

Genuine IRS letters will have an official IRS letterhead and a notice number in the upper right corner.

.jpg?width=950&height=534&name=Untitled%20design(1).jpg)

- Real letters will include official IRS contact details, which you can cross-check on the IRS website.

- The IRS will clearly state the reason for the correspondence and provide specific instructions on responding.

You can find a full list of tax and consumer scams here.

Tips for Verifying Authenticity

Tip 1: Always cross-reference any contact information or instructions with the official IRS website (www.irs.gov) to ensure they are legitimate.

Tip 2: If you receive a suspicious letter, email, or phone call, contact the IRS directly using the phone numbers provided on their official website. Do not use the contact information provided in the suspicious communication.

Tip 3: Genuine IRS communications will contain specific information about your tax situation, such as your account number and tax filing details. Generic or vague messages are a red flag.

Steps to Protect Your Business from Tax Scams

Protecting your business from tax scams requires a proactive approach. By implementing the following best practices and preventive measures, you can significantly reduce the risk of falling victim to fraud.

Educate Your Team

- Conduct regular employee training sessions on identifying and responding to potential tax scams. Ensure they are aware of common tactics used by fraudsters.

- Distribute information about the latest scams and red flags to watch out for. This helps maintain a high level of vigilance among your staff.

- Direct employees to the IRS Identity Theft Central at IRS.gov/IdentityTheft for comprehensive information.

- Share the Taxpayer Guide to Identity Theft and Publication 4524, Security Awareness for Taxpayers, which provides valuable tips on protecting personal and business information.

Safeguard Your EIN and Secure Your Information

Safeguarding your Employer Identification Number (EIN) is vital for your business's security. Keep it confidential and ensure the IRS has your current contact information on file. Securely store your EIN documents and restrict access to them (be sure to regularly update your EIN details with the IRS using Form 8822-B if your business structure or contact information changes).

Be vigilant and report any unauthorized EIN use to the IRS immediately. When storing sensitive financial and tax information on computers and servers, utilize robust encryption methods. Grant access to this sensitive data only to authorized employees and enforce strong, unique passwords that are updated regularly.

Maintain your business's cybersecurity by installing and updating firewalls and anti-malware software, and keep all software and systems patched with the latest security updates to minimize vulnerabilities.

What To Do If You Suspect a Tax Scam

If you suspect your business has been targeted by a tax scam, it is crucial to act quickly and effectively. Here are the steps you should take to address the situation and minimize any potential damage.

Contact the IRS

If you receive a suspicious phone call, hang up immediately. Do not provide any personal or financial information. Report the call to the Treasury Inspector General for Tax Administration (TIGTA) by calling 1-800-366-4484 or using their online form. You can also forward any suspicious emails to phishing@irs.gov. Do not open any attachments or click on any links in the email.

Report Identity Theft

If you suspect your business identity has been stolen, complete IRS Form 14039-B (Business Identity Theft Affidavit). Submit this form to the IRS to alert them of the identity theft and prevent further misuse of your information.

Notify Authorities

It's important to report scams to the appropriate authorities. You can report most scams to the Federal Trade Commission (FTC) at https://www.ftc.gov/media/71268. This helps them track fraudulent activities and potentially investigate them.

For scams related to the IRS, Treasury, or taxes specifically, there are separate reporting channels. If you encounter phishing attempts claiming to be from these entities, report them to phishing@irs.gov. In case of a W-2 scam that resulted in data loss, email dataloss@irs.gov with "W2 Data Loss" in the subject line. Be sure to include your contact information, but avoid including any employee's personal details.

Finally, if you suspect a W-2 or other identity information disclosure, notify your state by emailing StateAlert@taxadmin.org. Remember to always use the contact information provided on the official IRS website when reaching out to report scams or seek assistance. This ensures that you are communicating with legitimate representatives. Lastly, keep a detailed record of all communications related to the scam, including emails, letters, and phone calls. Note down dates, times, and the names of any individuals you speak with.

Protect Your Business From Tax Scams

Protecting your business from tax scams requires vigilance, education, and swift action. By staying informed about common scams, safeguarding sensitive information, and reporting any suspicious activity promptly, you can minimize the risk of falling victim to fraudsters.

Remember to verify all IRS communications, educate your team, and take proactive steps to secure your business's information. If you suspect a tax scam, follow the recommended steps to address the situation effectively. By taking these precautions, you can strengthen your business against potential threats and ensure a secure financial future. Stay informed, stay vigilant, and protect your business from tax scams!

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics:

.jpg?width=4000&height=3723&name=stack-papers-tax-concept-illustration(1).jpg)

.jpeg?width=1344&height=768&name=two%20binders%20stacked%20on%20top%20of%20eachother%20on%20top%20of%20paperwork%20and%20a%20calculator(1).jpeg)

.jpeg?width=1792&height=1024&name=glass%20jar%20on%20a%20restaurant%20table%20top%20bar%20with%20someone%20putting%20cash%20tips%20in%20it(1).jpeg)

.jpeg?width=1792&height=1024&name=a%20restaurant%20employee%20counting%20cash%20tips%20at%20a%20table(1).jpeg)

.jpg?width=5000&height=3337&name=account-assets-audit-bank-bookkeeping-finance-concept(1).jpg)