If you've ever had to manually calculate payroll, chase down timesheets, or double-check deductions and tax filings, you know how time-consuming and error-prone payroll can be. Switching to a new payroll system isn’t just a tech decision—it’s a high-stakes, high-anxiety change. One wrong setup and employees get paid late. Tax filings get botched. Trust erodes. Morale tanks. And guess who’s on the hook? You are.

At Lift HCM, we've helped countless businesses navigate the payroll implementation process smoothly and confidently. With over 50 years in the payroll and human capital management industry, we understand these challenges and what it takes to succeed.

In this article, we'll walk you through what payroll implementation really means, key steps and best practices, common pitfalls to avoid, and how to get started, so you can focus more on your business and less on paperwork.

Table of Contents

What Is Payroll Implementation?

Payroll implementation is the process of integrating a payroll system into your organization’s operations. This involves configuring payroll software, entering employee data, defining pay structures, aligning with compliance requirements, and testing the system before going live.

Whether you're setting up payroll for the first time or transitioning from another system, implementation is the foundation for everything that follows: timely payments, accurate tax reporting, employee trust, and legal compliance.

Key components include:

- Selecting the right software

- Gathering and migrating employee and pay data

- Setting up earnings, deductions, and tax codes

- Integrating with HR and accounting systems

- Training staff to manage and use the new platform

Implementing a New Payroll System: Laying the Groundwork for Success

Starting from scratch or switching providers? Here’s how to lay the groundwork for success.

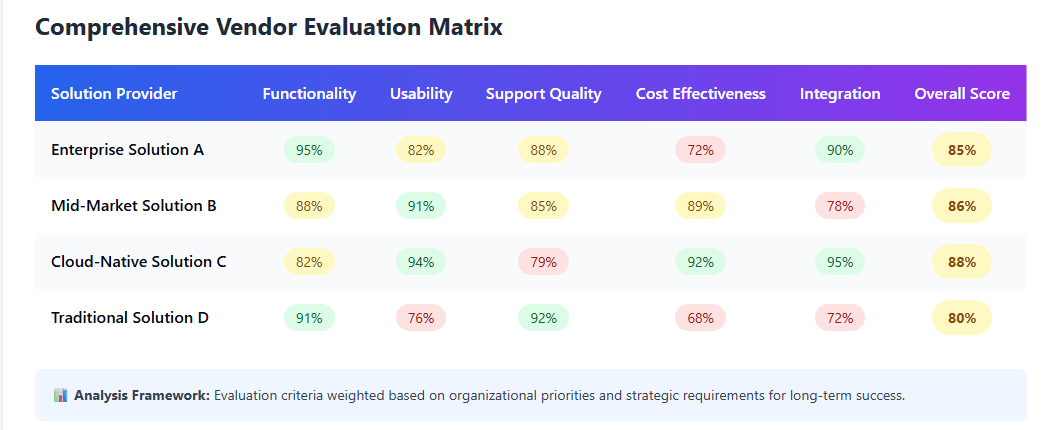

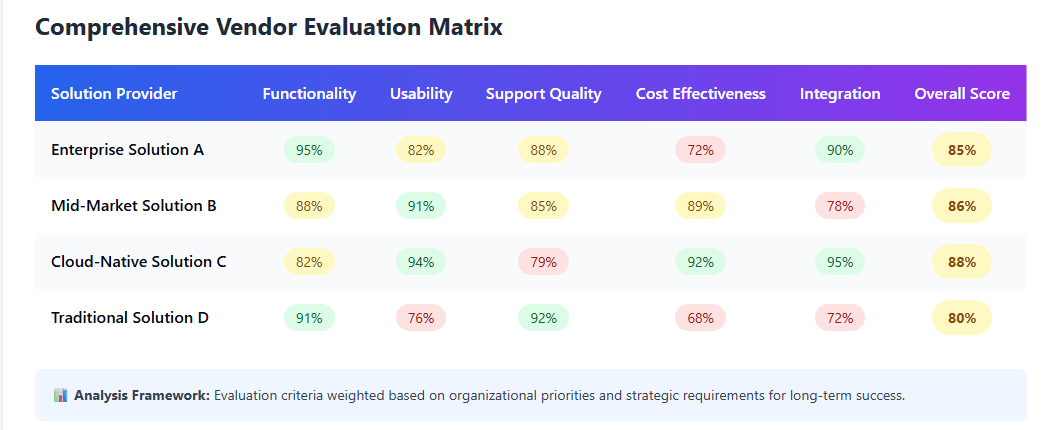

1. Select the Right Payroll System

Choosing the right payroll system is paramount for long-term success. It's not just about automating tasks; it's about investing in a solution that scales with your business, reduces compliance risks, and empowers your employees. Evaluate factors like:

- Automation capabilities: Does the system handle routine calculations, tax filings, and reporting automatically?

- Tax compliance features: Does it stay updated with federal, state, and local tax laws, including changing regulations like multi-state compliance?

- Employee self-service options: Can employees access pay stubs, update personal information, and manage benefits independently, reducing administrative burden on your HR team?

- Integration with existing platforms: Will it seamlessly connect with your current time tracking, benefits administration, and accounting systems to create a unified data flow?

Tip: Prioritize providers that offer strong data security protocols, such as SOC 2 compliance and encryption, and dedicated customer support to guide you through initial setup and ongoing use.

2. Set Clear Goals and a Timeline

Defining what success looks like for your payroll implementation is crucial. Without clear objectives, it's easy for projects to lose focus or fall behind schedule. Outline your specific goals by asking:

- What specific payroll challenges are we aiming to solve (e.g., reducing manual errors, speeding up processing time, improving data accuracy)?

- What’s our ideal go-live deadline, and what are the key milestones leading up to it?

- Who needs to be trained on the new system, and by when, to ensure a smooth transition?

Defining these goals upfront helps you track progress, measure the return on your investment, and align all stakeholders, from leadership to end-users.

3. Assemble an Implementation Team

A successful payroll implementation is a team effort. Designate a dedicated project manager who can oversee the entire process, coordinate tasks, and communicate effectively. Beyond that, involve key players from various departments, including:

- HR: To provide insights into employee data, benefit structures, and onboarding processes.

- Payroll: The core users who will manage the system daily and understand intricate pay rules.

- IT: To ensure seamless integration with existing systems, data security, and technical support.

- Finance: To align payroll with general ledger accounts and financial reporting requirements.

A cross-functional team ensures that all departmental needs are considered, data flows correctly across systems, and the new payroll solution meets the diverse operational demands of your organization.

Payroll Implementation Checklist: Essential Items for Success

Before diving into the technical aspects of implementation, make sure you have these foundational items in place. This checklist serves as a roadmap to ensure no critical steps are missed, setting you up for a smooth transition and successful launch.

|

Task

|

Description

|

|

✅ Payroll system selected

|

Choose a platform that meets your business and compliance needs

|

|

✅ Data gathering plan

|

Collect current employee information, pay history, and tax settings

|

|

✅ Project timeline

|

Set go-live dates and assign internal deadlines

|

|

✅ Team assigned

|

Include HR, finance, and IT representatives

|

|

✅ Integration mapping

|

Identify how payroll will connect with HR, time, and accounting systems

|

|

✅ Training schedule

|

Prepare training sessions for all system users

|

|

✅ Compliance review

|

Ensure tax filings, deductions, and labor laws are accurately reflected

|

Payroll System Implementation: Step-by-Step Breakdown

Once the planning phase is complete, the hands-on implementation process typically follows these seven critical stages. Each step builds upon the last, leading to a fully functional and optimized payroll system.

1. Data Collection

This foundational step involves compiling all necessary employee and pay-related information from your previous system or manual records. Accuracy is crucial here—because if a single tax exemption or bonus entry is off, you could be cutting a check twice or fixing a W-2 in Q4. Payroll errors don’t just cause admin headaches—they cause employee distrust, fast.

- Employee personal information (name, SSN, address, contact details)

- Pay rates and compensation structures (hourly, salary, commissions, bonuses)

- Tax forms (W-4, state/local equivalents, and any necessary tax exemptions)

- Benefit deductions (health insurance, 401k contributions, garnishments)

- PTO balances (vacation, sick leave, personal time accruals)

- Year-to-date earnings (essential if you're transitioning mid-year to ensure correct annual tax reporting)

2. System Configuration

Working closely with your chosen vendor or provider, this stage involves tailoring the payroll software to your organization's specific requirements. This is where the system is built to reflect your unique pay policies and reporting needs. Key configuration tasks include:

- Setting up pay frequencies and schedules (weekly, bi-weekly, semi-monthly, monthly)

- Adding all necessary deduction codes and benefit plans

- Configuring time tracking settings (if applicable, including overtime rules, break policies)

- Defining reporting and compliance requirements for state and federal agencies

3. Integrations

Modern payroll systems rarely operate in isolation. Ensuring seamless connections between your payroll platform and other business-critical software is vital for data accuracy and efficiency. This typically involves integrating with:

- HR software: For automatic transfer of new hire data, terminations, and employee status changes.

- Time tracking systems: To feed accurate hours worked directly into payroll, minimizing manual data entry and errors.

- Accounting systems: For general ledger (GL) reporting, ensuring payroll expenses are correctly categorized and posted to your financial records.

4. Testing and Validation

This is a critical "dry run" phase to catch and correct any errors before your first live payroll. Using sample or parallel data, you'll run test payroll cycles to thoroughly validate every aspect of the system. Carefully review:

- Gross-to-net pay calculations for accuracy

- Tax withholdings (federal, state, and local)

- Benefit deductions and their correct application

- Direct deposit setup to ensure funds go to the right accounts

- Pay stub accuracy, confirming all required information is present and correct

5. Staff Training

Even the most intuitive system requires proper training for your team to maximize its potential. Educate your payroll and HR staff on how to:

- Process payroll runs from start to finish

- Add, edit, and manage employee records efficiently

- Troubleshoot common issues and utilize support resources

- Access and generate various reports and dashboards for insights

Comprehensive training ensures user adoption, reduces help desk inquiries, and empowers your team to leverage the system's full capabilities. Because nothing derails a launch faster than a panicked manager who can’t remember how to add a new hire the morning payroll is due.

6. Go Live

After successful testing and final sign-off, it's time to run your first live payroll with the new system. This is an exciting milestone, but it requires diligent monitoring. Oversee results closely, confirm all aspects of the process as expected, and be prepared to address any immediate discrepancies.

7. Post-Go-Live Review

The implementation journey doesn't end after the first payroll. Evaluate the first few cycles to proactively catch any minor issues early and make necessary adjustments. Collect feedback from both employees and system users to identify areas for refinement and continuous improvement, ensuring the system continually meets your evolving business needs.

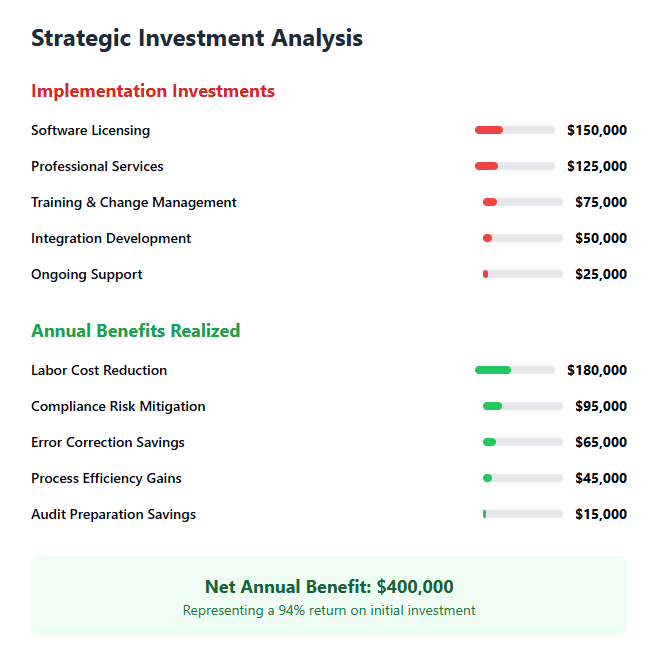

Key Benefits of Payroll Implementation for Growing Businesses

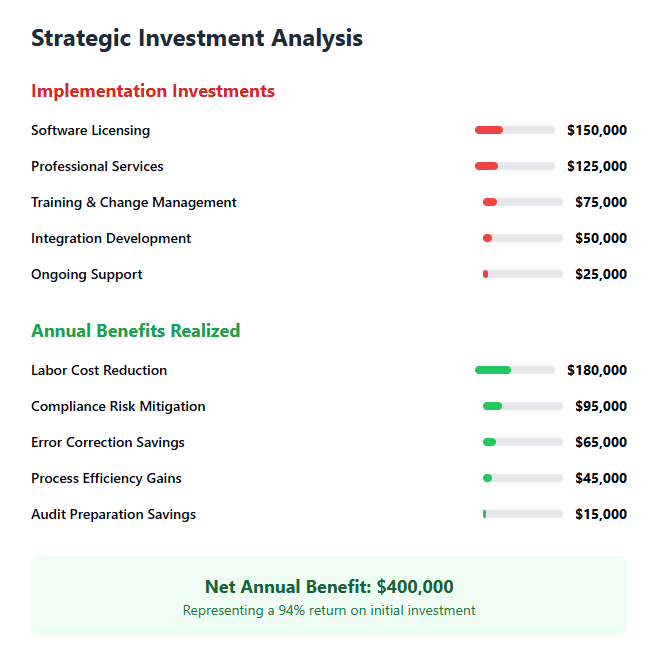

When done correctly, payroll implementation isn't just an administrative task; it's a strategic move that can transform your business operations and fuel growth.

1. Efficiency

Automating payroll significantly reduces the time and effort traditionally spent on manual calculations, data entry, and error correction. This newfound efficiency frees your team from tedious, repetitive tasks, allowing them to focus on more strategic HR initiatives like talent development, employee engagement, and business planning. For example, N&N Moving Supplies was able to reduce their payroll processing time by a remarkable 84% after implementing a new ERP system that integrated with a time-clock solution, demonstrating how automation directly translates to significant time savings for businesses of all sizes.

2. Compliance

Payroll compliance is a complex and ever-changing landscape, with federal, state, and local tax laws constantly evolving. A robust payroll system comes with built-in updates, helping you meet these regulatory requirements without constant guesswork. Automated systems can track changes in tax rates, deductions, and labor laws, minimizing the risk of costly penalties and audits. This built-in vigilance provides peace of mind, allowing you to operate confidently.

3. Scalability

As your business grows, so does the complexity of your payroll. A strong, modern payroll system is designed to grow with you, seamlessly handling new employees, expanding into new locations, and adapting to changing pay structures with ease. This scalability prevents your payroll process from becoming a bottleneck to your expansion. It ensures that your system can accommodate increased volume and complexity without requiring a complete overhaul down the line.

4. Data Transparency

With real-time dashboards and comprehensive reports, a new payroll system provides unparalleled visibility into your labor costs, tax liabilities, and trends. This access to actionable data empowers business owners and HR managers to make more informed strategic decisions. You can identify patterns, forecast expenses more accurately, and gain deeper insights into the financial impact of your workforce.

Common Payroll Implementation Challenges (And How to Overcome Them)

Even with thorough planning, challenges can arise during implementation. Being aware of these potential hurdles and having a strategy to address them can significantly increase your chances of a smooth transition. Here's what to watch for:

|

Challenge

|

How to Address It

|

|

Regulatory complexity

|

Work with experts who are familiar with local and multi-state compliance, especially if you have a distributed workforce. Laws vary significantly by jurisdiction, making expert guidance invaluable.

|

|

Data security concerns

|

Choose vendors with robust security certifications like SOC 2, strong encryption protocols, and role-based access controls to protect sensitive employee and financial data. This protects your business and builds employee trust.

|

|

Lack of training

|

Integrate comprehensive training into the rollout plan, along with readily available support resources (e.g., user guides, video tutorials, dedicated help desk). User adoption hinges on feeling confident with the new system.

|

|

Integration issues

|

Test early and often, with dedicated IT support readily available, to ensure seamless data flow between payroll and other systems (HRIS, time & attendance, accounting). Proactive testing can catch discrepancies before they become major problems.

|

|

User adoption

|

Communicate early and clearly about the benefits of the new system to all employees. Share how it will simplify their lives (e.g., easy access to pay stubs via self-service portals) and actively gather employee feedback throughout the process.

|

The key is proactive planning and selecting a provider that supports you not just during the launch, but with ongoing support and expertise after your system is live.

Payroll implementation isn’t just an IT project—it’s a strategic opportunity to simplify your operations, improve accuracy, and proactively support your employees. It's a chance to modernize your processes and lay a stronger foundation for business growth.

From system selection to staff training, each step builds a crucial foundation for long-term success and efficiency. However, it requires clear goals, the right technology, and a partner who understands the intricacies of the process and can guide you through every phase.

If you're considering implementing a new payroll system or improving your current one, now is the time to act. A strong start leads to smoother operations, fewer headaches, and a more engaged workforce down the line.

At Lift HCM, we’ve seen firsthand how overwhelming payroll changes can be. That’s why we guide you through every step—data, testing, training—so nothing gets lost in the shuffle. If you’re ready to make payroll easier and safer for your team, let’s talk.

.png?width=1536&height=1024&name=Create%20a%20background%20that%20reads%2c%20How%20Long%20to%20Keep%20P%20(1).png)