The Hidden Costs of Using Multiple HR, Payroll, and Benefits Systems

August 14th, 2025

6 min read

Have you ever spent your entire morning tracking down why an employee's paycheck was wrong, only to discover the issue stemmed from data living in three different systems? Are you tired of your team doing the same data entry work multiple times because your HR, payroll, and benefits platforms don't talk to each other?

You're not alone in this frustration. Every week, we speak with HR managers, payroll specialists, and business owners who feel trapped by the very systems meant to make their lives easier. What started as cost-effective solutions for a smaller company has become a web of inefficiencies, errors, and compliance headaches as your organization has grown.

We promise that by the end of this article, you'll have a clear understanding of exactly what these disconnected systems are costing you—not just in dollars, but in time, employee satisfaction, and peace of mind. We'll walk through the four major hidden expenses using verified industry data, show you real-world examples of their impact, provide specific calculations you can use to assess your own situation, and outline practical solutions ranging from quick fixes to comprehensive platform changes.

Table of Contents

- Understanding the Multiple HR Systems Challenge

- Administrative Inefficiency and Duplicate Work

- Benefits Administration Disconnects and Enrollment Errors

- Payroll Processing Errors and Correction Costs

- Time and Attendance Tracking Complications

- Compliance Risk and Regulatory Exposure

- Solution Approaches: From Quick Fixes to Complete Integration

- Future-Proofing Your HR Technology Investment

Understanding the Multiple HR Systems Challenge

When we talk about "multiple HR systems," we're referring to the common setup where organizations use separate software solutions for core functions like employee records management, payroll processing, time and attendance tracking, and benefits administration. Each system serves its purpose well individually, but they often operate in silos with minimal integration.

This fragmented approach typically develops over time as companies grow. You might have started with a simple payroll service, added an HR information system later, then implemented a separate time clock solution when you needed better attendance tracking.

The real challenge isn't the systems themselves—it's the gaps between them. Data doesn't flow automatically from one to another, creating manual touchpoints where information must be exported, reformatted, and imported. Every one of these handoffs represents a potential delay, error, or inconsistency that your team must monitor and correct.

Now, let's dive into the the four major hidden costs of system fragmentation.

Administrative Inefficiency and Duplicate Work

The most obvious but often underestimated cost comes from doing the same work multiple times. When systems don't share data, your team becomes a human integration layer, manually ensuring information stays consistent across platforms.

According to Ernst & Young's (EY) extensive study, the average cost of a single point of data entry is $4.78, with costs trending upward each year—from $4.39 in 2018 to $4.78 in 2024. This seemingly small amount multiplies quickly across all your HR processes.

The chart below shows how administrative tasks consume 51 hours monthly in a typical 150-employee organization, with duplicate data entry alone costing $875 per month. Notice how these seemingly small inefficiencies compound to create $21,420 in annual overhead costs.

This inefficiency manifests throughout the employee lifecycle. During onboarding, new hire information must be entered into your HRIS, then separately into payroll for tax setup, then again into your benefits platform for enrollment eligibility.

Organizations using multiple disconnected systems typically see increased administrative overhead due to duplicate work and system coordination requirements.

Benefits Administration Disconnects and Enrollment Errors

When benefits administration operates separately from HR and payroll systems, organizations face unique challenges that directly impact both costs and employee satisfaction. Benefits data must be manually synchronized across multiple platforms, creating opportunities for coverage gaps, billing discrepancies, and compliance violations.

Industry data shows that benefits administration costs average $24 per employee per month when using disconnected systems, with error rates significantly higher during open enrollment periods. A typical benefits enrollment error costs an average of $400 to resolve, including staff time, vendor communications, and potential retroactive corrections.

Common Benefits System Disconnects:

- Enrollment Data Lag: New hire benefits elections don't sync with payroll deductions, causing first-paycheck confusion

- Life Event Processing: Marriage, divorce, or family changes require manual updates across multiple systems, increasing error risk

- COBRA Administration: Termination data delays can create missed COBRA notification deadlines, resulting in penalties averaging $110 per day per affected employee

- Carrier Billing Reconciliation: Premium amounts in benefits systems often don't match payroll deduction amounts, requiring monthly reconciliation

- Compliance Reporting: ACA reporting requires data from both benefits and payroll systems, creating audit trails that are difficult to maintain

The chart below shows how benefits errors cluster during open enrollment periods (Feb-Mar), with enrollment mistakes and billing mismatches creating the highest volume of issues. Notice how life event processing errors remain consistently high throughout the year, reflecting the ongoing challenge of managing changes across disconnected systems.

Payroll Processing Errors and Correction Costs

Disconnected systems create numerous opportunities for payroll errors, each carrying both direct and indirect costs that can significantly impact your organization's finances and employee relations.

Industry data shows that companies have an average payroll error rate of 1.2% per pay period, and approximately 33% of employers make payroll errors annually. For a company with 100 employees making $900 weekly, those "small" errors cost $56,647 annually.

The indirect costs prove even more substantial. Research indicates that two payroll errors are enough to make 50% of employees start looking for a new job, directly impacting retention rates and recruitment costs.

Time and Attendance Tracking Complications

Time tracking becomes particularly complex when attendance systems don't integrate seamlessly with payroll processing. Multiple sources report significant error rates when time and attendance data must be manually transferred between systems.

According to verified payroll studies, vacation/paid time off requests and scheduled earnings disruptions were among the most common payroll errors, occurring at frequencies of 503 and 410 times per 1,000 employees respectively. Each error costs companies an average of $291 to remedy.

The administrative burden of managing these discrepancies can be substantial. A typical organization with 100 non-exempt employees might spend 5-8 hours per pay period reconciling time data, investigating discrepancies, and making manual adjustments.

The breakdown below shows time tracking errors dominating at 40% of all issues, followed by pay rate mistakes at 30%. While tax and benefits errors represent smaller percentages, they often carry the highest compliance risks and correction costs.

Compliance Risk and Regulatory Exposure

Perhaps the most dangerous hidden cost involves compliance failures that result from incomplete or inconsistent records across multiple systems. According to PayrollOrg's 2024 survey, 63% of respondents stated compliance is their biggest global payroll challenge.

Industry data reveals that 53% of companies have incurred payroll penalties in the last five years due to non-compliance. The IRS reports that nearly 5 million penalties were related to payroll taxes, costing $13.7 billion annually.

The timeline below tracks penalty costs increasing 87% over six months, from $150 to $280, while violations escalate from 12 to 25. This demonstrates how compliance problems in disconnected systems compound rapidly, creating cascade effects that are expensive to resolve.

The financial impact extends beyond immediate penalties. Audit responses typically require significant internal resources, often involving legal counsel and external consultants. According to the National Small Business Association, the average cost of compliance management stands at $12,000 per year, influenced by payroll system complexity and employee count.

Solution Approaches: From Quick Fixes to Complete Integration

Immediate Process Improvements

Quick wins focus on better managing your current systems while reducing error rates and inefficiencies. Implementing standardized processes and better training can help reduce common mistakes.

90-Day Quick Win Checklist:

- Implement standardized checklists for new hires, rate changes, and terminations

- Create weekly reconciliation reports between HR and payroll systems

- Establish cutoff dates for changes relative to payroll processing

- Train staff on common error patterns and prevention techniques

Enhanced Integration Solutions

Mid-level solutions focus on better connecting your existing systems through improved data flows and automation. Many organizations report cost savings when implementing better integration solutions.

Unified Platform Migration

Complete platform consolidation represents the most comprehensive solution. Research shows that the average expected cost for an HR system in 2025 is anywhere from $2 to $17 per employee per month for core functionality.

Industry data indicates that companies spend an average of 15 weeks selecting an HRIS, with 98% considering cloud-based solutions. Modern HCM platforms offer substantial advantages beyond simple integration, including unified reporting, automated workflows, and mobile capabilities.

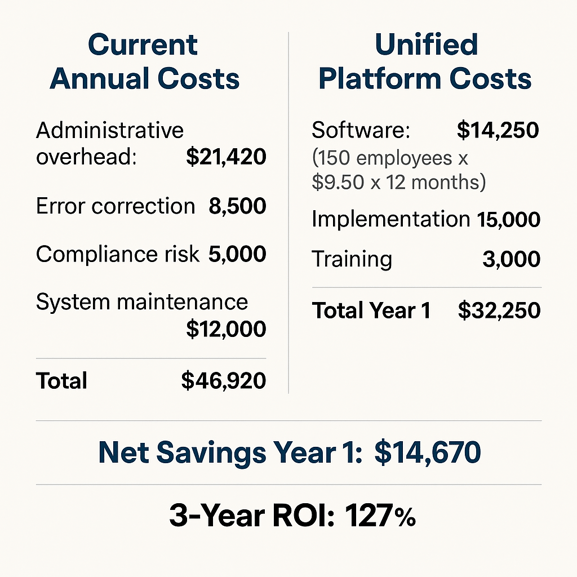

Platform Migration ROI Calculator:

Current Annual Costs:

Administrative overhead: $21,420

Error correction: $8,500

Compliance risk: $5,000

System maintenance: $12,000

Total: $46,920

Unified Platform Costs:

Software: $14,250 (150 employees × $9.50 × 12 months)

Implementation: $15,000

Training: $3,000

Total Year 1: $32,250

Net Savings Year 1: $14,670

3-Year ROI: 127%

The chart below compares total costs over three years, showing how unified platform investments (purple line) overtake other approaches by month 18 despite higher initial costs. Notice the convergence point where comprehensive solutions begin delivering the greatest long-term savings.

Future-Proofing Your HR Technology Investment

For the third consecutive year, HR leaders cite HR technology as their top investment priority, with 48% planning to increase their 2024 HR technology budget. However, Gartner research shows that HR technology solutions were not at all successful (26%) or only slightly successful (32%) in reducing HR operational costs, emphasizing the importance of careful vendor selection and implementation planning.

Consider these factors when evaluating solutions:

- Vendor stability and product roadmaps

- API capabilities for future integrations

- Scalability to support business growth

- Compliance features for your industry and locations

Disconnected tools don’t just waste time. They obscure insights, frustrate employees, introduce compliance risk, and quietly inflate costs.

The organizations that will thrive over the next five years are those that unify HR, payroll, and benefits into a single, agile platform — enabling them to adapt quickly, make decisions with confidence, and create an employee experience that attracts and retains top talent.

Ready to calculate exactly what disconnected systems are costing your organization? Contact Lift HCM for a complimentary assessment that will quantify your current hidden costs and identify the most impactful improvement opportunities for your specific situation.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics: