Are your employees putting in extra hours? Paying them overtime correctly is vital to avoid expensive penalties. Not sure how to stay compliant? Well, we've got you covered! In this guide, we'll walk you through the ins and outs of calculating overtime pay.

Lift HCM has been managing overtime pay for clients for over 50 years. We'll walk you through the calculations, call out common pitfalls, and highlight some applicable laws surrounding accurate payroll reporting. Hopefully, we’ll leave you with the knowledge you need to count the beans!

What is Overtime Pay?

Overtime is generally defined as working more than 40 hours in a single workweek or seven consecutive 24-hour periods (which may not align with the calendar week). Overtime pay typically applies to employees who earn hourly wages.

Typically, employees who fall into one of the following categories are exempt from overtime pay:

- Administrative

- Executive

- Professional

- Computer

- Outside sales

- Highly compensated individuals

However, if any of these employees earns less than $684 per week and diligently track their hours, they can still qualify for overtime.

How Does the FLSA Factor into Overtime?

If your business is involved in interstate commerce or generates annual revenues exceeding $500,000, you’ll need to adhere to the Fair Labor Standards Act (FLSA). The FLSA doesn't require overtime pay for work on Saturdays, Sundays, holidays, or regular days of rest. However, it does The FLSA dictates that when it comes to overtime, employees must be compensated at least 1.5 times their regular wage. However, there may be state laws that go beyond the FLSA, imposing even greater overtime obligations. Head over to your state labor department's website to see if they’ve thrown any fun curveballs into the mix.

Remember, if both the FLSA and state law apply to your employees, follow the provisions that offer them the most generous benefits. But just because you fall under the jurisdiction of the FLSA, doesn’t mean your employees qualify for overtime pay.

Who Gets Overtime?

Normally, overtime pay earned in a particular workweek must be paid on the regular pay day for the pay period in which the wages were earned. So if you pay weekly, then it must be paid weekly. If your payroll is bi-weekly, then you’ll pay it bi-weekly, although the amount is still based on a 40-hour workweek.

How to Calculate Overtime Pay

As we discussed earlier, the Fair Labor Standards Act (FLSA) requires that employees receive compensation of at least 150% of their regular wage for any hours worked beyond 40 in a single workweek.

To calculate the hours an employee has worked, it’s crucial to take all kinds of time into account. That includes:

- Unauthorized work time.

- Those times between meetings where you’ve got “just enough time to do nothing”.

- Traveling between work appointments.

- Time spent transitioning into and out of the day’s work.

- Time dedicated to work-related learning and development.

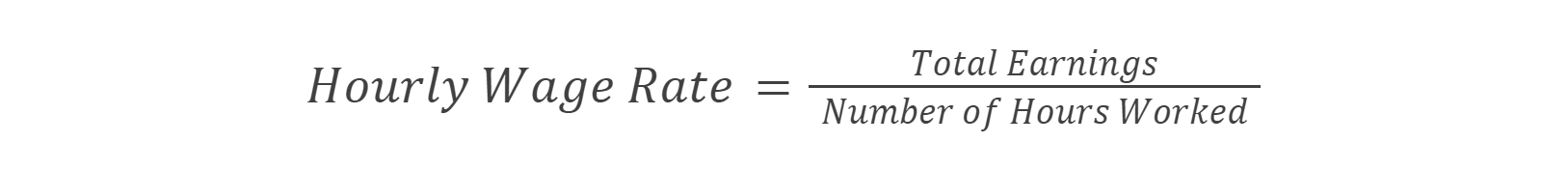

When it comes to calculating overtime, you’ll first need to calculate an employee's "regular wage rate". The regular wage rate is typically calculated by dividing the total earnings (such as salary or hourly pay) by the number of hours worked in a specified time period. The formula varies slightly depending on whether the employee is paid a fixed salary or an hourly wage.

Hourly Wage Rate

For employees paid on an hourly basis, the regular wage rate is calculated using the formula:

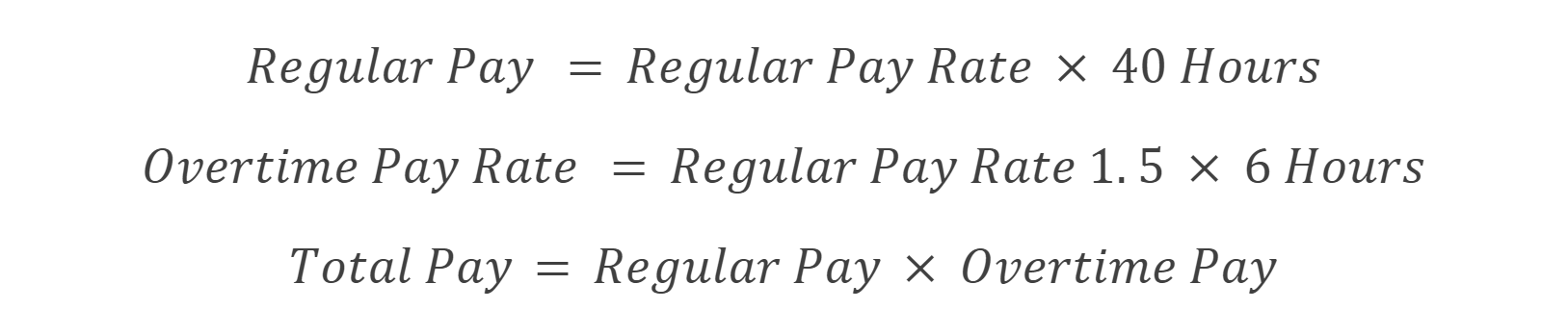

Once you’ve calculated an hourly employee’s regular wage rate, you can calculate their overtime pay for a 40-hour week as follows:

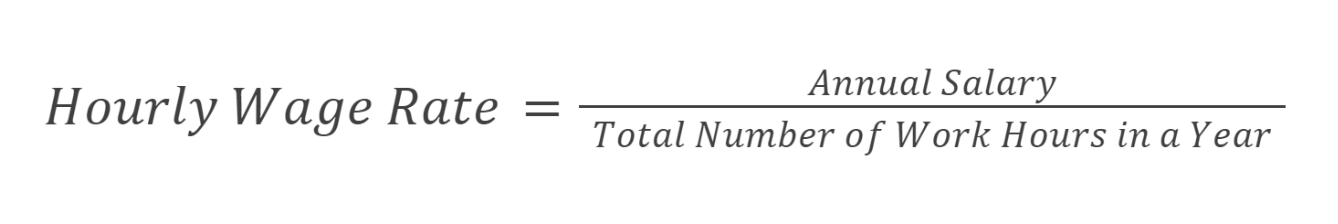

Salary-Based Wage Rate

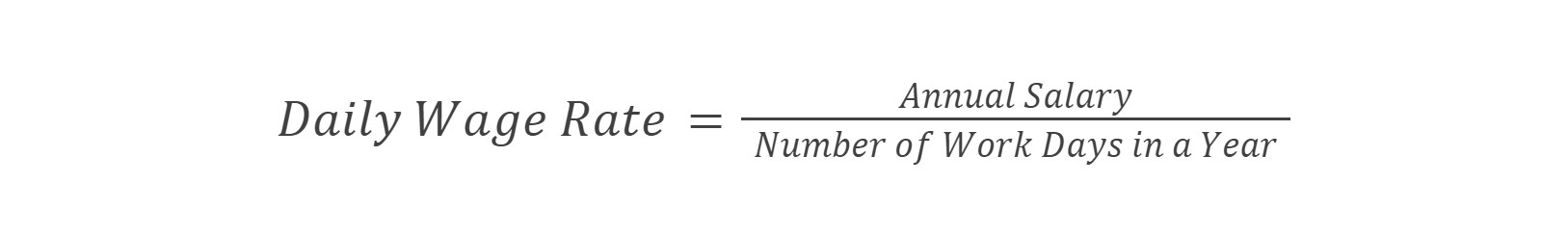

For salaried employees, the regular wage rate is typically calculated based on their annual salary. First, convert the annual salary to an hourly rate or a daily rate depending on the pay frequency (e.g., weekly, bi-weekly, or monthly). Then, divide by the standard number of hours or days in a workweek.

- Hourly rate from an annual salary:

- Hourly rate from an annual salary:

Note that the "Number of Work Hours in a Year" and "Number of Work Days in a Year" should be adjusted based on the specific workweek and workday configurations of the organization. For instance, if a standard workweek is 40 hours, you'd use 40 hours for the calculations. Similarly, adjust for part-time or flexible work arrangements accordingly.

It's important to note that overtime calculations must be adjusted for employees who receive a shift differential.

Calculating Accurate Overtime Pay

The process of calculating overtime is more complex than it may initially seem, especially when considering factors like shift differentials. Given the Department of Labor's increased focus on labor law compliance, it is crucial to ensure precise calculations to avoid enforcement actions. However, accuracy in overtime calculations isn't always the only concern. During an audit, the DOL examines not only payroll records but also your compliance with various aspects of the FLSA (e.g. notice postings, reporting of tips, appropriate exempt/non-exempt classifications, etc.).

Understanding the Consequences of Violating FLSA Overtime Rules

Violating the Fair Labor Standards Act (FLSA) overtime rules can have serious repercussions. Incorrectly calculating or failing to pay overtime as mandated by the FLSA can result in the obligation to compensate employees for unpaid overtime hours. If a complaint is filed with the Department of Labor (DOL) regarding mishandling of overtime payments, the consequences may include paying back wages, damages, penalties, and fines. Additionally, violations of state laws can lead to further penalties.

Key Takeaways for Compliance and Fair Compensation

Understanding and accurately calculating overtime pay is essential for maintaining compliance and ensuring fair compensation for your employees. By familiarizing yourself with the intricacies of the Fair Labor Standards Act (FLSA) and any applicable state laws, you can avoid costly penalties and foster a positive work environment.

Remember, the key to successful payroll management lies in staying informed and proactive. With Lift HCM's expertise and this comprehensive guide, you're well-equipped to navigate the complexities of overtime pay. Keep these insights handy, and you'll be well on your way to mastering payroll compliance.

Jason Noble is a seasoned expert in payroll and human capital management. With a wealth of experience in streamlining payroll processes and optimizing workforce management, Jason has successfully held key roles at leading organizations. His deep understanding of industry best practices ensures that his insights are both practical and authoritative.

Topics:

.png?width=1536&height=1024&name=Create%20a%20background%20that%20reads%2c%20How%20Long%20to%20Keep%20P%20(1).png)