Payroll Software Costs: Small vs. Mid-Market—What to Expect in 2026

November 4th, 2025

6 min read

Implementing or upgrading payroll software can feel like solving a puzzle with missing pieces. Between base fees, per-employee pricing, and hidden add-ons, HR leaders often spend more time decoding proposals than improving payroll operations.

At Lift HCM, we’ve helped hundreds of businesses—from startups processing their first pay run to multi-state employers managing complex compliance needs—transition to more efficient payroll systems.

This article answers your most pressing questions about 2026 payroll software pricing. You’ll learn how vendors price their products, what realistic benchmarks look like for small and mid-market businesses, and how to build a smart payroll budget that scales with your company.

Table of Contents

- Why Payroll Software Costs Are Rising in 2026

- Payroll Pricing Models Explained: Base, PEPM, and Usage

- Small vs. Mid-Market Payroll Software Costs in 2026

- When Payroll Add-Ons Become Mandatory

- Budgeting Formulas for Different Payroll Scenarios

- How to Avoid Overbuying Payroll Software

- FAQs: Payroll Software Cost Questions Answered

- Turning Payroll Complexity into Clarity

Why Payroll Software Costs Are Rising in 2026

Payroll software pricing isn’t static—it reflects larger changes across technology, regulation, and workforce management.

Compliance automation requirements are becoming more stringent, especially as state and local laws evolve to address labor standards, wage transparency, tax compliance, and data security. Recent trends show that more jurisdictions are mandating electronic recordkeeping, real-time wage reporting, and automated tracking of compliance processes to reduce risks and ensure accuracy.

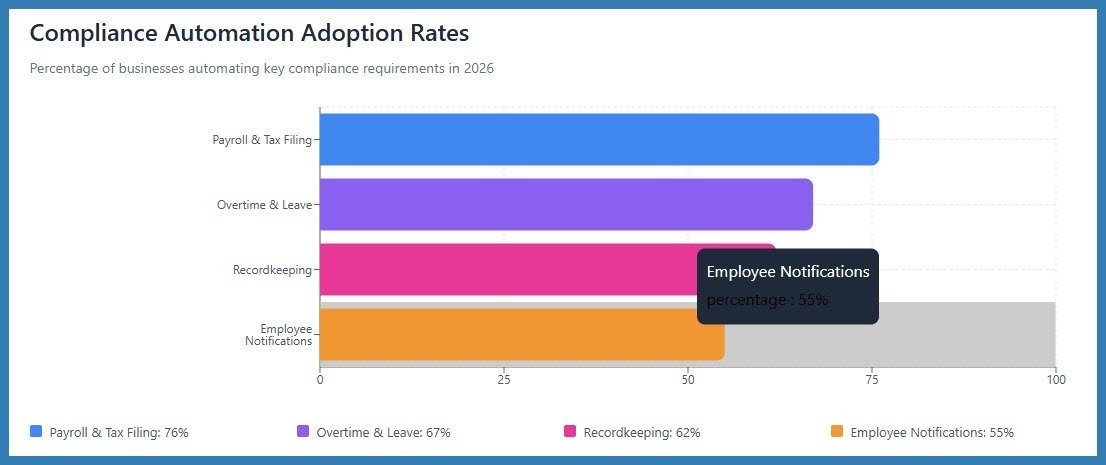

Key Compliance Automation Trends

Many states now require employers to use automated solutions for tracking overtime, paid leave, and wage payment records to ensure compliance with regulations such as the Fair Labor Standards Act (FLSA), state minimum wage laws, and mandated benefits.

Major cities like Chicago, New York City, and San Francisco now require electronic documentation and automated notifications for employee rights, schedule updates, paystub access, and anti-retaliation protections.

Automation is increasingly used to ensure compliance with emerging privacy regulations—such as the Illinois Biometric Information Privacy Act (BIPA) and the California Consumer Privacy Act (CCPA)—by providing audit trails and streamlining consent tracking for employee data management.

| Requirement | Percentage of Businesses Automating | Notable State/Local Laws |

|---|---|---|

| Payroll calculation and tax filing | 76% | IL Wage Payment Act, CA Labor Code, NYS Wage Theft Prevention Act |

| Overtime, leave, and scheduling compliance | 67% | Chicago Fair Workweek Ordinance, CA Paid Sick Leave, NYC Paid Safe/Sick Leave |

| Recordkeeping and audit trail maintenance | 62% | IL Biometric Privacy, CCPA, NYC Wage Transparency |

| Employee notifications and policy changes | 55% | SF Predictable Scheduling, NYC Worker Bill of Rights |

State and Local Law Examples

-

Illinois: BIPA requires automated biometric consent collection and retention logs for payroll clock and time-tracking systems .

-

California: CCPA mandates automated opt-out and data deletion workflows for employee personal information .

-

New York: Wage Theft Prevention Act and Fair Workweek rules require automated wage notice systems and schedule change alerts .

As compliance automation becomes a baseline expectation, state and local legal frameworks increasingly incorporate technology-driven controls, favoring businesses that proactively deploy advanced solutions .

Payroll Pricing Models Explained: Base, PEPM, and Usage

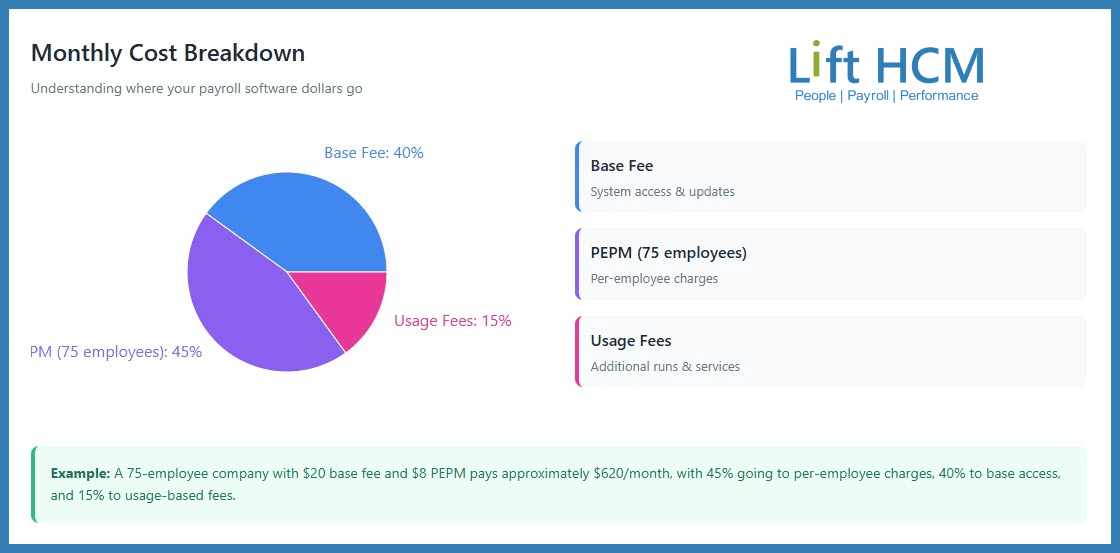

Payroll pricing models continue to evolve. As automation and compliance technology advance, vendors are shifting toward hybrid pricing that combines base fees, per-employee-per-month (PEPM) charges, and usage-based fees. Understanding these categories will help you compare quotes accurately.

Base Fees

This covers your access to the system, basic payroll processing, and standard updates.

-

Small businesses: $20–$100 per month

-

Mid-market companies: $200–$500 per month

Expect base fees to rise slightly in 2026 as vendors roll AI automation and compliance tools into core packages.

PEPM Charges

The true driver of payroll cost is the per-employee-per-month rate.

-

Small business range: $5–$12 PEPM

-

Mid-market range: $9–$20 PEPM

Industry forecasts predict a 3–6% increase in 2026 as platforms add analytics, multi-state tax filing automation, and advanced integrations.

Usage-Based Fees

Applied for specific services:

-

Additional payroll runs

-

Year-end tax filings

-

Garnishment processing

-

ACH reversals or multi-state tax registrations

Usage fees typically range $1–$3 per event.

Example: A 75-employee company paying $20 base + ($8 × 75) = $620/month, or $7,440/year. A 350-employee mid-market firm paying $300 base + ($12 × 350) = $4,500/month, or $54,000/year.

Small vs. Mid-Market Payroll Software Costs in 2026

While small businesses often start with simplified payroll platforms, mid-market firms require more robust capabilities—particularly around compliance, integrations, and employee self-service (ESS).

Small Business (1–100 employees):

- Average monthly cost: $200–$900

- Typical annual cost: $2,400–$10,800

- Common vendors: Gusto, OnPay, Patriot, QuickBooks Payroll

- Core features: Payroll runs, direct deposit, tax filing, W-2 prep

Mid-Market (100–1,000 employees):

- Average monthly cost: $3,000–$7,500

- Typical annual cost: $36,000–$90,000

- Common vendors: Paycor, ADP Workforce Now, Paylocity, isolved, Lift HCM

- Core features: Multi-state processing, benefits integration, time tracking, performance and onboarding modules

What’s changing in 2026: Expect bundled HR and compliance automation to become standard. Vendors are shifting toward unified HCM pricing, so separating payroll from HR modules may soon carry a surcharge.

When Payroll Add-Ons Become Mandatory

As your organization grows, certain add-ons shift from optional to necessary. The biggest cost jumps happen when employers expand across states, add hourly or tipped staff, or integrate benefits and scheduling.

Typical Add-On Costs (2026)

|

Add-On Module |

Typical PEPM Cost |

When It’s Needed |

|

Time & Attendance |

+$2–$6 |

Hourly or shift-based teams |

|

Benefits Administration |

+$3–$8 |

Offering health benefits or 401(k) |

|

Accounting / ERP Integrations |

+$2–$10 |

Linking HR and finance data |

|

Advanced Analytics |

+$1–$3 |

Workforce insights and reporting |

|

Compliance Automation |

+$3–$6 |

Multi-state or high-turnover environments |

Example: A 200-employee company adding time tracking and benefits integration could see total PEPM rise from $10 to $18—an 80% increase in spend.

Key takeaway: Add-ons become non-negotiable once you manage multiple pay groups, tipped wages, or benefits enrollment. Budget for them early to avoid mid-contract cost spikes.

Budgeting Formulas for Different Payroll Scenarios

Payroll costs increase with workforce complexity. Seasonal, tipped, and multi-state employers should calculate total payroll spend using realistic averages—not just headcount.

Budget formula: (Base fee × 12) + [(PEPM × Avg employees × 12 months) × 1.05 for add-ons] = Annual payroll software cost

Seasonal Example: A hospitality group with 150 year-round and 50 seasonal employees:

$250 base + ($10 × 200) = $2,250/month × 12 = $27,000/year × 1.05 (add-ons) = $28,350/year.

Multi-State Example: A 300-employee retailer in 4 states: $350 base + ($12 × 300) + $3/state integration = $4,000/month = $48,000/year.

Tipped Example: Restaurant with 100 employees using integrated T&A and tip allocation:

$150 base + ($11 × 100) + ($3 add-on) = $1,580/month = $18,960/year.

How to Avoid Overbuying Payroll Software

Overbuying is one of the most common—and costly—mistakes in payroll technology. A platform that’s too advanced wastes money; one that’s too basic stalls growth.

Step 1: Map must-have vs. future modules. Start with payroll and tax compliance. Add ESS, benefits, and time tracking only when operational needs justify them.

Step 2: Ask vendors about upgrade pricing. Some platforms let you lock in lower rates for future modules if you plan ahead during contract negotiation.

Step 3: Review contract terms for usage limits. Look for automatic tier jumps based on employee thresholds or new locations.

Step 4: Conduct annual payroll cost audits. A quick audit can reveal unnecessary licenses, duplicate integrations, or underused modules.

📌 Pro Tip: Request a “Total Cost of Ownership” summary before signing. It should include all one-time, recurring, and conditional costs.

FAQs: Payroll Software Cost Questions Answered

Q: Why do payroll costs vary so much between small businesses and mid-market organizations? A: Payroll software pricing reflects each company’s unique needs. Small businesses generally require core payroll processing and basic compliance tools, resulting in lower monthly fees. In contrast, mid-market companies often need more advanced features—multi-state tax filing, benefits integration, customizable reporting, and sophisticated employee self-service—all of which drive up per-employee and base costs. As your headcount and operational complexity grow, expect additional modules and integrations to become essential.

Q: Are there any hidden fees I should watch for in a payroll software contract? A: It’s common for some providers to advertise low headline rates, then add on fees for services like year-end filings, garnishment processing, data imports, or required integrations. Look for transparent per-employee-per-month (PEPM) pricing and insist on a detailed cost summary upfront. At Lift HCM, we offer upfront clarity—every cost is disclosed, with no surprises mid-contract.

Q: How can my business avoid overpaying for payroll technology? A: Start by mapping out the features you need now and those you might need in the future. Don’t let vendors bundle add-ons you won’t use right away. Ask about the flexibility to add modules as your business evolves, and review contract terms to avoid autorenewals or automatic tier jumps. Regularly auditing your payroll system against your current needs can also help you eliminate underused features and unnecessary expenses.

Q: Is it worth paying more for compliance automation and integrations? A: For businesses operating in multiple states or managing tipped employees, investing in compliance automation and seamless integrations can prevent costly errors and legal risks. While these features may increase your upfront costs, they deliver lasting value by streamlining payroll, reducing administrative work, and helping your business stay ahead of regulatory changes.

Q: What’s the best way to compare payroll vendors? A: Request a comprehensive pricing breakdown (including all anticipated add-ons and support costs), evaluate the quality of customer service, and ask about scalability if you expect to grow. Partnering with a provider that offers dedicated support—like Lift HCM—means you get guidance, transparency, and adaptability alongside robust technology.

Turning Payroll Complexity into Clarity

You don’t have to guess your way through payroll implementation or 2026 budget planning.

Whether you’re upgrading from basic software or expanding into multi-state operations, clarity on costs helps every decision—from compliance to employee satisfaction.

With the right partner, switching systems can be smooth, compliant, and stress-free. The best payroll platforms don’t just process pay—they simplify how you manage people, data, and growth.

Check out our other resource Payroll Implementation: A Complete Guide for HR and Payroll Leaders or schedule a consultation with Lift HCM’s experts. We’ll help you plan the transition, compare vendors, and build a realistic 2026 payroll budget tailored to your organization.

Lift HCM has helped organizations across industries transition payroll systems with confidence—combining local expertise, national scalability, and human-first support. Explore Lift HCM’s payroll and HCM services!

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

.png?width=1536&height=1024&name=Create%20a%20background%20that%20reads%2c%20How%20Long%20to%20Keep%20P%20(1).png)