Best Practices for Accurate Time and Attendance Tracking in Payroll Management

November 4th, 2024

4 min read

Are payroll errors and compliance issues caused by inconsistent time-tracking practices taking a toll on your business? If you’re finding that manual time-tracking is prone to errors, or if your HR team is overwhelmed by correcting time-related discrepancies, you’re not alone. These challenges are common and can disrupt smooth operations, resulting in costly errors and overburdened HR teams.

At Lift HCM, we’ve seen this happen time and again, and we know the best ways to streamline your process. With over five decades in the Payroll and Human Capital Management (HCM) industry, we understand the impact of accurate time and attendance tracking on payroll efficiency and compliance. In this article, we’ll cover tried-and-tested best practices for time tracking, so you can improve accuracy, ensure compliance, and lighten the load on your payroll team.

Table of Contents

- The Impact of Accurate Time Tracking on Payroll Management

- Best Practice #1: Implement Automated Time-Tracking Systems

- Best Practice #2: Establish Clear Attendance Policies

- Best Practice #3: Integrate Time-Tracking Systems with Payroll Software

- Best Practice #4: Conduct Regular Audits and Compliance Checks

- Best Practice #5: Train Employees on Timekeeping Protocols

- Common Mistakes to Avoid in Time and Attendance Tracking

- Improve Efficiency and Stay Compliant with Lift HCM

📝 Download the free Time and Attendance Tracking Audit Checklist at the end of this article! ⬇️

The Impact of Accurate Time Tracking in Payroll Management

Accurate time and attendance tracking is the backbone of payroll management. When employees are assured of correct pay and regulations are followed consistently, it boosts morale, minimizes legal risks, and improves payroll efficiency. According to the American Payroll Association (APA), businesses can lose up to 7% of gross payroll due to time-tracking issues, including time theft and manual entry errors.

Using a robust time-tracking system doesn’t just support payroll accuracy; it fosters a fair and transparent work environment, setting the stage for smoother operations and happier employees.

Best Practice #1: Implement Automated Time-Tracking Systems

Manual time recording invites payroll discrepancies due to human error, forgotten entries, or calculation mistakes. Switching to an automated time-tracking system can significantly reduce these issues. Here are some key benefits of automated tracking:

- Real-time tracking: Employees’ clock-ins and clock-outs are automatically recorded for precise timekeeping.

- Remote access: Cloud-based options allow employees to track hours from any location—a great fit for hybrid teams.

- Payroll integration: Automated systems sync seamlessly with payroll software, eliminating the need for manual data entry and reducing errors.

Automated time-tracking systems also allow managers to view real-time attendance data, helping them monitor attendance patterns and make timely decisions. The “Before and After” chart below clearly shows how automated tracking significantly reduces errors, enhances real-time tracking, and seamlessly integrates with payroll systems, emphasizing the efficiency gains of automation.

Best Practice #2: Establish Clear Attendance Policies

Even the most sophisticated time-tracking tools are only effective when employees understand and follow clear attendance guidelines. Ambiguous policies can lead to payroll discrepancies and misunderstandings.

To avoid these issues, develop written attendance policies that cover:

- Clock-in/out procedures: Define when and how to clock in and out, including any consequences for missed steps.

- Breaks and lunch: Specify how breaks should be logged, and if unpaid lunch breaks need separate documentation.

- Overtime and time-off requests: Outline the process for approving and recording overtime and requesting time off.

- Remote and flexible work: For teams working remotely, set policies on how to track time outside the office.

Introduce these policies during onboarding and reinforce them regularly to maintain payroll consistency.

Best Practice #3: Integrate Time-Tracking Systems with Payroll Software

Transferring data from time-tracking logs to payroll systems manually is a common source of error. By integrating your time-tracking system with payroll software, you streamline processes and minimize risks. Integration offers several benefits:

- Automated data transfer: Time data flows directly into payroll, reducing manual input errors.

- Faster processing: Automations speed up payroll calculations, making payroll processing more efficient.

- Enhanced compliance: Integrated systems can help meet labor law requirements, like overtime and break policies.

- Detailed reporting: Generate accurate reports for audits, tracking trends, and managing employee time effectively.

Best Practice #4: Conduct Regular Audits and Compliance Checks

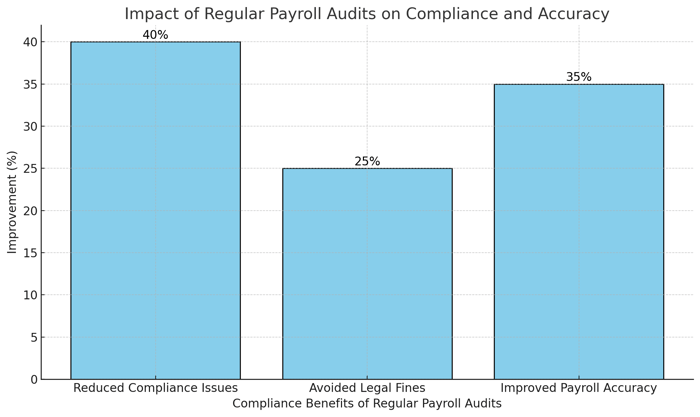

Routine audits of time and attendance records are essential for ensuring accuracy and compliance over time. Regular checks help identify and correct errors, prevent time theft, and maintain alignment with labor laws.

Here’s how routine audits make a difference:

- Catch errors early: Identify system or data entry errors before they impact payroll.

- Prevent time theft: Auditing logs can reveal issues like buddy punching, where one employee clocks in for another.

- Maintain compliance: Regular checks ensure adherence to all labor laws, protecting against costly fines or legal issues.

Set up monthly or quarterly audits to keep payroll data accurate and compliant.

The chart below visually emphasizes the value of conducting regular audits for compliance and payroll accuracy, demonstrating the significant impact on reducing risks and enhancing payroll management.

Best Practice #5: Train Employees on Timekeeping Protocols

Even with automated systems and clear policies, employee training is crucial for effective time and attendance tracking. If staff members aren’t familiar with your system or policies, errors and confusion are likely to arise.

Training should focus on:

- System Use: Train employees on how to clock in and out, whether through an app, desktop, or physical system.

- Attendance Policies: Reinforce company policies so employees know the importance of logging breaks and clocking in and out correctly.

- Correcting Mistakes: Teach employees how to report and correct errors if they forget to clock in or out.

- Compliance Awareness: Emphasize that accurate timekeeping ensures fair pay and legal compliance.

Investing in training builds a culture of accountability and ensures effective use of your time-tracking system.

Common Mistakes to Avoid in Time and Attendance Tracking

Avoid these common pitfalls to protect payroll accuracy:

- Manual timekeeping reliance: Opt for automated solutions whenever possible to reduce human error.

- Inconsistent policy enforcement: Apply policies equally across your organization to avoid confusion and resentment.

- Neglecting break/overtime tracking: Accurate logging of breaks and overtime is essential for labor law compliance.

- Skipping regular audits: Routine audits catch errors early and maintain data accuracy.

- Ignoring employee feedback: Employees can offer valuable insights into the time-tracking system’s functionality, helping improve your processes.

A study by Software Advice shows that companies using automated time-tracking software see a 58% reduction in payroll processing errors.

Improve Efficiency and Stay Compliant with Lift HCM

Payroll errors, compliance risks, and HR resource strain are often the result of inconsistent time tracking. By implementing these best practices, like automated systems, clear policies, and employee training, you can avoid common pitfalls and streamline payroll management. At Lift HCM, we’re here to support you with advanced, reliable solutions for seamless time and attendance tracking.

Ready to simplify your time-tracking and ensure compliance? Discover how Lift HCM’s solutions can help you maintain a compliant and efficient payroll process.

Free Checklist: Download Your Time and Attendance Tracking Audit Checklist!

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

.png?width=473&height=315&name=Digital%20Employee%20Experience%20DEX%20in%20HCM-21%20(1).png)