State Retirement Plan Mandates: Is Your Business Compliant? (Illinois & Beyond)

May 16th, 2025

6 min read

You’ve heard something about new retirement plan laws. Maybe it was a letter from the state, a headline, or just a conversation with another business owner. Now you're wondering:

“Am I supposed to be doing something? And what happens if I don’t?”

If you're running a business in Illinois or any of the growing number of states implementing retirement mandates, you need to know: many compliance deadlines have already passed, with penalties of up to $500 per employee being enforced. With thousands of businesses still non-compliant, understanding your obligations and options isn't just important—it's urgent.

At Lift HCM, we work with businesses like yours every day. Ones that are just trying to do the right thing for their team without getting buried in red tape. We’ve helped companies navigate state mandates, avoid five-figure fines, and find smarter, more flexible retirement options. In this article, you will be better educated to navigate state retirement mandate requirements with clarity, minimize your risk exposure, and identify the most advantageous compliance strategy for your business.

Table of Contents

- The Retirement Savings Crisis by the Numbers

- What Are State-Mandated Retirement Programs (and How Do They Work)?

- The Illinois Compliance Crisis: Are You at Risk?

- Strategic Compliance Options: State vs. Private Plans

- Key Differences: State-Sponsored Plans vs. Private Options

- Why Businesses Fall Short of These Challenges

- Solution Spotlight: Human Interest

- Multi-State Compliance Chart

- Charting a Path to Compliance and Prosperity

The Retirement Savings Crisis by the Numbers

The shift from traditional pensions to employee-directed retirement savings has created a significant gap in retirement preparedness:

- 25% of Americans have no retirement savings whatsoever

- 55% of workers lack access to workplace retirement plans

- The average retirement savings for Americans aged 55-64 is just $120,000

- Financial experts recommend saving 10-12 times your annual income for retirement

- Social Security benefits replace only about 40% of pre-retirement income for average earners

- Without additional savings, millions face potential financial hardship in retirement

This crisis has far-reaching implications—not just for individuals but for the broader economy. Inadequate retirement savings can increase reliance on social safety net programs, reduce consumer spending, and create broader economic challenges as the population ages.

📊 Industry Insight: Nearly every state (48 out of 50) is in some phase of developing retirement programs, with 20 states having enacted legislation and 12 currently having active programs. This rapid expansion reflects growing recognition of the problem's scale and urgency.

What Are State-Mandated Retirement Programs (and How Do They Work)?

State-mandated retirement programs are government-initiated savings plans designed to address America's retirement savings crisis. These programs require employers to provide access to retirement savings options by either:

- Enrolling employees in a state-sponsored retirement program, or

- Choosing a qualifying employer-sponsored plan, such as a 401(k)

The Illinois Compliance Crisis: Are You at Risk?

Illinois was one of the first states to launch a mandatory retirement savings program for private-sector workers. Called Illinois Secure Choice, this program applies to businesses with five or more employees that don't offer a qualified retirement plan.

The problem? Thousands of businesses still aren’t compliant. And now the penalties are kicking in.

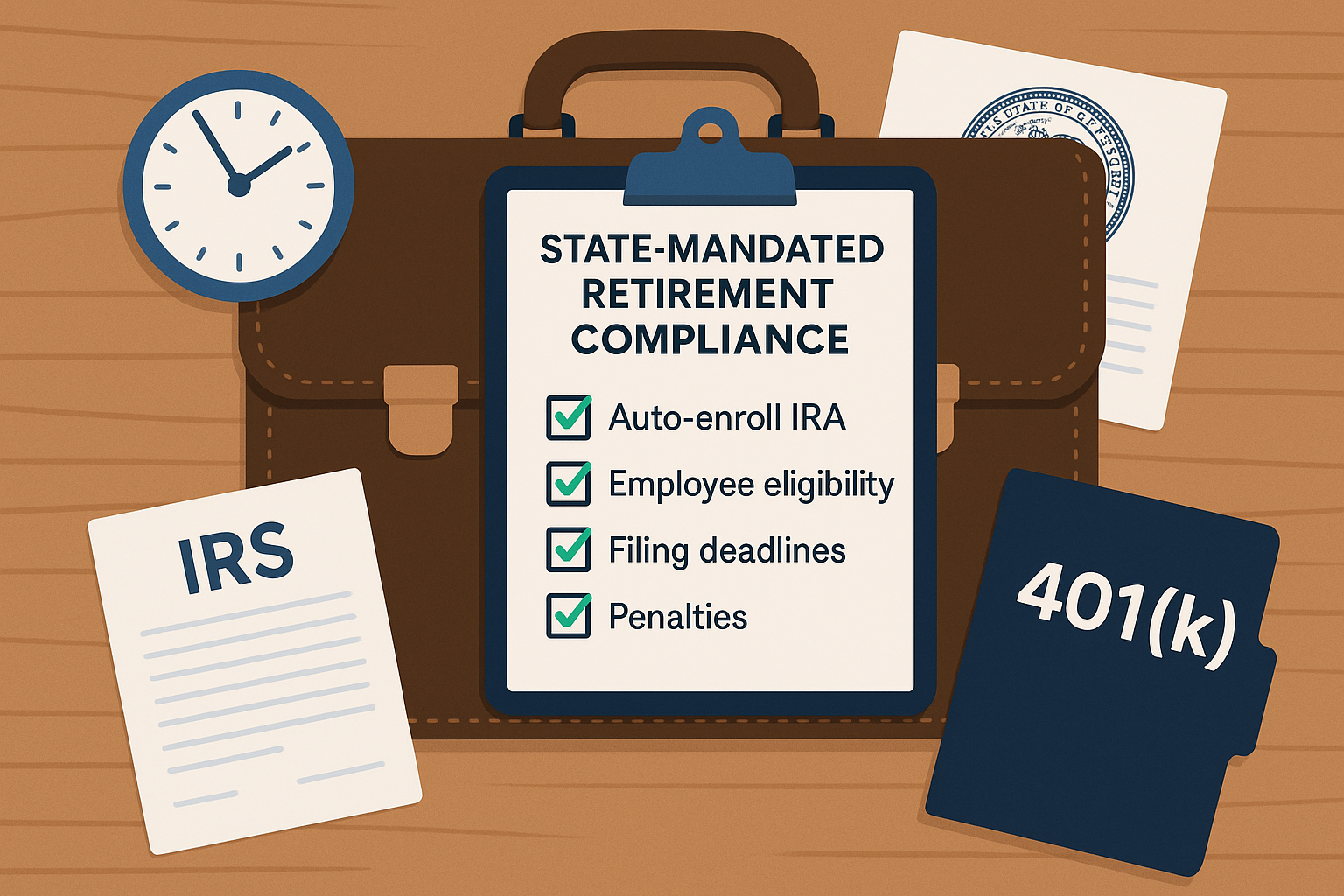

What Illinois Businesses Currently Out of Compliance Need to Know

- Penalties:

- First year of non-compliance: $250 per eligible employee

- Each subsequent year: $500 per eligible employee

- Enforcement Process: Secure Choice monitors compliance and reaches out to employers who receive a notice (potentially electronic) with 120 days to file a protest.

- Compliance Requirements: Applies to employers with 5+ employees in Illinois who have been in business for at least two years and do not offer a qualified retirement savings plan.

- Registration Deadlines (Past):

- 25+ employees: Earlier deadlines have passed

- 16-24 employees: November 1, 2022 (passed)

- 5-15 employees: November 1, 2023 (passed)

Strategic Compliance Options: State vs. Private Plans

For compliance with retirement mandates, businesses have two main options:

Option 1: Use Your State's Program

This is the default option if you don’t set up your own plan. It’s designed to be easy to implement, but it’s also pretty limited.

- Roth IRA Plans: These typically have lower annual contribution limits ($7,000, or $8,000 for those 50+ years old) compared to 401(k) plans.

- No Employer Contributions: State-run plans do not allow for employer contributions.

- Manual Payroll Deductions: Minimal to no payroll integrations, requiring manual deductions each pay period, which can increase workload and risk of human error.

Option 2: Offer a Qualifying Retirement Plan

Instead of using the state-run program, you can offer your own qualifying plan—like a 401(k).

- 401(k) Plans: Higher annual contribution limits ($23,500, or up to $34,750 for those 60-63 years old).

- Employer Contributions: Allows for discretionary employer contributions.

- Payroll Integration: Offers seamless payroll integration, reducing administrative burden and minimizing errors.

Key Differences: State-Sponsored Plans vs. Private Options

When evaluating retirement options for your Illinois business, consider these important differences:

State-Sponsored Plan Limitations

State-sponsored programs like Illinois Secure Choice are designed to be easy for employers to implement, often featuring automatic enrollment and default contribution rates . However, these programs typically have limitations. Illinois Secure Choice, for instance, uses Roth IRA plans, which have lower annual contribution limits compared to 401(k) plans.

- Often Roth IRAs with lower contribution limits ($7,000 in 2025) than 401(k) plans.

- Illinois Secure Choice has an annual expense ratio of approximately 0.75%, meaning employees pay about $0.75 for every $100 saved.

- Limited investment options.

- The annual contribution cap for IRAs ($7,000 in 2025) is significantly lower than the $23,500 limit for 401(k) plans in 2025.

There are tax incentives available for businesses with 51-100 employees under the original SECURE Act. Use this plan cost calculator to see how tax incentives may help you start a 401(k) plan.

Private Plan Advantages

A private 401(k) plan offers businesses cost control, flexible design, and tax benefits. Higher contribution limits allow more savings, and employer matching boosts participation. It also helps avoid state mandates.

SIMPLE IRAs offer easy setup and tax credits for small firms, including up to $5,000 annually for startup costs and $500 for automatic enrollment over three years. Employer contributions and fees are usually tax-deductible, encouraging participation.

- Higher contribution limits ($23,500 for employees in 2025, plus $7,500 catch-up for those 50+ and $11,250 for those 60-63).

- Greater flexibility and a wider range of investment options.

- Potential for employer matching contributions.

- Tax advantages for both employers and employees.

- A valuable employee benefit that can attract and retain talent.

Why Businesses Fall Short of These Challenges

If you haven’t acted yet, you’re not alone. Thousands of small businesses across the country are in the same boat. But it’s not because they’re careless. It’s usually because of one (or more) of these challenges:

- Awareness Gap: Many small business owners are unaware of or misunderstand the requirements.

- Perceived Complexity: Concerns about administrative burden and implementation difficulties.

- Deadline Confusion: Multi-phase rollout based on company size has created timeline uncertainty.

- Penalty Blindness: Lack of awareness about significant financial penalties.

- Limited Resources and HR Capacity: Small businesses often operate on tight margins and lack dedicated HR staff.

- High Turnover Rates: Administrative challenges with enrollment and ongoing management.

- Multi-State Operations: Regulatory complexity for businesses with locations across state lines.

Solution Spotlight: Human Interest

Small businesses often struggle with state retirement mandates due to lack of awareness, complexity, looming deadlines, and limited HR resources. Partnering with a private retirement plan provider can offer a straightforward solution.

This is where Human Interest comes in. They simplify retirement plan administration and compliance, providing a competitive and affordable alternative to state-run programs that benefits both your business and your employees.

Here's how partnering with Human Interest helps you meet mandates and support your team:

- Competitive & Affordable Plans: Offer a cost-effective option compared to state-run alternatives.

- Streamlined Administration: Simplify plan management to save you time and hassle.

- Flexible Plan Design: Customize options with open-architecture investments to fit your business needs.

- Seamless Payroll Integration: Connects with over 500 payroll providers for smooth operation.

- Dedicated Administrative Support: Get assistance with enrollment, employee education, and ongoing compliance.

- Multi-State Compliance Expertise: Navigate mandates confidently in states like Illinois, California, and beyond.

💡 Did You Know? While state-run plans limit annual contributions to $7,000 per employee (2025), Human Interest 401(k) plans allow up to $23,500—providing significantly greater tax advantages and retirement readiness for your team.

Human Interest is committed to providing retirement benefit plans to all small and medium-sized businesses. While SECURE Act 2.0 supports this mission, Human Interest believes more can be done.

Learn more about Human Interest's small business 401(k) and 403(b) plans, or schedule a free consultation today! If you're in Illinois, connect directly with our local resource, Katie Francis.

Multi-State Compliance Chart

For businesses operating across multiple states, retirement mandates create complex compliance challenges. Here's a snapshot of active programs:

|

State |

Program Name |

Official Website |

Business Size Requirement |

|

California |

CalSavers |

5+ employees (expanding to 1+ by 2025) |

|

|

Colorado |

SecureSavings |

5+ employees |

|

|

Connecticut |

MyCTSavings |

5+ employees |

|

|

Delaware |

EARNS |

5+ employees |

|

|

Illinois |

Secure Choice |

5+ employees |

|

|

Maine |

MERIT |

5+ employees |

|

|

Maryland |

Maryland$aves |

1+ employees |

|

|

Massachusetts |

CORE (Nonprofit-focused MEP program) |

For nonprofits with 20 or fewer employees |

|

|

New Jersey |

RetireReady NJ |

25+ employees |

|

|

Oregon |

OregonSaves |

1+ employees |

|

|

Rhode Island |

Secure Choice Retirement Savings Program Act |

N/A |

5+ employees |

|

Virginia |

RetirePath VA |

25+ employees |

|

|

Vermont |

VT Saves Pilot Program |

N/A |

5+ employees |

|

Washington |

Retirement Marketplace |

Any size (voluntary) |

💡 Multi-State Strategy: Rather than managing enrollment in multiple state programs with varying requirements, establishing a single qualified private plan can satisfy mandate requirements across all jurisdictions simultaneously.

Charting a Path to Compliance and Prosperity

Navigating the complexities of state-mandated retirement plans requires a proactive approach to ensure compliance and optimize benefits for both your business and employees. By understanding the specific requirements of programs like Illinois Secure Choice and evaluating the advantages of private plans, you can make informed decisions that align with your business goals.

At Lift HCM, we are committed to supporting businesses in this journey, offering expertise and solutions that simplify compliance and enhance employee satisfaction. Embrace these mandates as an opportunity to strengthen your business's financial health and secure a prosperous future for your team.

Note: This article provides general information about state-mandated retirement programs. For specific advice about your business situation, please consult with a retirement plan specialist or financial advisor.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

.png?width=473&height=315&name=Digital%20Employee%20Experience%20DEX%20in%20HCM-21%20(1).png)