Illinois Paid Leave Laws: Payout Rules for Employers

January 15th, 2026

9 min read

If you're an Illinois employer, you've probably heard about the state's Paid Leave for All Workers Act that took effect in January 2024. Maybe you've even set up a basic sick leave policy to comply. But when an employee leaves your company—whether they quit, retire, or are terminated—do you have to pay out their unused sick time? And what about employees who work in Chicago or Cook County, where local ordinances add extra layers of requirements?

These questions keep HR managers up at night, especially when the answer impacts your budget, your compliance risk, and your ability to manage employee separations smoothly. At Lift HCM, we've helped dozens of Illinois employers navigate these overlapping leave laws, and we know how confusing the patchwork of state and local regulations can be.

In this article, we'll breakdown exactly what Illinois employers need to know about paid leave accrual limits, carryover rules, and payout obligations under state law and local ordinances. By the end, you'll have a clear roadmap for structuring your policies to stay compliant while avoiding unnecessary payout obligations.

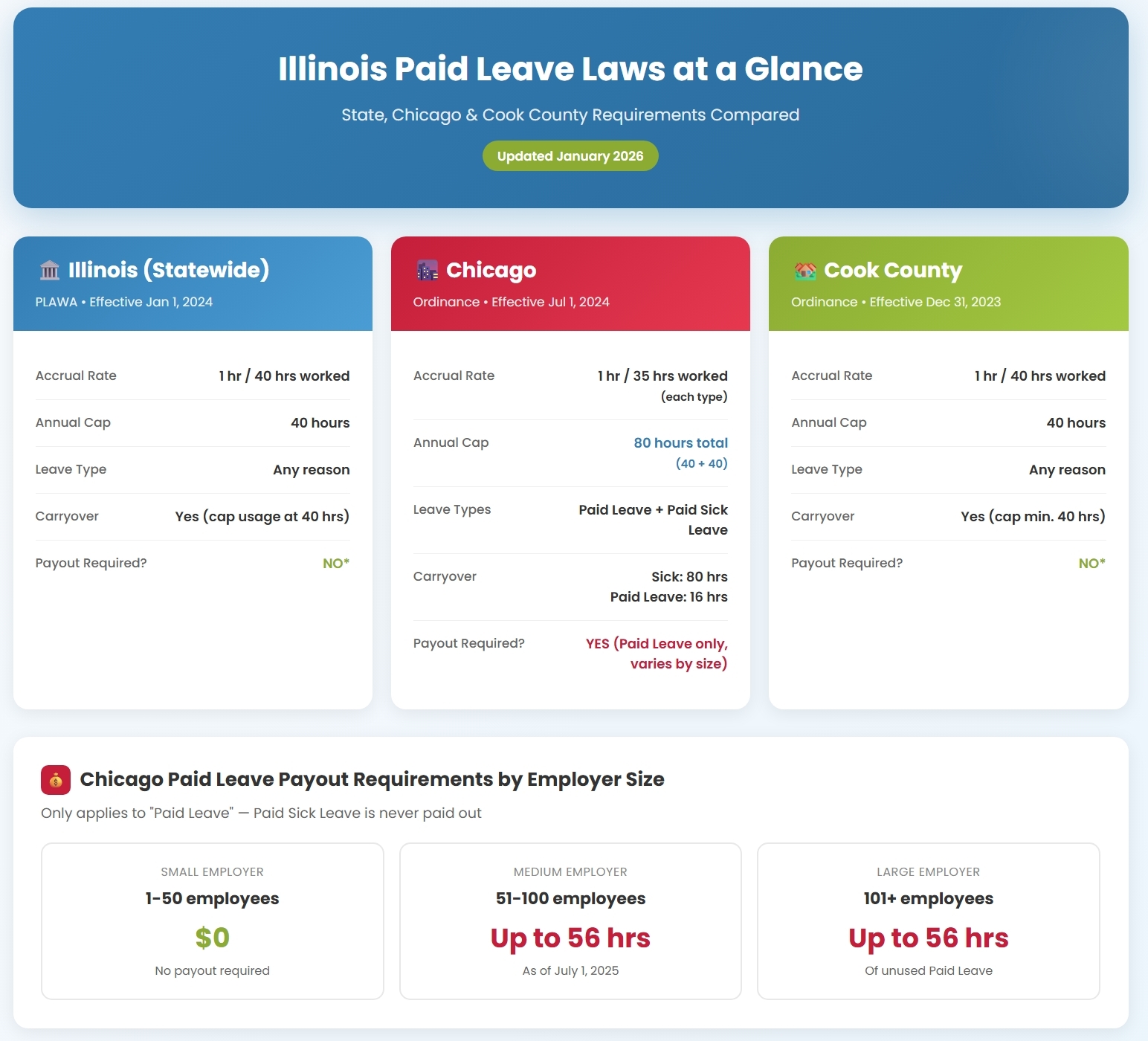

📋 QUICK ANSWER: Illinois Paid Leave Payout Rules

STATE LAW (PLAWA): NO payout required — unless combined with vacation/PTO.

CHICAGO: YES for Paid Leave (up to 56 hours, varies by employer size). NO for Paid Sick Leave.

COOK COUNTY: NO payout required — unless combined with vacation/PTO.

KEY RULE: Keep state-mandated leave SEPARATE from vacation/PTO to avoid triggering payout requirements.

Table of Contents

- What Does Illinois State Law Require for Paid Leave?

- Does Illinois Require Payout of Unused Paid Leave at Termination?

- Chicago's Paid Leave Ordinance: Double the Complexity

- What Are Cook County's Paid Leave Requirements?

- Illinois Paid Leave Laws: Side-by-Side Comparison

- How Can Employers Structure Policies to Minimize Payout Obligations?

- What Mistakes Do Illinois Employers Commonly Make with Paid Leave?

- Frequently Asked Questions About Illinois Paid Leave Payout

- Turn Complex Illinois Leave Rules Into a Clear, Compliant Strategy

What Does Illinois State Law Require for Paid Leave?

The Illinois Paid Leave for All Workers Act (PLAWA) took effect on January 1, 2024. This was a big deal — Illinois became one of only a handful of states requiring employers to provide paid leave that employees can use for any reason, not just illness.

Here's what the state law requires:

- Accrual rate: Employees earn 1 hour of paid leave for every 40 hours worked.

- Annual cap: Employers can cap accrual at 40 hours (5 days) per 12-month period.

- Usage: Employees can use this leave for any reason — it's not limited to sickness.

- Waiting period: Employers can require employees to wait 90 days before using accrued leave.

- Carryover: Unused leave must carry over to the next year, but employers can still cap annual usage at 40 hours.

Accrual rate: Employees earn 1 hour of paid leave for every 40 hours worked.

Annual cap: Employers can cap accrual at 40 hours (5 days) per 12-month period.

Usage: Employees can use this leave for any reason — it's not limited to sickness.

Waiting period: Employers can require employees to wait 90 days before using accrued leave.

Carryover: Unused leave must carry over to the next year, but employers can still cap annual usage at 40 hours.

The law applies to nearly all Illinois employers, with limited exemptions for certain school districts, park districts, and employees covered by collective bargaining agreements that explicitly waive the benefit.

💡 Key Takeaways for Illinois Employers

No payout required under state law and Cook County — unless you combine leave with vacation/PTO in a single bank

Keep leave buckets separate to avoid triggering Illinois Wage Payment and Collection Act payout requirements

Chicago employees need 80 hours total (40 Paid Leave + 40 Paid Sick Leave) — track both separately

Chicago has faster accrual — 1 hour per 35 hours worked vs. 1 hour per 40 hours for state/Cook County

Count only Chicago employees for employer size thresholds — employees outside city limits don't count

Does Illinois Require Payout of Unused Paid Leave at Termination?

Here's the straightforward answer: No, payout is not required under PLAWA—but only if you keep this leave separate from your vacation or general PTO bank.

If you track PLAWA leave in its own bucket (labeled "Paid Leave for All Workers" or "State Sick Leave"), you have no obligation to pay out unused hours when employment ends, whether the employee quits, is fired, or retires.

However, if you combine PLAWA leave with vacation or PTO in a single bank, Illinois' Wage Payment and Collection Act kicks in. That law treats vacation as earned wages that must be paid out at separation. Once you blend the two, any unused balance becomes wages owed to the departing employee.

Accrual Limits: How Much Can Employees Bank?

Under the statewide law, employees accrue up to 40 hours per year. Here's how it works in practice:

- Non-exempt employees: Accrual based on actual hours worked

- Exempt employees: Deemed to work 40 hours per week for accrual purposes (unless their normal schedule is less)

- Annual cap: Employers can cap accrual at 40 hours per 12-month period

- Carryover: Unused leave carries over, but employers can still limit annual usage to 40 hours

- Alternative approach: You can front-load the full 40 hours at the start of each 12-month period. If you choose this option, you're not required to allow carryover since you're providing the full annual allotment upfront.

Chicago's Paid Leave Ordinance: Double the Complexity

If your employees work in Chicago, you're dealing with a more generous—and more complex—ordinance. The Chicago Paid Leave and Paid Sick and Safe Leave Ordinance took effect on July 1, 2024.

Chicago's Two-Bucket System

Unlike state law, Chicago requires employers to provide two separate types of leave:

- Paid Leave (for any reason): Employees earn 1 hour for every 35 hours worked, up to 40 hours per year. This can be used for vacation, personal time, or any reason the employee chooses.

- Paid Sick and Safe Leave: Employees earn 1 hour for every 35 hours worked, up to 40 hours per year. This can only be used for illness, medical appointments, domestic violence situations, or public health emergencies.

That's a total of 80 hours of leave per year — double what state law requires. And notice the faster accrual rate: 1 hour per 35 hours worked in Chicago versus 1 hour per 40 hours worked under state law.

Chicago's Carryover Rules

Carryover also works differently in Chicago:

- Paid Sick Leave: Up to 80 hours can carry over from year to year.

- Paid Leave: Only 16 hours carry over if you use the accrual method. If you front-load the full 40 hours at the start of the year, no carryover is required.

Chicago's Payout Requirements by Employer Size

Here's where Chicago really differs from state law: Chicago does require payout of unused Paid Leave (but not Paid Sick Leave) when an employee separates. However, the requirement varies based on how many employees you have working in Chicago:

|

Employer Size |

Paid Leave Payout Requirement |

|

Small (1-50 employees) |

No payout required |

|

Medium (51-100 employees) |

Must pay out up to 56 hours of unused Paid Leave (as of July 1, 2025) |

|

Large (101+ employees) |

Must pay out up to 56 hours of unused Paid Leave |

Important: Paid Sick and Safe Leave is never required to be paid out in Chicago, regardless of employer size. The payout requirement only applies to the "Paid Leave" bucket.

📌Also note: The employee count is based on employees who work in Chicago, not your total company headcount. If you have 200 employees statewide but only 30 work in Chicago, you're considered a "small employer" under the Chicago ordinance.

What Are Cook County's Paid Leave Requirements?

Cook County (outside of Chicago city limits) has its own Paid Leave Ordinance that took effect December 31, 2023. The good news? It's almost identical to state law, which makes compliance easier if you have employees in both Cook County and other parts of Illinois.

Here's what Cook County requires:

- Accrual rate: 1 hour of paid leave for every 40 hours worked (same as state law).

- Annual cap: 40 hours per year (same as state law).

- Usage: For any reason (same as state law).

- Carryover: Unused leave carries over, with a minimum carryover cap of 40 hours.

- Payout: No payout required at termination — unless combined with vacation/PTO (same as state law).

The main difference between Cook County and state law is enforcement. Cook County allows employees to file a private lawsuit and potentially recover treble (triple) damages for violations, plus attorney's fees. State law doesn't have this provision.

Illinois Paid Leave Laws: Side-by-Side Comparison

|

Feature |

Illinois (PLAWA) |

Chicago |

Cook County |

Key Takeaway |

|

Effective Date |

Jan 1, 2024 |

Jul 1, 2024 |

Dec 31, 2023 |

All are now in effect |

|

Leave Types |

1 type (any reason) |

2 types (Paid Leave + Sick Leave) |

1 type (any reason) |

Chicago is most complex |

|

Annual Hours |

40 hours |

80 hours (40+40) |

40 hours |

Chicago = double the hours |

|

Accrual Rate |

1 hr / 40 hrs |

1 hr / 35 hrs (each) |

1 hr / 40 hrs |

Chicago accrues faster |

|

Payout Required? |

NO* |

YES (Paid Leave only, up to 56 hrs) |

NO* |

Chicago has payout mandate |

*Unless combined with vacation/PTO in a single bank

How Can Employers Structure Policies to Minimize Payout Obligations?

Now that you understand what each jurisdiction requires, let's talk about strategy. There's no one-size-fits-all answer — the right approach depends on where your employees work, how many you have, and how much administrative complexity you're willing to manage.

Strategy 1: Keep Leave Buckets Separate

This is the most protective approach for employers with employees outside Chicago. Maintain distinct leave banks:

- Bucket 1: "IL Paid Leave" or "PLAWA Leave" — the state-mandated 40 hours

- Bucket 2: "Vacation" or "PTO" — any additional time off you offer

Bucket 1: "IL Paid Leave" or "PLAWA Leave" — the state-mandated 40 hours

Bucket 2: "Vacation" or "PTO" — any additional time off you offer

With this structure, you only pay out the vacation bucket at termination. The state-mandated leave stays in its own lane and doesn't trigger payout requirements.

Strategy 2: Use a Single PTO Bank (With Full Awareness of the Cost)

Some employers prefer simplicity over savings. If you combine everything into one PTO bank, you avoid the administrative hassle of tracking multiple leave types — but you commit to paying out the entire unused balance whenever an employee leaves.

If you go this route, make sure your PTO bank provides at least 40 hours for non-Chicago employees and at least 80 hours for Chicago employees.

Strategy 3: Create Location-Specific Policies

If you have employees in multiple jurisdictions, you may need different policies for different locations:

- Chicago employees: Two separate buckets (Paid Leave and Paid Sick Leave) to comply with the dual requirement.

- Cook County employees (outside Chicago): Single state-compliant bucket.

- Other Illinois employees: Single state-compliant bucket.

Your payroll system needs to be able to handle these variations automatically based on where each employee works. This is where a good HCM system pays for itself — manual tracking across multiple jurisdictions is a recipe for errors and compliance failures.

What Mistakes Do Illinois Employers Commonly Make with Paid Leave?

In our work with Illinois employers, we see the same mistakes come up again and again. Here are the ones that cause the most problems:

Mistake #1: Assuming all sick leave must be paid out

Reality: Only vacation/PTO must be paid out under the Wage Payment and Collection Act. State-required leave in a separate bucket does not require payout. Many employers pay out more than they're legally required to simply because they don't understand this distinction.

Mistake #2: Applying Chicago rules to all Illinois employees

Reality: Chicago's ordinance only applies to employees who physically work within city limits. If you apply Chicago's rules statewide, you're providing more leave and paying out more at termination than the law requires.

Mistake #3: Forgetting about employer size thresholds in Chicago

Reality: Your payout obligations in Chicago depend on how many Chicago employees you have — not your total headcount. A company with 500 employees statewide might still be a "small employer" in Chicago if only 40 employees work there.

Mistake #4: Not updating employee handbooks

Reality: Your policies need to clearly explain which leave types are paid out and which aren't. Ambiguous handbook language creates confusion and can lead to disputes and claims. When in doubt, employees (and courts) tend to interpret unclear policies in favor of the employee.

Mistake #5: Manual tracking without proper systems

Reality: Trying to track multiple leave types, different accrual rates, and location-specific rules in spreadsheets is asking for trouble. A single error can lead to underpaying (compliance violation) or overpaying (unnecessary cost) leave balances.

Frequently Asked Questions About Illinois Paid Leave Payout

Q: Is Illinois paid leave the same as sick leave?

Under state law (PLAWA), Illinois paid leave can be used for any reason — not just illness. However, Chicago requires two separate types: Paid Leave (any reason) and Paid Sick Leave (health-related reasons only). Cook County follows the state model with all-purpose leave.

Q: How many hours of paid leave do Illinois employees get?

Illinois employees earn up to 40 hours per year under state law and Cook County ordinance. Chicago employees can earn up to 80 hours total (40 hours Paid Leave + 40 hours Paid Sick Leave).

Q: Can Illinois employers front-load paid leave instead of using accrual?

Yes. Employers can provide the full 40 hours (or 80 hours in Chicago) at the beginning of the benefit year instead of tracking accrual. If you front-load, you're generally not required to allow carryover of unused Paid Leave.

Q: Which law applies to my employees — state, Chicago, or Cook County?

It depends on where employees physically work. Chicago employees are covered by the Chicago ordinance. Cook County employees (outside Chicago) are covered by the Cook County ordinance. All other Illinois employees are covered by state PLAWA. Only one jurisdiction's law applies to each employee.

Q: What triggers mandatory payout of paid leave in Illinois?

Two things trigger payout: (1) In Chicago, Paid Leave (not Sick Leave) must be paid out based on employer size. (2) Anywhere in Illinois, combining state-mandated leave with vacation or PTO in a single bank triggers the Wage Payment and Collection Act, requiring payout of the entire balance.

Q: Do part-time employees get paid leave in Illinois?

Yes. PLAWA, the Chicago ordinance, and the Cook County ordinance all apply to part-time employees. Leave accrues based on hours worked, so part-time employees will accrue less total leave than full-time employees, but they're still entitled to the benefit.

Turn Complex Illinois Leave Rules Into a Clear, Compliant Strategy

In today’s Illinois landscape, paid leave isn’t just a benefits question—it’s a compliance strategy. The key takeaway is that you can significantly reduce unwanted payout obligations by being intentional about how you structure and track leave:

Keep state-mandated PLAWA/County leave in its own bucket whenever possible.

Treat Chicago as its own universe with two distinct banks and size-based payout rules.

Align your handbook, payroll, and HCM system so they all tell the same story—and back it up with clean, auditable records.

Ready to pressure-test your current PTO and paid leave setup against Illinois, Chicago, and Cook County rules? At Lift HCM, we partner with employers to redesign policies, configure accruals and payouts correctly in the system, and streamline tracking across jurisdictions—so you stay compliant without overspending on unnecessary leave payouts.

Connect with our team today to review your current structure and see how our HCM platform and local expertise can help you protect your budget, your people, and your peace of mind!

Non-exempt employees: Accrual based on actual hours worked

Exempt employees: Deemed to work 40 hours per week for accrual purposes (unless their normal schedule is less)

Annual cap: Employers can cap accrual at 40 hours per 12-month period

Carryover: Unused leave carries over, but employers can still limit annual usage to 40 hours

Alternative approach: You can front-load the full 40 hours at the start of each 12-month period. If you choose this option, you're not required to allow carryover since you're providing the full annual allotment upfront.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.

Topics: