FMLA vs Paid Family Leave: Key Differences Employers Need to Know

November 6th, 2025

9 min read

Understanding employee leave laws can be confusing—especially when federal and state programs overlap. Many business owners and HR professionals struggle to determine which laws apply, how long leave should last, and how to stay compliant when employees work in different states.

At Lift HCM, we help employers navigate the complexities of compliance, payroll, and leave management every day. One of the most common questions we hear is: What’s the difference between FMLA and Paid Family Leave?

In this article, we’ll clearly explain the key differences between the Family and Medical Leave Act (FMLA) and state Paid Family Leave (PFL) programs—so you can confidently manage employee leave no matter where your workforce is located. You’ll learn how each program works, who qualifies, and how to ensure your business stays compliant while supporting your team’s well-being.

Table of Contents

- What Is the Family and Medical Leave Act (FMLA)?

- The Rise of Paid Family Leave (PFL): A State-Level Solution

- How FMLA and Paid Family Leave (PFL) Work Together

- Key Differences Between the Family and Medical Leave Act (FMLA) and Paid Family Leave (PFL)

- State-by-State Guide: Active and Upcoming Paid Family Leave Laws

- Common Employer Missteps and How to Avoid Them

- Frequently Asked Questions About FMLA and Paid Family Leave

- The Path to Confident Leave Management: From Uncertainty to Assurance

What Is the Family and Medical Leave Act (FMLA)?

The Family and Medical Leave Act (FMLA) is a cornerstone of federal labor law, enacted in 1993 to provide job-protected, unpaid leave for specific family and medical reasons. It was designed to help employees balance their work and family responsibilities, ensuring they could take necessary time off without the threat of losing their employment or their health insurance. FMLA is a powerful safety net, but it is crucial to understand its specific provisions and, more importantly, its limitations.

Key Provisions of the Family and Medical Leave Act (FMLA)

Under FMLA, eligible employees are entitled to several key protections that every employer must be aware of, as outlined by the U.S. Department of Labor:

- Up to 12 workweeks of unpaid leave within a 12-month period. This leave can be taken continuously, intermittently, or on a reduced schedule, depending on the qualifying reason. For military caregiver leave, this can extend to 26 weeks in a single 12-month period.

- Job protection during and after the leave. When an employee returns, they must be restored to their original job or an "equivalent position" with the same pay, benefits, and other terms of employment.

- Continuation of group health insurance at the same level and cost as if the employee had never taken leave. Employers must continue their share of the premiums, and the employee must continue to pay their share.

What Reasons Qualify for FMLA Leave?

FMLA covers a variety of significant life events, including:

- The birth of a child and bonding time within one year of birth, available to mothers and fathers regardless of medical recovery needs.

- The placement of a child for adoption or foster care.

- To care for a spouse, child, or parent with a serious health condition.

- An employee's own serious health condition that makes them unable to perform their job duties.

- A qualifying exigency arising from a family member’s military service.

Who Is Eligible for the Family and Medical Leave Act (FMLA)?

To qualify for FMLA, both the employer and the employee must meet specific criteria. This is a common area of confusion, particularly for businesses with a smaller workforce.

- Covered Employer: Your business must employ 50 or more employees within a 75-mile radius for at least 20 workweeks in the current or preceding calendar year. Public agencies and schools are generally covered regardless of employee count.

- Employee Eligibility: The employee must have worked for the employer for at least 12 months (not necessarily consecutive) and completed 1,250 hours of service in the 12 months immediately before leave. The worksite must be within 75 miles of at least 50 employees.

What the Family and Medical Leave Act (FMLA) Doesn’t Cover

The most significant limitation of FMLA is its lack of paid benefits. FMLA guarantees job protection, not wage replacement. This is a critical distinction, as many employees simply cannot afford to take extended time off without an income. This is precisely where state-level Paid Family Leave programs step in to fill the gap.

FMLA defines family members as a spouse, a child (biological, adopted, foster, step, or legal ward under 18 or incapable of self-care), or a parent (biological, adoptive, step, or foster). It does not cover siblings, grandparents, domestic partners, or in-laws.

The Rise of Paid Family Leave (PFL): A State-Level Solution

Over the past two decades, a growing number of states have recognized the financial hardship caused by unpaid leave. In response, they have established Paid Family Leave (PFL) programs, often called Paid Family and Medical Leave (PFML), to provide partial wage replacement for employees on leave. These programs are fundamentally different from FMLA in their purpose, administration, and funding.

Key Characteristics of Paid Family Leave (PFL) Programs

- Wage Replacement: The core benefit of PFL is that it provides a portion of an employee's regular wages while they are on leave. The specific percentage and weekly maximum benefit amount vary significantly by state

- Funding Mechanism: PFL benefits are typically funded through payroll taxes. In some states, employees are the sole contributors; in others, employers contribute as well. These funds are collected and managed by a state agency, similar to how unemployment insurance works.

- Administration: Unlike FMLA, which is primarily administered by the employer, PFL is managed by a state agency. Employees typically apply directly to the state for benefits, and the state agency makes payments.

- Broader Coverage: PFL programs often apply to businesses of all sizes, including those with fewer than 50 employees, which are not covered by FMLA. They also tend to have a much broader definition of a "family member," often including domestic partners, grandparents, and siblings.

- Varying Job Protection: This is a crucial point of confusion. Some states provide job protection that matches or exceeds FMLA, while others offer wage replacement only. In states without PFL job protection, eligible employees rely on FMLA for reinstatement rights. Employers should confirm both federal and state job protection rules for each location.

How FMLA and Paid Family Leave (PFL) Work Together

Understanding the relationship between FMLA and PFL is the key to confident compliance. It's not a matter of one or the other; for many employees and employers, these laws run concurrently. This means an employee's leave can be covered by both FMLA and a state PFL program at the same time.

Here's a simple way to think about it:

- FMLA provides the 'Job Protection' umbrella. If your business is FMLA-covered and the employee is eligible, their job is safe.

- PFL provides the 'Wage Replacement' stream. If the employee works in a state with a PFL program and meets that state’s eligibility criteria, they can receive partial pay while on leave.

For example, a new parent in New York who works for an FMLA-covered employer can take 12 weeks of leave. During that time, FMLA ensures their job is protected and their health insurance continues. Simultaneously, New York's Paid Family Leave program provides them with a percentage of their wages for the duration of that leave.

When an employee qualifies under both FMLA and a state PFL program, the leave periods generally run concurrently. Employers are not required to provide FMLA and PFL consecutively when both apply.

Key Differences Between the Family and Medical Leave Act (FMLA) and Paid Family Leave (PFL)

Understanding the nuances between federal FMLA and state-level Paid Family Leave is paramount for compliance and for supporting your workforce effectively. While both address the need for employees to take time off for significant life events, their mechanisms and protections differ.

Let’s break this down into a visual comparison to highlight the critical distinctions:

|

Feature |

FMLA (Federal) |

PFL (State-Level) |

|

Purpose |

Job protection for specific family/medical reasons |

Partial income replacement during specific family/medical leave |

|

Paid? |

No |

Yes (partial wage replacement) |

|

Job-Protected? |

Yes (if eligible) |

Varies by state; sometimes yes, sometimes not by the PFL itself |

|

Employer Size Req. |

50+ employees within 75 miles |

Often applies to 1+ employees (varies greatly by state) |

|

Eligibility |

12 months of employment, 1,250+ hours worked |

Usually lower thresholds for hours worked/tenure; varies by state |

|

Covered Reasons |

Employee's serious health condition, new child, care for spouse/child/parent, military exigencies |

Similar reasons, but often with a broader definition of "family member" (e.g., siblings, grandparents) |

|

Administered By |

Employer (with DOL oversight) |

State agency |

|

Payroll Tax Funding |

None |

Required in most states with PFL programs (employee, employer, or shared contributions) |

💡KEY INSIGHT: These Programs Often Run Concurrently

When an employee's leave qualifies under both FMLA and a state PFL program, the leave time typically runs at the same time, not as separate periods. FMLA provides the job protection umbrella while PFL provides the wage replacement stream.

State-by-State Guide: Active and Upcoming Paid Family Leave Laws

The landscape of Paid Family Leave is continuously evolving, with more states recognizing the importance of paid time off for workers. Programs change frequently. Always verify benefit amounts, durations, job protection details, and funding with each state’s official agency before making policy or payroll updates. It's crucial for employers to stay updated on which programs are active and which are slated for future implementation, especially if you have a multi-state workforce or remote employees.

Here’s a breakdown of states with active or upcoming Paid Family Leave laws, noting their effective dates and funding mechanisms:

|

State/Jurisdiction |

Year Effective |

Funded By (Typically) |

Maximum Leave |

Key Notes |

|

California (CA) |

2004 |

Employee-funded (payroll tax) |

8 weeks |

Pioneer program; often coordinates with State Disability Insurance (SDI). |

|

New Jersey (NJ) |

2009 |

Employer + Employee-funded |

12 weeks |

Benefits run concurrently with Temporary Disability Insurance (TDI). |

|

Rhode Island (RI) |

2014 |

Employee-funded (payroll tax) |

7 weeks |

Administered through the state’s TDI program. |

|

New York (NY) |

2018 |

Employee-funded (payroll tax) |

12 weeks |

Broad coverage for family members and military exigencies. |

|

Washington (WA) |

2020 |

Shared (Employer + Employee) |

12-18 weeks |

Offers a generous duration for various qualifying reasons. |

|

Massachusetts (MA) |

2021 |

Shared (Employer + Employee) |

12-26 weeks |

One of the most generous programs; covers up to 26 weeks for military caregiver leave. |

|

Connecticut (CT) |

2022 |

Employee-funded (payroll tax) |

12 weeks |

Applies to employers with just one employee. |

|

Oregon (OR) |

2023 |

Shared (Employer + Employee) |

12 weeks |

With possible additional weeks for pregnancy-related complications. Confirm current totals with the state agency. |

|

Colorado (CO) |

2024 |

Shared (Employer + Employee) |

12 weeks |

FAMLI program provides job-protected leave. |

|

District of Columbia (DC) |

2020 |

Employer-funded (payroll tax) |

12 weeks |

Unique for its employer-only funding model. |

|

Delaware (DE) |

2026 (Benefits begin) |

Shared (Employer + Employee) |

12 weeks |

Contributions began in January 2025. |

|

Maryland (MD) |

2028 (Benefits begin) |

Shared (Employer + Employee) |

12 weeks |

Payroll contributions began in 2027. |

|

Maine (ME) |

2026 (Benefits begin) |

Shared (Employer + Employee) |

12 weeks |

Contributions began in January 2025. |

|

Minnesota (MN) |

2026 (Benefits begin) |

Shared (Employer + Employee) |

Up to 20 weeks |

Combined across paid family and medical leave, subject to state eligibility rules. |

|

Voluntary/Employer-Based Programs (e.g., New Hampshire, Vermont) |

Varies |

Varies |

Varies |

Some states, like New Hampshire and Vermont, have enacted voluntary paid leave insurance programs, where employers or employees can opt-in. These are not universally mandated but offer an avenue for paid leave. |

💡 Important Note: Some state PFL/PFML programs include job protection; others rely on FMLA for reinstatement. Review each law’s eligibility, tenure, hours, and employer-size thresholds.

Sources: Bipartisan Policy Center, New America, Paycor, OnPay, Cocoon, Risk Strategies. It is highly recommended to consult state labor departments for the most up-to-date information.

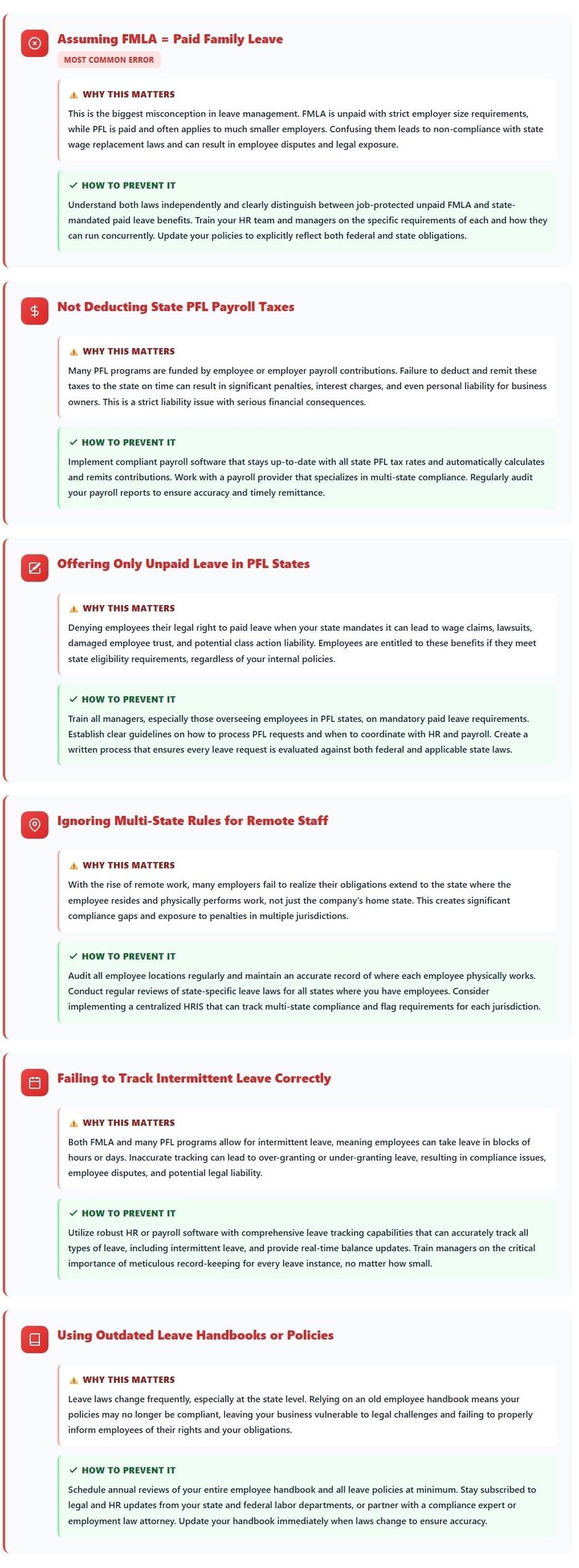

Common Employer Missteps and How to Avoid Them

Even the most well-intentioned businesses can stumble when it comes to navigating the intricate world of family leave laws. Small missteps can lead to significant headaches, including fines, audits, and strained employee relations. Being aware of the most common mistakes is the first step toward avoiding them.

Here are the top errors we frequently see employers make, along with practical strategies to prevent them:

👉 PRO TIP:

Technology is Your Compliance Ally: Integrated HCM systems with built-in compliance monitoring automate the complex work of tracking multi-state leave requirements, calculating payroll deductions, and maintaining accurate records. This dramatically reduces human error and keeps you audit-ready at all times.

At Lift HCM, we use this same approach—leveraging integrated, cloud-based HCM technology to simplify leave tracking, payroll coordination, and compliance documentation for every client we serve.

Frequently Asked Questions About FMLA and Paid Family Leave

Q1: Does Paid Family Leave replace FMLA?

No. Paid Family Leave (PFL) does not replace the Family and Medical Leave Act (FMLA). FMLA is a federal law that provides unpaid, job-protected leave, while PFL is a state-level program that provides partial wage replacement. In many cases, they run concurrently.

Q2: Can employees use both FMLA and Paid Family Leave at the same time?

Yes, in most situations. If an employee is eligible for both, their FMLA job-protected leave and their state’s PFL wage benefits often overlap. Employers should track both programs carefully to ensure proper compliance and accurate payroll deductions.

Q3: Is Paid Family Leave available in every state?

Not yet. As of 2025, 13 states and Washington, D.C. have active or approved Paid Family Leave programs. States such as California, New York, and Washington were early adopters, while others like Delaware and Minnesota are implementing programs in the next few years.

Q4: Do small businesses have to offer FMLA?

FMLA applies to employers with 50 or more employees within 75 miles. Some state PFL programs require participation from smaller employers, including those with one employee. Check the state’s rules for size thresholds and job protection.

Q5: How can employers stay compliant with both FMLA and Paid Family Leave?

The most effective strategy is to use integrated HCM technology that automates leave tracking, payroll deductions, and compliance documentation. At Lift HCM, we help employers manage these complexities by connecting HR, payroll, and timekeeping data into one unified system.

The Path to Confident Leave Management: From Uncertainty to Assurance

Managing employee leave no longer needs to be a source of stress or guesswork for businesses. You now understand the key differences: FMLA ensures unpaid, job-protected leave, while state Paid Family Leave (PFL) programs offer wage replacement in select locations. This knowledge gives you a clear path forward and highlights the importance of coordinating these benefits to ensure both compliance and support for your employees.

With the right policies and integrated solutions, your business can be confidently compliant—from automatic payroll deductions for state programs to clear communication with your team during critical life events. Lift HCM supports small and mid-sized businesses in transforming leave management from a compliance burden into a competitive strength, with comprehensive technology and a dedicated support team guiding you every step of the way.

Lift HCM connects leave eligibility, payroll deductions, and documentation in one system, with multi-state rules built in. If you’re ready to simplify FMLA and Paid Family Leave administration, explore Lift HCM’s services to move forward with confidence.

Caitlin Kapolas is a results-driven professional with a strong background in account management and retail. She is dedicated to improving client experiences and building lasting relationships. Caitlin excels in identifying client needs, resolving issues, and implementing customized solutions that drive value. Her effective communication skills ensure high client satisfaction and loyalty, making her a trusted advisor and partner in meeting client needs with precision and professionalism.